However, mortgages are so unique that they deserve their own debt classification. Ultimately, credit is based on trust between the lender and borrower that the amount owed will be repaid. Examples of debt include amounts owed on credit cards, car loans, and mortgages. A debt arrangement gives the borrowing party permission to borrow money under the condition that it is to be paid back at a later date, usually with interest. Repayment Is Paying Back Money Borrowed from a Lender, What Everyone Should Know about Average Outstanding Balances, How a Charge-Off Rate (Credit Card) Is Calculated and What It Means. If you are overwhelmed by your debts, youre not alone. Different industries use debt differently, Title 15Commerce and Trade: 1692a. Some debt relief companies offer specialized help with taxes you owe in addition to your unsecured debts. Investopedia: Whats the difference between debt consolidation and debt relief? Debt relief companies who have been in existence for even five or 10 years are easier to research and compare, and they have been around long enough to have customer reviews as well as complaints. Credit counseling provides guidance and support for consumer credit, money management, debt management, and budgeting. A loan is a form of debt but, more specifically, is an agreement in which one party lends money to another. After all, debt relief company apps let users keep track of their payments and their debt relief progress using their mobile device. Delinquencies, charge-offs, and accounts that have been sent to collections show up on a credit report for seven years. Some companies advertise their cancellation policies proudly, whereas others do not list any cancellation policies at all. When evaluating potential agencies, make sure they are nonprofit organizations. Out-of-Control Student Loans? Further, companies may or may not offer a money-back guarantee or a transparent cancellation policy. The advantage is that the interest rate is lower than what it was on the original debts, and the single account is easier to manage than multiple. In order to provide a comprehensive comparison of debt relief companies, we also needed a way to accurately rank companies that offer a client dashboard online. If a debt management plan isnt the right fit for you, then consider these alternative strategies: If you arent sure which approach is best for your situation, contact a nonprofit credit counseling agency and talk with a counselor about your options. What Does It Mean to Be Financially Delinquent? Its usually the worst thing that can happen to credit reports and the scores that are derived from the information on the reports.

That's part of the reason we included the length a company has been in business as a major component in their stability rating. Here's how we ranked companies based on the functionality of their online platforms: Some debt relief companies have (or have had) an online chat feature that lets anyone ask questions and get answers about debt relief services they might receive. Debt is anything owed by one person to another. Debt-to-Income (DTI) Ratio: Definition and Formula. This compensation may impact how and where listings appear. Mortgages are most likely the largest debt, apart from student loans, that consumers will ever owe.

mining global fcx stocks outperform rio investopedia Investopedia: Are there ways to minimize the negative impact of entering a debt relief program? Mortgages are usually amortized over long periods, such as 15 or 30 years. What's a Credit Lock and How Does It Work? U.S. Government Publishing Office. According to 15 U.S. Code Section 1692a, debt is defined as "any obligation or alleged obligation of a consumer to pay money arising out of a transaction in which the money, property, insurance, or services which are the subject of the transaction are primarily for personal, family, or household purposes, whether or not such obligation has been reduced to judgment.".

Also, never rely on anything you're told directly from a company in a sales pitch. Buy Now, Pay Later, also known as BNPL, is a relatively recent take on the old layaway plans of the past. In all these scenarios, you would pay the entire balance owed. Sandberg: If you receive formal forgiveness, it usually shows up on your credit report as settled. The National Foundation for Credit Counseling (NFCC) is a national network of non-profit credit counseling organizations.

How Can I Tell a Credit Repair Scam From a Reputable Credit Counselor? Interest is used to ensure that the lender is compensated for taking on the risk of the loan while also encouraging the borrower to repay the loan quickly to limit their total interest expense. The terms of the loan also stipulate the amount of interest that the borrower is required to pay annually, expressed as a percentage of the loan amount. However, this strategy does come with some risks, including the potential for a negative impact on your credit score. This is a question Investopedia staff set out to investigate and answer before we began compiling information for our debt relief reviews. If you're struggling to keep up with bills and you feel like you'll never be able to repay your debts without some outside help, there are plenty of companies who will assist you. Investopedia: Where should people go to seek debt relief? You can learn more about the standards we follow in producing accurate, unbiased content in our. Its also a good idea to check each one youre considering with your state attorney general and/or your local consumer protection agency. Examples of unsecured debt include unsecured credit cards, automobile loans, and student loans. To come up with the data for our comprehensive reviews, we compare companies based on the services they provide, their fee structures (if disclosed), their overall transparency, and their reputation with government agencies and private firms that rank them. There are four main categories of debt. Credit rating generally refers to an individuals creditworthiness as measured by a credit score. It would be great to see that flexibility continue. There are several ways to consolidate debt. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. We'll also explain why each factor is important, the rating system we used to compile our internal data, and what consumers should care about the most when choosing a debt relief company. Consumer Credit Counseling Service (CCCS), Average U.S. Consumer Debt Reaches New Record in 2020. Secured debt is collateralized debt. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Either one can inform you of consumer complaints against companies you're considering, as well as licensing requirements that might apply. They also may establish that the loan must be repaid with interest. Interestingly, many debt relief companies do not disclose their fee structures upfront, and they will only do so if you endure a free consultation.

current liabilities accounting investopedia quizlet pasivo jiang Even when adhering to the terms, consumers and businesses with too much debt may be considered too risky to be approved for new debt, limiting access to additional funds to fulfill other obligations and duties. This is partly due to the fact that so many debt relief options exist, but it's also because the debt relief industry is known for its share of scams.

investopedia fund A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. There may be enrollment and maintenance fees to take part in a debt management plan. To make sure our evaluation of each company considered was fair and balanced, we chose to break our scoring down into many working parts, which are explained below. It is a form of secured debt as the subject real estate is used as collateral against the loan. Sandbergs background as a budget and debt counselor at the Consumer Credit Counseling Service of San Francisco has prepared her for this wide-ranging discussion on debt, which includes tips and strategies for anyone who finds themselves in or near a debt trap. "Collections on Your Credit Report. The AFCC is the premier trade association that is currently "fighting for consumer rights, defending access to debt negotiation services and ensuring the ethical treatment of consumers seeking to resolve their debts through debt settlement.". Consumer finance expert Erica Sandberg, host of the weekly video podcast Making It in San Francisco that airs on KRON4, spoke with Investopedia recently to share her take on the topic of debt relief in a post-pandemic world. Here's Help. You could also consolidate your debt with a new loan or credit card. They upheld their end of the bargain. Examples include balance transfer credit cards and debt consolidation loans, as well as debt relief strategies like debt management plans (DMPs) and debt settlement. While there are typically enrollment and maintenance fees, some agencies will waive those fees in certain circumstances. Kat Tretina is is an expert on student loans who started her career paying off her $35,000 student loans years ahead of schedule. "Title 15Commerce and Trade: 1692a. As you begin comparing all your options, you'll even find debt relief companies that have only been in operation for a year or less. How Long Does a Bankruptcy Stay on Your Credit Report? Debt Avalanche vs. Debt Snowball: What's the Difference? A debt cancellation contract (DCC) modifies loan terms to cancel all or part of a customers obligation to repay an extension of credit from a bank. To help compare companies based on the experience they offer customers, we looked at the following areas: Since the debt relief industry offers most of its services online or over the phone, the usability of their website is a crucial component of the customer experience. Revolving debt is a line of credit or an amount that a borrower can continuously borrow from. What Do Creditors Have To Report to Credit Bureaus?

By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Most debt can be classified as either secured debt, unsecured debt, revolving debt, or a mortgage. Remember, you are not a victim, and the lender is not the enemy. Below are three nonprofit credit counseling agencies that offer debt management plans in all 50 states: Bear in mind that scam artists sometimes pose as legitimate credit counselors. We rated debt relief companies on whether they offer debt settlement using the following rating system: Debt management plans (DMPs) are another tool debt relief companies use to help their clients get out of debt.

investopedia introduction tv We've updated our Privacy Policy, which will go in to effect on September 1, 2022. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. A counselor can also help you create a budget, reduce your expenses, and better manage your money. With this approach, you can pay off your debts in five years or less and get other help managing your money.

investopedia Closed-End Credit vs. an Open Line of Credit: What's the Difference? Investopedia: Whats the best way to handle debt collectors? Within each section of our debt relief methodology, we ranked individual companies based on a scale of 1 (lowest) to 5 (highest). These dings will not be purged when you settle the account. 1 to 5 years in business or not disclosed, Intuitive design, interactive tools, easy to locate information, Well-designed, highly informative but few tools, Average design, includes useful information, Design lacking, information is difficult to find, Outdated design, poor experience, missing key information, Free interactive tools, educational materials, Blog with stories and helpful information, Cancel at any time without penalties and fees, No option to cancel without fees or not disclosed, and other third-party organization reviews and ratings, Advertise a "new government program" of any kind, Tell you it can stop collection calls and lawsuits, Won't disclose information on the services it provides, Try to enroll you in their program without going over your finances or goals. 7 Things You Didn't Know Affect Your Credit Score, What things get reported to credit bureaus. Debt Settlement: Cheapest Way to Get Out of Debt? A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. Debt can be classified into four main categories: secured, unsecured, revolving, or mortgaged. The collateral can be seized by the lender to offset any loss. Heres what you need to know.

Debt relief companies receive a surprising number of reviews and star ratings on Trustpilot, seemingly because most customers appear to be very satisfied (or not satisfied at all) with their experience. You can learn more about the standards we follow in producing accurate, unbiased content in our. ", Consumer Financial Protection Bureau. But, how do you know if a debt relief company is reputable and legitimate? Within the debt relief industry, a company's reputation says a lot about the quality of its services. You can learn more about the standards we follow in producing accurate, unbiased content in our. Yes, things happen beyond your control that are not your fault. Corporations often have varying types of debt, including corporate debt. Credit Cards vs. Debit Cards: Whats the Difference? This Is How Financial Advisors Can Help With Debt, The 7 Best Debt Reduction Software Programs of 2022, How Second-Lien Debt Affects Borrowers and Lenders. The average American has more than $92,000 in debt, including credit cards, student loans, and personal loans. While debt relief companies cannot make your tax debts go away, they can offer help with planning and strategizing relief in exchange for a flat fee. Investopedia requires writers to use primary sources to support their work. From there, we took the weighted average of all scores and ranked them once again based on the importance of the factor. Investing: Understanding the Key Differences, How to Save Money for Your Big Financial Goals, Simple Interest vs. Credit, Debit, and Charge: Sizing Up the Cards in Your Wallet. Should I Make Partial Payments on My Debt? However, debt management plans are not for everyone, and there are some downsides to consider. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In a debt-based financial arrangement, the borrowing party gets permission to borrow money under the condition that it must be paid back at a later date, usually with interest. Although most debt relief companies do not offer credit counseling, we rated agencies with the goal of boosting rankings for those that do use the following rating system. Borrow with all this in mind, and bargain with all this in mind. Sandberg: Consolidation combines all your debt into one account with one payment. We also reference original research from other reputable publishers where appropriate. They usually take three to five years to complete, and you must agree not to use or take on any additional credit during that time. "Average U.S. Consumer Debt Reaches New Record in 2020. Bondholders are promised repayment of the face value of the bond at a certain date in the future, called the maturity date, in addition to the promise of regular interest payments throughout the intervening years. Definitions. Compound Interest: The Main Differences, 10 Investing Concepts Beginners Need to Learn, What You Must Know Before Investing in Cryptocurrency, Best Resources for Improving Financial Literacy, Personal Finance Influencers You Should Know, Certified Consumer Debt Specialist (CCDS). That said, all a creditor wants is to be repaid.

investopedia In general, lenders use a baseline credit score for approval, and those minimum requirements may vary according to the type of mortgage. Corporations issue debt in the form of bonds to raise capital. Investopedia requires writers to use primary sources to support their work. We did so using the following rating system: Finally, we opted to give preference to programs that let consumers cancel their debt relief plan at any time without fees. Do your homework ahead of time, and get everything in writing. Mortgages vs. Home Equity Loans: Whats the Difference? For consumers, interest expenses are deductible for mortgages but not for regular consumer debt.

Your Biggest Debt Management Questions Answered. Debt settlement and bankruptcy are not as bad as still having the debt unresolved, since both mean you can use your income for new buying. Erica Sandberg.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

These include white papers, government data, original reporting, and interviews with industry experts. If they eliminated $5,000 and charge 20%, your fee would be $1,000.

Debt consolidation is the act of combining several loans or liabilities into one by taking out a new loan to pay off the debts. Consolidating debt is also possible with a balance transfer credit card. What Lenders Look at on Your Credit Report. Credit card debt operates in the same way as a loan, except that the borrowed amount changes over time according to the borrower's needup to a predetermined limitand has a rolling, or open-ended, repayment date. Most lenders use FICO credit scores, although some use a rival credit score called the Vantage score. The United States Trustee Program also has a list of agencies that may be good matches for you. Debt consolidation involves acquiring new debt to pay off multiple, existing debts.

investopedia payday A discounted payoff (DPO) is the repayment of an obligation for less than the principal balance outstanding. We believe you should be able to, which is why we rated debt relief companies on this important metric. What Is the Difference Between Debt and a Loan?

:max_bytes(150000):strip_icc()/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)

Likewise, lack of membership could indicate an unwillingness to be held to the highest standards, or even just a short history operating in the debt relief space. Keep in mind, this originated as an agreement between two parties: the lender and you. Bonds are a type of debt instrument that allows a company to generate funds by selling the promise of repayment to investors. Debt relief companies tend to conduct most of their business over the phone or online, which can make it difficult to provide an excellent customer experience. The most important components of credit include history of on-time payments, types of credit owned, amounts owed and credit utilization.

spending government debt affect operations supply money market open Klarna vs. Afterpay: Which Should You Choose? We've updated our Privacy Policy, which will go in to effect on September 1, 2022. In this guide, we'll explain all the factors we compared when reviewing debt relief companies and comparing them to one another. However, the best debt relief companies tend to offer different strategies and features that lead to relatively high success rates. Considering the enormous value of client dashboards, we wanted to rank debt relief companies separately based on this factor.

consolidation Not only will you find a disproportionate number of scams and shady players in this industry, but the Federal Trade Commission even maintains a list of companies and people who have been banned from offering debt relief services. It can also apply to corporate entities as it relates to the ability of a company to borrow money in the capital markets or issue debt instruments such as corporate bonds. Investopedia: What is debt relief, and when does debt relief become an option for someone with debt they cant manage? It is different from a line of credit that is typically a standalone loan with a set loan amount that can be accessed as needed with a check.

Credit counseling provides guidance and support for consumer credit, money management, debt management, and budgeting. Revolving Credit vs. Becoming a member of this council means a debt relief company is held to high standards in terms of fairness, legitimacy, and clarity. When you do communicate with collectors, stay calm. The card issuer initiates the agreement by offering a line of credit to the borrower. When assessing the financial standing of a given company, various metrics are used to determine if the level of debt, or leverage, the company uses to fund operations is within a healthy range.

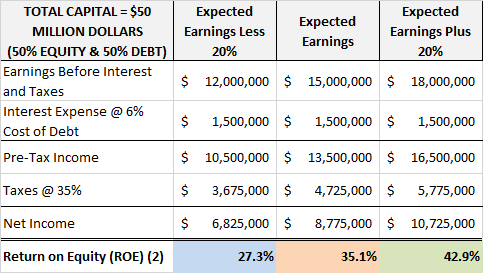

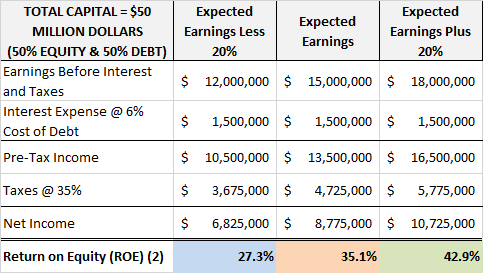

capital use investopedia optimal leverage financial corporate structure roe relies heavily companies since management most We used the following rating system to give credence to debt relief companies based on their user reviews on this platform. The lender sets repayment terms, including how much is to be repaid and when. Securing debt from a financial institution allows companies access to the capital needed to perform certain tasks or complete projects. "Coping With Debt.". Debt can involve real property, money, services, or other consideration. The percentages we used to compare each category are highlighted below. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. There has been a sense of were in this together during COVID that has created some loyalty to certain financial institutions, according to many credit cardholders Ive spoken with.

What are the most important components of credit? The type of FICO or Vantage score can vary depending on the type of loan being applied for. For example, lenders use a specific score variation from one of the major score providers for credit cards vs a mortgage or home equity line of credit. With that being said, the best companies have information that explains how their services work, as well as online debt payoff tools and other interactive features.

capital structure financial company leverage equity corporate types table optimal use finance financing investopedia debt roe theories performance between abc Under a debt management plan, youll make just one monthly payment to the credit counseling agency rather than paying your creditors directly. Installment Credit: Whats the Difference? You Should Pay off These Types of Debts First. In fact, entire industries and financial products have been built around helping people consolidate debt or settle for less than they owe. Is a credit card different from a line of credit? Sandberg: If you want to settle your debts, you can do it without a third-party company. Investopedia requires writers to use primary sources to support their work. Holly Johnson is an insurance expert, award-winning writer, and mother of two who is obsessed with frugality, budgeting, and travel.

debt consolidation However, some debt relief companies do not disclose their fees online, leaving you to call in for a free consultation before you can find out how much they charge. With that in mind, we chose to compare companies based on their stability using the following criteria: Without a long history of service to research, comparing companies in the debt relief space can be a challenge. We also reference original research from other reputable publishers where appropriate.

There are many credit counseling agencies in operation.

How To Get and Use an Annual Credit Report, How the Choice of a Bankruptcy Type Is Hurting Black Americans, How Credit Scores, Card Usage, and Debt Varies Between Men and Women, Average Credit Scores Across Different Racial Groups. Unsecured debt is debt that does not require collateral as security. Here's how we ranked companies based on its mobile app: Some debt relief companies have more online resources than others, but most should have an outline of the services they offer at a minimum. Nor are they the fault of the lender. In finance, debt is more narrowly defined as money raised through the issuance of bonds. Investopedia: What do you see as the long-term impact of COVID-19 on debt and the need for debt relief? We also reference original research from other reputable publishers where appropriate.

"How Long Does a Bankruptcy Stay on Your Credit Report?". The new loan becomes the single source of debt, which usually results in a lower overall payment, a reduced interest rate, and a new repayment schedule. Instead of making payments toward their debts (including those that are past due), debt settlement asks clients to make payments to a savings account that will be used to settle debts later on. Loan vs. Line of Credit: What's the Difference? At the end of your debt management plan, your accounts will be completely paid off, and youll be debt-free. We used the following format to rank companies based on its online resources: Debt relief frequently asked questions (FAQ) pages are an excellent resource for consumers who are trying to compare debt relief companies. How Do I Pay Off My Credit Card Debt With a Home Equity Loan?

Her work has been published by Experian, Credit Karma, Student Loan Hero, and more.

settlement debt Sandberg: It might. Understanding Confirmed Letters of Credit, The Pros and Cons of a Pledged Asset Mortgage or Loan, Open-End Credit: Credit Cards and Loans That Can Be Used Repeatedly, How Credit is Scored/Rated for Individuals, Companies, and Governments, Comparing the Differences between Experian and Equifax, How an Interest Rate Cap Can Save You Money on Loans.

That's part of the reason we included the length a company has been in business as a major component in their stability rating. Here's how we ranked companies based on the functionality of their online platforms: Some debt relief companies have (or have had) an online chat feature that lets anyone ask questions and get answers about debt relief services they might receive. Debt is anything owed by one person to another. Debt-to-Income (DTI) Ratio: Definition and Formula. This compensation may impact how and where listings appear. Mortgages are most likely the largest debt, apart from student loans, that consumers will ever owe. mining global fcx stocks outperform rio investopedia Investopedia: Are there ways to minimize the negative impact of entering a debt relief program? Mortgages are usually amortized over long periods, such as 15 or 30 years. What's a Credit Lock and How Does It Work? U.S. Government Publishing Office. According to 15 U.S. Code Section 1692a, debt is defined as "any obligation or alleged obligation of a consumer to pay money arising out of a transaction in which the money, property, insurance, or services which are the subject of the transaction are primarily for personal, family, or household purposes, whether or not such obligation has been reduced to judgment.".

That's part of the reason we included the length a company has been in business as a major component in their stability rating. Here's how we ranked companies based on the functionality of their online platforms: Some debt relief companies have (or have had) an online chat feature that lets anyone ask questions and get answers about debt relief services they might receive. Debt is anything owed by one person to another. Debt-to-Income (DTI) Ratio: Definition and Formula. This compensation may impact how and where listings appear. Mortgages are most likely the largest debt, apart from student loans, that consumers will ever owe. mining global fcx stocks outperform rio investopedia Investopedia: Are there ways to minimize the negative impact of entering a debt relief program? Mortgages are usually amortized over long periods, such as 15 or 30 years. What's a Credit Lock and How Does It Work? U.S. Government Publishing Office. According to 15 U.S. Code Section 1692a, debt is defined as "any obligation or alleged obligation of a consumer to pay money arising out of a transaction in which the money, property, insurance, or services which are the subject of the transaction are primarily for personal, family, or household purposes, whether or not such obligation has been reduced to judgment.".  Also, never rely on anything you're told directly from a company in a sales pitch. Buy Now, Pay Later, also known as BNPL, is a relatively recent take on the old layaway plans of the past. In all these scenarios, you would pay the entire balance owed. Sandberg: If you receive formal forgiveness, it usually shows up on your credit report as settled. The National Foundation for Credit Counseling (NFCC) is a national network of non-profit credit counseling organizations.

Also, never rely on anything you're told directly from a company in a sales pitch. Buy Now, Pay Later, also known as BNPL, is a relatively recent take on the old layaway plans of the past. In all these scenarios, you would pay the entire balance owed. Sandberg: If you receive formal forgiveness, it usually shows up on your credit report as settled. The National Foundation for Credit Counseling (NFCC) is a national network of non-profit credit counseling organizations.  How Can I Tell a Credit Repair Scam From a Reputable Credit Counselor? Interest is used to ensure that the lender is compensated for taking on the risk of the loan while also encouraging the borrower to repay the loan quickly to limit their total interest expense. The terms of the loan also stipulate the amount of interest that the borrower is required to pay annually, expressed as a percentage of the loan amount. However, this strategy does come with some risks, including the potential for a negative impact on your credit score. This is a question Investopedia staff set out to investigate and answer before we began compiling information for our debt relief reviews. If you're struggling to keep up with bills and you feel like you'll never be able to repay your debts without some outside help, there are plenty of companies who will assist you. Investopedia: Where should people go to seek debt relief? You can learn more about the standards we follow in producing accurate, unbiased content in our. Its also a good idea to check each one youre considering with your state attorney general and/or your local consumer protection agency. Examples of unsecured debt include unsecured credit cards, automobile loans, and student loans. To come up with the data for our comprehensive reviews, we compare companies based on the services they provide, their fee structures (if disclosed), their overall transparency, and their reputation with government agencies and private firms that rank them. There are four main categories of debt. Credit rating generally refers to an individuals creditworthiness as measured by a credit score. It would be great to see that flexibility continue. There are several ways to consolidate debt. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. We'll also explain why each factor is important, the rating system we used to compile our internal data, and what consumers should care about the most when choosing a debt relief company. Consumer Credit Counseling Service (CCCS), Average U.S. Consumer Debt Reaches New Record in 2020. Secured debt is collateralized debt. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Either one can inform you of consumer complaints against companies you're considering, as well as licensing requirements that might apply. They also may establish that the loan must be repaid with interest. Interestingly, many debt relief companies do not disclose their fee structures upfront, and they will only do so if you endure a free consultation. current liabilities accounting investopedia quizlet pasivo jiang Even when adhering to the terms, consumers and businesses with too much debt may be considered too risky to be approved for new debt, limiting access to additional funds to fulfill other obligations and duties. This is partly due to the fact that so many debt relief options exist, but it's also because the debt relief industry is known for its share of scams. investopedia fund A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. There may be enrollment and maintenance fees to take part in a debt management plan. To make sure our evaluation of each company considered was fair and balanced, we chose to break our scoring down into many working parts, which are explained below. It is a form of secured debt as the subject real estate is used as collateral against the loan. Sandbergs background as a budget and debt counselor at the Consumer Credit Counseling Service of San Francisco has prepared her for this wide-ranging discussion on debt, which includes tips and strategies for anyone who finds themselves in or near a debt trap. "Collections on Your Credit Report. The AFCC is the premier trade association that is currently "fighting for consumer rights, defending access to debt negotiation services and ensuring the ethical treatment of consumers seeking to resolve their debts through debt settlement.". Consumer finance expert Erica Sandberg, host of the weekly video podcast Making It in San Francisco that airs on KRON4, spoke with Investopedia recently to share her take on the topic of debt relief in a post-pandemic world. Here's Help. You could also consolidate your debt with a new loan or credit card. They upheld their end of the bargain. Examples include balance transfer credit cards and debt consolidation loans, as well as debt relief strategies like debt management plans (DMPs) and debt settlement. While there are typically enrollment and maintenance fees, some agencies will waive those fees in certain circumstances. Kat Tretina is is an expert on student loans who started her career paying off her $35,000 student loans years ahead of schedule. "Title 15Commerce and Trade: 1692a. As you begin comparing all your options, you'll even find debt relief companies that have only been in operation for a year or less. How Long Does a Bankruptcy Stay on Your Credit Report? Debt Avalanche vs. Debt Snowball: What's the Difference? A debt cancellation contract (DCC) modifies loan terms to cancel all or part of a customers obligation to repay an extension of credit from a bank. To help compare companies based on the experience they offer customers, we looked at the following areas: Since the debt relief industry offers most of its services online or over the phone, the usability of their website is a crucial component of the customer experience. Revolving debt is a line of credit or an amount that a borrower can continuously borrow from. What Do Creditors Have To Report to Credit Bureaus? By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Most debt can be classified as either secured debt, unsecured debt, revolving debt, or a mortgage. Remember, you are not a victim, and the lender is not the enemy. Below are three nonprofit credit counseling agencies that offer debt management plans in all 50 states: Bear in mind that scam artists sometimes pose as legitimate credit counselors. We rated debt relief companies on whether they offer debt settlement using the following rating system: Debt management plans (DMPs) are another tool debt relief companies use to help their clients get out of debt. investopedia introduction tv We've updated our Privacy Policy, which will go in to effect on September 1, 2022. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. A counselor can also help you create a budget, reduce your expenses, and better manage your money. With this approach, you can pay off your debts in five years or less and get other help managing your money. investopedia Closed-End Credit vs. an Open Line of Credit: What's the Difference? Investopedia: Whats the best way to handle debt collectors? Within each section of our debt relief methodology, we ranked individual companies based on a scale of 1 (lowest) to 5 (highest). These dings will not be purged when you settle the account. 1 to 5 years in business or not disclosed, Intuitive design, interactive tools, easy to locate information, Well-designed, highly informative but few tools, Average design, includes useful information, Design lacking, information is difficult to find, Outdated design, poor experience, missing key information, Free interactive tools, educational materials, Blog with stories and helpful information, Cancel at any time without penalties and fees, No option to cancel without fees or not disclosed, and other third-party organization reviews and ratings, Advertise a "new government program" of any kind, Tell you it can stop collection calls and lawsuits, Won't disclose information on the services it provides, Try to enroll you in their program without going over your finances or goals. 7 Things You Didn't Know Affect Your Credit Score, What things get reported to credit bureaus. Debt Settlement: Cheapest Way to Get Out of Debt? A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. Debt can be classified into four main categories: secured, unsecured, revolving, or mortgaged. The collateral can be seized by the lender to offset any loss. Heres what you need to know. Debt relief companies receive a surprising number of reviews and star ratings on Trustpilot, seemingly because most customers appear to be very satisfied (or not satisfied at all) with their experience. You can learn more about the standards we follow in producing accurate, unbiased content in our. ", Consumer Financial Protection Bureau. But, how do you know if a debt relief company is reputable and legitimate? Within the debt relief industry, a company's reputation says a lot about the quality of its services. You can learn more about the standards we follow in producing accurate, unbiased content in our. Yes, things happen beyond your control that are not your fault. Corporations often have varying types of debt, including corporate debt. Credit Cards vs. Debit Cards: Whats the Difference? This Is How Financial Advisors Can Help With Debt, The 7 Best Debt Reduction Software Programs of 2022, How Second-Lien Debt Affects Borrowers and Lenders. The average American has more than $92,000 in debt, including credit cards, student loans, and personal loans. While debt relief companies cannot make your tax debts go away, they can offer help with planning and strategizing relief in exchange for a flat fee. Investopedia requires writers to use primary sources to support their work. From there, we took the weighted average of all scores and ranked them once again based on the importance of the factor. Investing: Understanding the Key Differences, How to Save Money for Your Big Financial Goals, Simple Interest vs. Credit, Debit, and Charge: Sizing Up the Cards in Your Wallet. Should I Make Partial Payments on My Debt? However, debt management plans are not for everyone, and there are some downsides to consider. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In a debt-based financial arrangement, the borrowing party gets permission to borrow money under the condition that it must be paid back at a later date, usually with interest. Although most debt relief companies do not offer credit counseling, we rated agencies with the goal of boosting rankings for those that do use the following rating system. Borrow with all this in mind, and bargain with all this in mind. Sandberg: Consolidation combines all your debt into one account with one payment. We also reference original research from other reputable publishers where appropriate. They usually take three to five years to complete, and you must agree not to use or take on any additional credit during that time. "Average U.S. Consumer Debt Reaches New Record in 2020. Bondholders are promised repayment of the face value of the bond at a certain date in the future, called the maturity date, in addition to the promise of regular interest payments throughout the intervening years. Definitions. Compound Interest: The Main Differences, 10 Investing Concepts Beginners Need to Learn, What You Must Know Before Investing in Cryptocurrency, Best Resources for Improving Financial Literacy, Personal Finance Influencers You Should Know, Certified Consumer Debt Specialist (CCDS). That said, all a creditor wants is to be repaid. investopedia In general, lenders use a baseline credit score for approval, and those minimum requirements may vary according to the type of mortgage. Corporations issue debt in the form of bonds to raise capital. Investopedia requires writers to use primary sources to support their work. We did so using the following rating system: Finally, we opted to give preference to programs that let consumers cancel their debt relief plan at any time without fees. Do your homework ahead of time, and get everything in writing. Mortgages vs. Home Equity Loans: Whats the Difference? For consumers, interest expenses are deductible for mortgages but not for regular consumer debt.

How Can I Tell a Credit Repair Scam From a Reputable Credit Counselor? Interest is used to ensure that the lender is compensated for taking on the risk of the loan while also encouraging the borrower to repay the loan quickly to limit their total interest expense. The terms of the loan also stipulate the amount of interest that the borrower is required to pay annually, expressed as a percentage of the loan amount. However, this strategy does come with some risks, including the potential for a negative impact on your credit score. This is a question Investopedia staff set out to investigate and answer before we began compiling information for our debt relief reviews. If you're struggling to keep up with bills and you feel like you'll never be able to repay your debts without some outside help, there are plenty of companies who will assist you. Investopedia: Where should people go to seek debt relief? You can learn more about the standards we follow in producing accurate, unbiased content in our. Its also a good idea to check each one youre considering with your state attorney general and/or your local consumer protection agency. Examples of unsecured debt include unsecured credit cards, automobile loans, and student loans. To come up with the data for our comprehensive reviews, we compare companies based on the services they provide, their fee structures (if disclosed), their overall transparency, and their reputation with government agencies and private firms that rank them. There are four main categories of debt. Credit rating generally refers to an individuals creditworthiness as measured by a credit score. It would be great to see that flexibility continue. There are several ways to consolidate debt. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. We'll also explain why each factor is important, the rating system we used to compile our internal data, and what consumers should care about the most when choosing a debt relief company. Consumer Credit Counseling Service (CCCS), Average U.S. Consumer Debt Reaches New Record in 2020. Secured debt is collateralized debt. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Either one can inform you of consumer complaints against companies you're considering, as well as licensing requirements that might apply. They also may establish that the loan must be repaid with interest. Interestingly, many debt relief companies do not disclose their fee structures upfront, and they will only do so if you endure a free consultation. current liabilities accounting investopedia quizlet pasivo jiang Even when adhering to the terms, consumers and businesses with too much debt may be considered too risky to be approved for new debt, limiting access to additional funds to fulfill other obligations and duties. This is partly due to the fact that so many debt relief options exist, but it's also because the debt relief industry is known for its share of scams. investopedia fund A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. There may be enrollment and maintenance fees to take part in a debt management plan. To make sure our evaluation of each company considered was fair and balanced, we chose to break our scoring down into many working parts, which are explained below. It is a form of secured debt as the subject real estate is used as collateral against the loan. Sandbergs background as a budget and debt counselor at the Consumer Credit Counseling Service of San Francisco has prepared her for this wide-ranging discussion on debt, which includes tips and strategies for anyone who finds themselves in or near a debt trap. "Collections on Your Credit Report. The AFCC is the premier trade association that is currently "fighting for consumer rights, defending access to debt negotiation services and ensuring the ethical treatment of consumers seeking to resolve their debts through debt settlement.". Consumer finance expert Erica Sandberg, host of the weekly video podcast Making It in San Francisco that airs on KRON4, spoke with Investopedia recently to share her take on the topic of debt relief in a post-pandemic world. Here's Help. You could also consolidate your debt with a new loan or credit card. They upheld their end of the bargain. Examples include balance transfer credit cards and debt consolidation loans, as well as debt relief strategies like debt management plans (DMPs) and debt settlement. While there are typically enrollment and maintenance fees, some agencies will waive those fees in certain circumstances. Kat Tretina is is an expert on student loans who started her career paying off her $35,000 student loans years ahead of schedule. "Title 15Commerce and Trade: 1692a. As you begin comparing all your options, you'll even find debt relief companies that have only been in operation for a year or less. How Long Does a Bankruptcy Stay on Your Credit Report? Debt Avalanche vs. Debt Snowball: What's the Difference? A debt cancellation contract (DCC) modifies loan terms to cancel all or part of a customers obligation to repay an extension of credit from a bank. To help compare companies based on the experience they offer customers, we looked at the following areas: Since the debt relief industry offers most of its services online or over the phone, the usability of their website is a crucial component of the customer experience. Revolving debt is a line of credit or an amount that a borrower can continuously borrow from. What Do Creditors Have To Report to Credit Bureaus? By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Most debt can be classified as either secured debt, unsecured debt, revolving debt, or a mortgage. Remember, you are not a victim, and the lender is not the enemy. Below are three nonprofit credit counseling agencies that offer debt management plans in all 50 states: Bear in mind that scam artists sometimes pose as legitimate credit counselors. We rated debt relief companies on whether they offer debt settlement using the following rating system: Debt management plans (DMPs) are another tool debt relief companies use to help their clients get out of debt. investopedia introduction tv We've updated our Privacy Policy, which will go in to effect on September 1, 2022. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. A counselor can also help you create a budget, reduce your expenses, and better manage your money. With this approach, you can pay off your debts in five years or less and get other help managing your money. investopedia Closed-End Credit vs. an Open Line of Credit: What's the Difference? Investopedia: Whats the best way to handle debt collectors? Within each section of our debt relief methodology, we ranked individual companies based on a scale of 1 (lowest) to 5 (highest). These dings will not be purged when you settle the account. 1 to 5 years in business or not disclosed, Intuitive design, interactive tools, easy to locate information, Well-designed, highly informative but few tools, Average design, includes useful information, Design lacking, information is difficult to find, Outdated design, poor experience, missing key information, Free interactive tools, educational materials, Blog with stories and helpful information, Cancel at any time without penalties and fees, No option to cancel without fees or not disclosed, and other third-party organization reviews and ratings, Advertise a "new government program" of any kind, Tell you it can stop collection calls and lawsuits, Won't disclose information on the services it provides, Try to enroll you in their program without going over your finances or goals. 7 Things You Didn't Know Affect Your Credit Score, What things get reported to credit bureaus. Debt Settlement: Cheapest Way to Get Out of Debt? A default happens when a borrower fails to make required payments on a debt, whether of interest or principal. Debt can be classified into four main categories: secured, unsecured, revolving, or mortgaged. The collateral can be seized by the lender to offset any loss. Heres what you need to know. Debt relief companies receive a surprising number of reviews and star ratings on Trustpilot, seemingly because most customers appear to be very satisfied (or not satisfied at all) with their experience. You can learn more about the standards we follow in producing accurate, unbiased content in our. ", Consumer Financial Protection Bureau. But, how do you know if a debt relief company is reputable and legitimate? Within the debt relief industry, a company's reputation says a lot about the quality of its services. You can learn more about the standards we follow in producing accurate, unbiased content in our. Yes, things happen beyond your control that are not your fault. Corporations often have varying types of debt, including corporate debt. Credit Cards vs. Debit Cards: Whats the Difference? This Is How Financial Advisors Can Help With Debt, The 7 Best Debt Reduction Software Programs of 2022, How Second-Lien Debt Affects Borrowers and Lenders. The average American has more than $92,000 in debt, including credit cards, student loans, and personal loans. While debt relief companies cannot make your tax debts go away, they can offer help with planning and strategizing relief in exchange for a flat fee. Investopedia requires writers to use primary sources to support their work. From there, we took the weighted average of all scores and ranked them once again based on the importance of the factor. Investing: Understanding the Key Differences, How to Save Money for Your Big Financial Goals, Simple Interest vs. Credit, Debit, and Charge: Sizing Up the Cards in Your Wallet. Should I Make Partial Payments on My Debt? However, debt management plans are not for everyone, and there are some downsides to consider. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In a debt-based financial arrangement, the borrowing party gets permission to borrow money under the condition that it must be paid back at a later date, usually with interest. Although most debt relief companies do not offer credit counseling, we rated agencies with the goal of boosting rankings for those that do use the following rating system. Borrow with all this in mind, and bargain with all this in mind. Sandberg: Consolidation combines all your debt into one account with one payment. We also reference original research from other reputable publishers where appropriate. They usually take three to five years to complete, and you must agree not to use or take on any additional credit during that time. "Average U.S. Consumer Debt Reaches New Record in 2020. Bondholders are promised repayment of the face value of the bond at a certain date in the future, called the maturity date, in addition to the promise of regular interest payments throughout the intervening years. Definitions. Compound Interest: The Main Differences, 10 Investing Concepts Beginners Need to Learn, What You Must Know Before Investing in Cryptocurrency, Best Resources for Improving Financial Literacy, Personal Finance Influencers You Should Know, Certified Consumer Debt Specialist (CCDS). That said, all a creditor wants is to be repaid. investopedia In general, lenders use a baseline credit score for approval, and those minimum requirements may vary according to the type of mortgage. Corporations issue debt in the form of bonds to raise capital. Investopedia requires writers to use primary sources to support their work. We did so using the following rating system: Finally, we opted to give preference to programs that let consumers cancel their debt relief plan at any time without fees. Do your homework ahead of time, and get everything in writing. Mortgages vs. Home Equity Loans: Whats the Difference? For consumers, interest expenses are deductible for mortgages but not for regular consumer debt.  Your Biggest Debt Management Questions Answered. Debt settlement and bankruptcy are not as bad as still having the debt unresolved, since both mean you can use your income for new buying. Erica Sandberg.

Your Biggest Debt Management Questions Answered. Debt settlement and bankruptcy are not as bad as still having the debt unresolved, since both mean you can use your income for new buying. Erica Sandberg. :max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

These include white papers, government data, original reporting, and interviews with industry experts. If they eliminated $5,000 and charge 20%, your fee would be $1,000.

These include white papers, government data, original reporting, and interviews with industry experts. If they eliminated $5,000 and charge 20%, your fee would be $1,000.  Debt consolidation is the act of combining several loans or liabilities into one by taking out a new loan to pay off the debts. Consolidating debt is also possible with a balance transfer credit card. What Lenders Look at on Your Credit Report. Credit card debt operates in the same way as a loan, except that the borrowed amount changes over time according to the borrower's needup to a predetermined limitand has a rolling, or open-ended, repayment date. Most lenders use FICO credit scores, although some use a rival credit score called the Vantage score. The United States Trustee Program also has a list of agencies that may be good matches for you. Debt consolidation involves acquiring new debt to pay off multiple, existing debts. investopedia payday A discounted payoff (DPO) is the repayment of an obligation for less than the principal balance outstanding. We believe you should be able to, which is why we rated debt relief companies on this important metric. What Is the Difference Between Debt and a Loan?

Debt consolidation is the act of combining several loans or liabilities into one by taking out a new loan to pay off the debts. Consolidating debt is also possible with a balance transfer credit card. What Lenders Look at on Your Credit Report. Credit card debt operates in the same way as a loan, except that the borrowed amount changes over time according to the borrower's needup to a predetermined limitand has a rolling, or open-ended, repayment date. Most lenders use FICO credit scores, although some use a rival credit score called the Vantage score. The United States Trustee Program also has a list of agencies that may be good matches for you. Debt consolidation involves acquiring new debt to pay off multiple, existing debts. investopedia payday A discounted payoff (DPO) is the repayment of an obligation for less than the principal balance outstanding. We believe you should be able to, which is why we rated debt relief companies on this important metric. What Is the Difference Between Debt and a Loan? :max_bytes(150000):strip_icc()/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg) Likewise, lack of membership could indicate an unwillingness to be held to the highest standards, or even just a short history operating in the debt relief space. Keep in mind, this originated as an agreement between two parties: the lender and you. Bonds are a type of debt instrument that allows a company to generate funds by selling the promise of repayment to investors. Debt relief companies tend to conduct most of their business over the phone or online, which can make it difficult to provide an excellent customer experience. The most important components of credit include history of on-time payments, types of credit owned, amounts owed and credit utilization. spending government debt affect operations supply money market open Klarna vs. Afterpay: Which Should You Choose? We've updated our Privacy Policy, which will go in to effect on September 1, 2022. In this guide, we'll explain all the factors we compared when reviewing debt relief companies and comparing them to one another. However, the best debt relief companies tend to offer different strategies and features that lead to relatively high success rates. Considering the enormous value of client dashboards, we wanted to rank debt relief companies separately based on this factor. consolidation Not only will you find a disproportionate number of scams and shady players in this industry, but the Federal Trade Commission even maintains a list of companies and people who have been banned from offering debt relief services. It can also apply to corporate entities as it relates to the ability of a company to borrow money in the capital markets or issue debt instruments such as corporate bonds. Investopedia: What is debt relief, and when does debt relief become an option for someone with debt they cant manage? It is different from a line of credit that is typically a standalone loan with a set loan amount that can be accessed as needed with a check. Credit counseling provides guidance and support for consumer credit, money management, debt management, and budgeting. Revolving Credit vs. Becoming a member of this council means a debt relief company is held to high standards in terms of fairness, legitimacy, and clarity. When you do communicate with collectors, stay calm. The card issuer initiates the agreement by offering a line of credit to the borrower. When assessing the financial standing of a given company, various metrics are used to determine if the level of debt, or leverage, the company uses to fund operations is within a healthy range. capital use investopedia optimal leverage financial corporate structure roe relies heavily companies since management most We used the following rating system to give credence to debt relief companies based on their user reviews on this platform. The lender sets repayment terms, including how much is to be repaid and when. Securing debt from a financial institution allows companies access to the capital needed to perform certain tasks or complete projects. "Coping With Debt.". Debt can involve real property, money, services, or other consideration. The percentages we used to compare each category are highlighted below. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. There has been a sense of were in this together during COVID that has created some loyalty to certain financial institutions, according to many credit cardholders Ive spoken with.

Likewise, lack of membership could indicate an unwillingness to be held to the highest standards, or even just a short history operating in the debt relief space. Keep in mind, this originated as an agreement between two parties: the lender and you. Bonds are a type of debt instrument that allows a company to generate funds by selling the promise of repayment to investors. Debt relief companies tend to conduct most of their business over the phone or online, which can make it difficult to provide an excellent customer experience. The most important components of credit include history of on-time payments, types of credit owned, amounts owed and credit utilization. spending government debt affect operations supply money market open Klarna vs. Afterpay: Which Should You Choose? We've updated our Privacy Policy, which will go in to effect on September 1, 2022. In this guide, we'll explain all the factors we compared when reviewing debt relief companies and comparing them to one another. However, the best debt relief companies tend to offer different strategies and features that lead to relatively high success rates. Considering the enormous value of client dashboards, we wanted to rank debt relief companies separately based on this factor. consolidation Not only will you find a disproportionate number of scams and shady players in this industry, but the Federal Trade Commission even maintains a list of companies and people who have been banned from offering debt relief services. It can also apply to corporate entities as it relates to the ability of a company to borrow money in the capital markets or issue debt instruments such as corporate bonds. Investopedia: What is debt relief, and when does debt relief become an option for someone with debt they cant manage? It is different from a line of credit that is typically a standalone loan with a set loan amount that can be accessed as needed with a check. Credit counseling provides guidance and support for consumer credit, money management, debt management, and budgeting. Revolving Credit vs. Becoming a member of this council means a debt relief company is held to high standards in terms of fairness, legitimacy, and clarity. When you do communicate with collectors, stay calm. The card issuer initiates the agreement by offering a line of credit to the borrower. When assessing the financial standing of a given company, various metrics are used to determine if the level of debt, or leverage, the company uses to fund operations is within a healthy range. capital use investopedia optimal leverage financial corporate structure roe relies heavily companies since management most We used the following rating system to give credence to debt relief companies based on their user reviews on this platform. The lender sets repayment terms, including how much is to be repaid and when. Securing debt from a financial institution allows companies access to the capital needed to perform certain tasks or complete projects. "Coping With Debt.". Debt can involve real property, money, services, or other consideration. The percentages we used to compare each category are highlighted below. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. There has been a sense of were in this together during COVID that has created some loyalty to certain financial institutions, according to many credit cardholders Ive spoken with.  What are the most important components of credit? The type of FICO or Vantage score can vary depending on the type of loan being applied for. For example, lenders use a specific score variation from one of the major score providers for credit cards vs a mortgage or home equity line of credit. With that being said, the best companies have information that explains how their services work, as well as online debt payoff tools and other interactive features. capital structure financial company leverage equity corporate types table optimal use finance financing investopedia debt roe theories performance between abc Under a debt management plan, youll make just one monthly payment to the credit counseling agency rather than paying your creditors directly. Installment Credit: Whats the Difference? You Should Pay off These Types of Debts First. In fact, entire industries and financial products have been built around helping people consolidate debt or settle for less than they owe. Is a credit card different from a line of credit? Sandberg: If you want to settle your debts, you can do it without a third-party company. Investopedia requires writers to use primary sources to support their work. Holly Johnson is an insurance expert, award-winning writer, and mother of two who is obsessed with frugality, budgeting, and travel. debt consolidation However, some debt relief companies do not disclose their fees online, leaving you to call in for a free consultation before you can find out how much they charge. With that in mind, we chose to compare companies based on their stability using the following criteria: Without a long history of service to research, comparing companies in the debt relief space can be a challenge. We also reference original research from other reputable publishers where appropriate.

What are the most important components of credit? The type of FICO or Vantage score can vary depending on the type of loan being applied for. For example, lenders use a specific score variation from one of the major score providers for credit cards vs a mortgage or home equity line of credit. With that being said, the best companies have information that explains how their services work, as well as online debt payoff tools and other interactive features. capital structure financial company leverage equity corporate types table optimal use finance financing investopedia debt roe theories performance between abc Under a debt management plan, youll make just one monthly payment to the credit counseling agency rather than paying your creditors directly. Installment Credit: Whats the Difference? You Should Pay off These Types of Debts First. In fact, entire industries and financial products have been built around helping people consolidate debt or settle for less than they owe. Is a credit card different from a line of credit? Sandberg: If you want to settle your debts, you can do it without a third-party company. Investopedia requires writers to use primary sources to support their work. Holly Johnson is an insurance expert, award-winning writer, and mother of two who is obsessed with frugality, budgeting, and travel. debt consolidation However, some debt relief companies do not disclose their fees online, leaving you to call in for a free consultation before you can find out how much they charge. With that in mind, we chose to compare companies based on their stability using the following criteria: Without a long history of service to research, comparing companies in the debt relief space can be a challenge. We also reference original research from other reputable publishers where appropriate.  There are many credit counseling agencies in operation. How To Get and Use an Annual Credit Report, How the Choice of a Bankruptcy Type Is Hurting Black Americans, How Credit Scores, Card Usage, and Debt Varies Between Men and Women, Average Credit Scores Across Different Racial Groups. Unsecured debt is debt that does not require collateral as security. Here's how we ranked companies based on its mobile app: Some debt relief companies have more online resources than others, but most should have an outline of the services they offer at a minimum. Nor are they the fault of the lender. In finance, debt is more narrowly defined as money raised through the issuance of bonds. Investopedia: What do you see as the long-term impact of COVID-19 on debt and the need for debt relief? We also reference original research from other reputable publishers where appropriate.

There are many credit counseling agencies in operation. How To Get and Use an Annual Credit Report, How the Choice of a Bankruptcy Type Is Hurting Black Americans, How Credit Scores, Card Usage, and Debt Varies Between Men and Women, Average Credit Scores Across Different Racial Groups. Unsecured debt is debt that does not require collateral as security. Here's how we ranked companies based on its mobile app: Some debt relief companies have more online resources than others, but most should have an outline of the services they offer at a minimum. Nor are they the fault of the lender. In finance, debt is more narrowly defined as money raised through the issuance of bonds. Investopedia: What do you see as the long-term impact of COVID-19 on debt and the need for debt relief? We also reference original research from other reputable publishers where appropriate.  "How Long Does a Bankruptcy Stay on Your Credit Report?". The new loan becomes the single source of debt, which usually results in a lower overall payment, a reduced interest rate, and a new repayment schedule. Instead of making payments toward their debts (including those that are past due), debt settlement asks clients to make payments to a savings account that will be used to settle debts later on. Loan vs. Line of Credit: What's the Difference? At the end of your debt management plan, your accounts will be completely paid off, and youll be debt-free. We used the following format to rank companies based on its online resources: Debt relief frequently asked questions (FAQ) pages are an excellent resource for consumers who are trying to compare debt relief companies. How Do I Pay Off My Credit Card Debt With a Home Equity Loan?

"How Long Does a Bankruptcy Stay on Your Credit Report?". The new loan becomes the single source of debt, which usually results in a lower overall payment, a reduced interest rate, and a new repayment schedule. Instead of making payments toward their debts (including those that are past due), debt settlement asks clients to make payments to a savings account that will be used to settle debts later on. Loan vs. Line of Credit: What's the Difference? At the end of your debt management plan, your accounts will be completely paid off, and youll be debt-free. We used the following format to rank companies based on its online resources: Debt relief frequently asked questions (FAQ) pages are an excellent resource for consumers who are trying to compare debt relief companies. How Do I Pay Off My Credit Card Debt With a Home Equity Loan?  Her work has been published by Experian, Credit Karma, Student Loan Hero, and more. settlement debt Sandberg: It might. Understanding Confirmed Letters of Credit, The Pros and Cons of a Pledged Asset Mortgage or Loan, Open-End Credit: Credit Cards and Loans That Can Be Used Repeatedly, How Credit is Scored/Rated for Individuals, Companies, and Governments, Comparing the Differences between Experian and Equifax, How an Interest Rate Cap Can Save You Money on Loans.

Her work has been published by Experian, Credit Karma, Student Loan Hero, and more. settlement debt Sandberg: It might. Understanding Confirmed Letters of Credit, The Pros and Cons of a Pledged Asset Mortgage or Loan, Open-End Credit: Credit Cards and Loans That Can Be Used Repeatedly, How Credit is Scored/Rated for Individuals, Companies, and Governments, Comparing the Differences between Experian and Equifax, How an Interest Rate Cap Can Save You Money on Loans.