The amount entered on page 2, Part III, line 2, should be entered on line 14, page 1. Heroes for Hire Tax Credit Act of 2012 Business Start-Up Expense Credit. You may elect to credit all or part of the overpayment shown on line 31 to your 2014 estimated tax. After then, press 3 for any more questions. Please use sheets that are the same size as the forms and schedules. Add the Alabama income tax withheld together and enter on line 22. Credit for Taxes Paid to Another State. Tax filers must follow prompts to enter their Social Security Number and the numbers in their street address. Montgomery, AL 36135-0001. Amounts may be considered nondeductible contributions for the following reasons: Line 3. The Child Support Enforcement (CSE or IV-D) Division Online Payment Inquiry system provides a portal so that Custodial parties can find child support payment information and Non-Custodial parents can find court order balances, bills and payment coupons through their MyAlabama account. Copies of your returns and your other records may be helpful to your survivor, or the executor or administrator of your estate. Note:

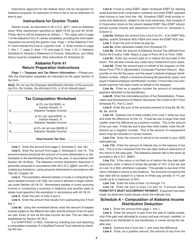

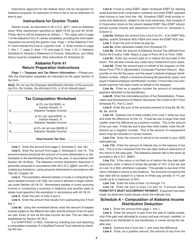

You must figure your tax from the Tax Tables unless you are claiming a carryover or carryback Net Operating Loss from another year. Once an election is made to apply this overpayment to your 2014 estimated tax, it cannot later be refunded to you or applied to pay additional tax for 2013. There is no provision in Alabama law for forward averaging of such distributions. (Place amount on line 32.) Make certain the "State Copy" of all forms W-2 wage and tax statements are included, W-2s are frequently missing. Page 16 of this booklet provides additional information on these penalties. (Your 2012 tax return must cover a 12-month period.) (See definition of dependent on page 8.). C - Pensions, annuities, etc., you began receiving prior to January 1, 1987 in which you have not recovered your cost. Interest on the additional tax due from the due date of the return and any penalties will be assessed if applicable to your return.

Please note: An Alabama refund of a deceased taxpayer cannot be issued to a third party. Review the purchases you made during 2013. Alabama Historic Commission The IRS phone number is 1-800-829-1040, and they are open from 7 a.m.to 7 p.m., seven days a week.- 7 p.m.is the end time. Credit Card: (Schedule B). In order to receive a direct deposit refund for a paper return, your return must be prepared using tax preparation software that utilizes 2D bar code technology or from our Web site by using the Form 40 with calculations. If you sold real estate, stocks, bonds or other capital assets, use Schedule D to report the net gain (or loss). The Alabama Department of Revenue will issue you a Form 1099-G for the overpayment amount. For amounts you began receiving prior to 1987, you can exclude from the taxable amount your unrecovered cost to the plan. For further information regarding the "Alabama Enterprise Zone Act" and the necessary forms to claim this credit, you should contact: Alabama Department of Economic and Community Affairs The taxable portion may NOT be the same for Alabama purposes as for Federal purposes because you may have a different cost basis. You can also file a joint return if your spouse died in 2013 before filing a 2013 return. Statement from Alabama Department of Revenue: "For the most up-to-date information concerning the status of your current year refund, call 1-855-894-7391 or check our website, then click on Where's My Refund. Enter the taxable amount of your pension or annuity on line 5b. Subsistence allowance received by law enforcement and corrections officers of the State of Alabama. If your return is corrected by the Department, the amount contributed cannot be used to pay any additional tax due. Note to readers: if you purchase something through one of our affiliate links we may earn a commission. Interest on: bank deposits, bonds, notes, Federal Income Tax Refunds, mortgages on which you receive payments, accounts with savings and loan associations, mutual savings banks, credit unions, etc. This credit is available to recently deployed and now discharged unemployed veterans who start their own business. Privacy Policy and Cookie Statement updated 7/1/2022). Accurate records should be kept of the amounts contributed in order to determine your cost basis when the funds are withdrawn. When you purchase merchandise from a business located outside of Alabama the seller might collect use tax on the purchase. options to request Verification of Non-filing. Estimated tax payments were not credited in the correct manner. From Monday through Friday.The ideal time to contact someone is first thing in the morning.Option 1 should not be selected after you have selected your language (regarding refund info).Instead, select Option 2 for your Personal Income Tax return. This copy should be marked "To Be Filed With Your Alabama Income Tax Return.". The amounts entered on these lines will be paid to the programs you indicate. For more information concerning the prepaid debit card go to page 32. All retirement compensation received by an eligible peace officer or a designated beneficiary from any Alabama police retirement system. Enter the amounts you received as alimony or separate maintenance. and Common Mistakes That Delay Refunds on page 4 of this booklet for further information about your refund. Enter the full amount you received on line 9 and the taxable portion on line 10. If you move after filing your return and expect a refund, you should notify the Department of Revenue and send a change of address notice to: Alabama Department of Revenue, Individual and Corporate Tax Division, P. O. Usually this is 3 years from the date the return was filed. If a citizen of a foreign country comes to Alabama to work (no matter how long he stays), buys a home, secures an Alabama driver's license, does not intend to apply for U.S.

refund tax guy filing paper revenue refunds carolina department welcome south fusion cold Gross income usually means money, goods, and property you received on which you must pay tax.

Beginning January 1, 1998, all benefits received from Alabama Prepaid Tuition Contracts (PACT). (See page 21. If you have questions about whether a preparer is required to sign a return, please contact an Alabama Taxpayer Service Center. Each year thousands of returns are mailed to the Internal Revenue Service instead of the Alabama Department of Revenue. If you are a victim of IRS Identity Theft and have been selected for verification you must provide a copy of your Tax Return DataBase View (TRDBV) along with a signed and dated statement indicating that you are a victim and that the IRS has been notified. The increase must equal or exceed the number of newly hired employees for which a credit is sought by one employee for each newly hired employee for whom a credit is being sought for the current year, plus one employee for all employees for whom credits were claimed in prior years. Last year over 50 percent of the income tax returns filed were received between April 1 and April 15. Subtract line 21 from line 28, and enter the amount on line 30 - this is the amount you overpaid. Our team is happy to answer questions about this process.

attempts exceeded addresources webfiles For example, electronically filed returns are received and processed significantly faster than mailed returns. If you purchased items for use in Alabama from out-of-state sellers who did not charge sales or use tax, you owe consumers use tax on the items. This is true even if the taxpayer leaves no property in Alabama.

You MAY Use Form 40A If You Meet ALL The Following Conditions: Part-year residents of Alabama should only report income earned while a resident of Alabama. Because of the COVID-19 pandemic, the Internal Revenue Service (IRS) has extended the deadline for filing tax returns for tax year 2019 from April 15 to July 15, 2020.

If you received income from sources taxable for Federal purposes but exempt for Alabama tax purposes, the source(s) and amount(s) should be entered on line 5 unless they are explained elsewhere on the Alabama return. A married nonresident military person with income earned in Alabama may file either a separate return claiming himself or herself only, or a joint return claiming the total allowable personal exemption. The state will ask you to enter the exact amount of your expected refund in whole dollars. If the former employee began receiving payments after De cem ber 31, 1986, the beneficiary must continue to use the Federal Annuity Tables based on the beneficiary's life expectancy in determining the taxable part. This child must be your dependent. The payer should send you a Form 1099-INT, Form 1099-OID, or 1099-DIV, if applicable, showing interest or dividends you must report. Tennessee Valley Authority Pension System benefits. Are you ready to file your income tax return? P. O. 3. This includes regular distributions, early distributions, rollovers, Roth conversions, and any other money or property you received from your IRA account or annuity. Alabama resident taxpayers may deduct from Alabama gross income 100 percent of the amounts that they pay as health insurance premiums as part of an employer provided health insurance plan who are employed by an employer that has less than 25 employees and earns no more than $50,000.00 of wages and reports no more than $75,000.00 of adjusted gross income on their Alabama individual income tax return or $150,000.00 if married filing joint.

Welcome to MyAlabama.gov, your online portal for Alabama services. 5. Any person failing to file a return as required by Alabama law or rendering a willfully false or fraudulent return will be assessed by the Alabama Department of Revenue on the basis of the best information obtainable by the Department with respect to the income of such taxpayer. Did You Have Someone Else Prepare Your Return? Domicile may be by birth, choice, or operation of law. Step 2:Sign in using your username and password, Step 3:Once signed in, click "Report a donation to an SGO" on the right side of the screen. Step 8: An authorization code for your intial login will be emailed to you and may take up to 24 hours. numbers for loan or credit card associated with your name, and mobile phone A resident of Alabama for only a part of 2013 may deduct only those expenses paid or incurred while a resident of Alabama. If you and your spouse file a joint return, your spouse must have a social security number. Your envelope should be addressed in accordance with one of the following examples: If you are not making a payment, mail your return to: Alabama Department of Revenue Property transferred in conjunction with performance of services. applies to purchases of machinery or equipment used in connection with the production of agricultural products, livestock, or poultry on farms and the replacement parts for such machinery or equipment. Generally, you may deduct the ordinary and necessary expenses of doing business - the cost of merchandise, salaries, interest, taxes, rent, repairs, and incidental supplies. ), you should complete a worksheet for each type of account. Accurate records of all expenses claimed as an adjustment to income must be maintained by the taxpayer and be available to the Alabama Department of Revenue upon request. Rehabilitation, Preservation and Development of Historic Structures Credit. Submitting unrecquired documents could slow down the award process. Direct deposit is only available for electronically filed or Alabama Form 40 individual returns. Income earned while serving as a foreign missionary after first serving 24 months as a missionary in a foreign country. Line 6a, 6b, 6c or 7: Select the checkbox on the right hand side for one of these For more information on the above exclusions, please see the instructions for Part II on page 15. Each year the Alabama Depart ment of Revenue receives over 1.8 million income tax re turns. Part-year residents are allowed to deduct the full standard deduction, personal, and dependent exemptions. If your Alabama gross income exceeds the prorated amount, a return must be filed. Individuals who are domiciled in (or residents of) Alabama are subject to tax on their entire income whether earned within or without Alabama. It is very important that the social security numbers be listed in this order so your refund debit card or check will be issued in the correct name. If you owe money or have a delinquent account under any of the following public assistance programs, your refund may be applied to offset that debt: If the Alabama Department of Human Re sources, Alabama Department of Industrial Relations, Alabama Medicaid Agency, or the Administrative Office of Courts notifies the Alabama Department of Revenue that you have a delinquent account in excess of $25, part or all of your refund may be applied to offset that debt. Use these lines to report only the pensions and annuities you first began receiving in 1987 which are not fully taxable and for which you used the Federal Annuity Tables to compute the taxable portion on your federal return.

You must figure your tax from the Tax Tables unless you are claiming a carryover or carryback Net Operating Loss from another year. Once an election is made to apply this overpayment to your 2014 estimated tax, it cannot later be refunded to you or applied to pay additional tax for 2013. There is no provision in Alabama law for forward averaging of such distributions. (Place amount on line 32.) Make certain the "State Copy" of all forms W-2 wage and tax statements are included, W-2s are frequently missing. Page 16 of this booklet provides additional information on these penalties. (Your 2012 tax return must cover a 12-month period.) (See definition of dependent on page 8.). C - Pensions, annuities, etc., you began receiving prior to January 1, 1987 in which you have not recovered your cost. Interest on the additional tax due from the due date of the return and any penalties will be assessed if applicable to your return.

You must figure your tax from the Tax Tables unless you are claiming a carryover or carryback Net Operating Loss from another year. Once an election is made to apply this overpayment to your 2014 estimated tax, it cannot later be refunded to you or applied to pay additional tax for 2013. There is no provision in Alabama law for forward averaging of such distributions. (Place amount on line 32.) Make certain the "State Copy" of all forms W-2 wage and tax statements are included, W-2s are frequently missing. Page 16 of this booklet provides additional information on these penalties. (Your 2012 tax return must cover a 12-month period.) (See definition of dependent on page 8.). C - Pensions, annuities, etc., you began receiving prior to January 1, 1987 in which you have not recovered your cost. Interest on the additional tax due from the due date of the return and any penalties will be assessed if applicable to your return.  Please note: An Alabama refund of a deceased taxpayer cannot be issued to a third party. Review the purchases you made during 2013. Alabama Historic Commission The IRS phone number is 1-800-829-1040, and they are open from 7 a.m.to 7 p.m., seven days a week.- 7 p.m.is the end time. Credit Card: (Schedule B). In order to receive a direct deposit refund for a paper return, your return must be prepared using tax preparation software that utilizes 2D bar code technology or from our Web site by using the Form 40 with calculations. If you sold real estate, stocks, bonds or other capital assets, use Schedule D to report the net gain (or loss). The Alabama Department of Revenue will issue you a Form 1099-G for the overpayment amount. For amounts you began receiving prior to 1987, you can exclude from the taxable amount your unrecovered cost to the plan. For further information regarding the "Alabama Enterprise Zone Act" and the necessary forms to claim this credit, you should contact: Alabama Department of Economic and Community Affairs The taxable portion may NOT be the same for Alabama purposes as for Federal purposes because you may have a different cost basis. You can also file a joint return if your spouse died in 2013 before filing a 2013 return. Statement from Alabama Department of Revenue: "For the most up-to-date information concerning the status of your current year refund, call 1-855-894-7391 or check our website, then click on Where's My Refund. Enter the taxable amount of your pension or annuity on line 5b. Subsistence allowance received by law enforcement and corrections officers of the State of Alabama. If your return is corrected by the Department, the amount contributed cannot be used to pay any additional tax due. Note to readers: if you purchase something through one of our affiliate links we may earn a commission. Interest on: bank deposits, bonds, notes, Federal Income Tax Refunds, mortgages on which you receive payments, accounts with savings and loan associations, mutual savings banks, credit unions, etc. This credit is available to recently deployed and now discharged unemployed veterans who start their own business. Privacy Policy and Cookie Statement updated 7/1/2022). Accurate records should be kept of the amounts contributed in order to determine your cost basis when the funds are withdrawn. When you purchase merchandise from a business located outside of Alabama the seller might collect use tax on the purchase. options to request Verification of Non-filing. Estimated tax payments were not credited in the correct manner. From Monday through Friday.The ideal time to contact someone is first thing in the morning.Option 1 should not be selected after you have selected your language (regarding refund info).Instead, select Option 2 for your Personal Income Tax return. This copy should be marked "To Be Filed With Your Alabama Income Tax Return.". The amounts entered on these lines will be paid to the programs you indicate. For more information concerning the prepaid debit card go to page 32. All retirement compensation received by an eligible peace officer or a designated beneficiary from any Alabama police retirement system. Enter the amounts you received as alimony or separate maintenance. and Common Mistakes That Delay Refunds on page 4 of this booklet for further information about your refund. Enter the full amount you received on line 9 and the taxable portion on line 10. If you move after filing your return and expect a refund, you should notify the Department of Revenue and send a change of address notice to: Alabama Department of Revenue, Individual and Corporate Tax Division, P. O. Usually this is 3 years from the date the return was filed. If a citizen of a foreign country comes to Alabama to work (no matter how long he stays), buys a home, secures an Alabama driver's license, does not intend to apply for U.S. refund tax guy filing paper revenue refunds carolina department welcome south fusion cold Gross income usually means money, goods, and property you received on which you must pay tax. Beginning January 1, 1998, all benefits received from Alabama Prepaid Tuition Contracts (PACT). (See page 21. If you have questions about whether a preparer is required to sign a return, please contact an Alabama Taxpayer Service Center. Each year thousands of returns are mailed to the Internal Revenue Service instead of the Alabama Department of Revenue. If you are a victim of IRS Identity Theft and have been selected for verification you must provide a copy of your Tax Return DataBase View (TRDBV) along with a signed and dated statement indicating that you are a victim and that the IRS has been notified. The increase must equal or exceed the number of newly hired employees for which a credit is sought by one employee for each newly hired employee for whom a credit is being sought for the current year, plus one employee for all employees for whom credits were claimed in prior years. Last year over 50 percent of the income tax returns filed were received between April 1 and April 15. Subtract line 21 from line 28, and enter the amount on line 30 - this is the amount you overpaid. Our team is happy to answer questions about this process. attempts exceeded addresources webfiles For example, electronically filed returns are received and processed significantly faster than mailed returns. If you purchased items for use in Alabama from out-of-state sellers who did not charge sales or use tax, you owe consumers use tax on the items. This is true even if the taxpayer leaves no property in Alabama. You MAY Use Form 40A If You Meet ALL The Following Conditions: Part-year residents of Alabama should only report income earned while a resident of Alabama. Because of the COVID-19 pandemic, the Internal Revenue Service (IRS) has extended the deadline for filing tax returns for tax year 2019 from April 15 to July 15, 2020. If you received income from sources taxable for Federal purposes but exempt for Alabama tax purposes, the source(s) and amount(s) should be entered on line 5 unless they are explained elsewhere on the Alabama return. A married nonresident military person with income earned in Alabama may file either a separate return claiming himself or herself only, or a joint return claiming the total allowable personal exemption. The state will ask you to enter the exact amount of your expected refund in whole dollars. If the former employee began receiving payments after De cem ber 31, 1986, the beneficiary must continue to use the Federal Annuity Tables based on the beneficiary's life expectancy in determining the taxable part. This child must be your dependent. The payer should send you a Form 1099-INT, Form 1099-OID, or 1099-DIV, if applicable, showing interest or dividends you must report. Tennessee Valley Authority Pension System benefits. Are you ready to file your income tax return? P. O. 3. This includes regular distributions, early distributions, rollovers, Roth conversions, and any other money or property you received from your IRA account or annuity. Alabama resident taxpayers may deduct from Alabama gross income 100 percent of the amounts that they pay as health insurance premiums as part of an employer provided health insurance plan who are employed by an employer that has less than 25 employees and earns no more than $50,000.00 of wages and reports no more than $75,000.00 of adjusted gross income on their Alabama individual income tax return or $150,000.00 if married filing joint.

Please note: An Alabama refund of a deceased taxpayer cannot be issued to a third party. Review the purchases you made during 2013. Alabama Historic Commission The IRS phone number is 1-800-829-1040, and they are open from 7 a.m.to 7 p.m., seven days a week.- 7 p.m.is the end time. Credit Card: (Schedule B). In order to receive a direct deposit refund for a paper return, your return must be prepared using tax preparation software that utilizes 2D bar code technology or from our Web site by using the Form 40 with calculations. If you sold real estate, stocks, bonds or other capital assets, use Schedule D to report the net gain (or loss). The Alabama Department of Revenue will issue you a Form 1099-G for the overpayment amount. For amounts you began receiving prior to 1987, you can exclude from the taxable amount your unrecovered cost to the plan. For further information regarding the "Alabama Enterprise Zone Act" and the necessary forms to claim this credit, you should contact: Alabama Department of Economic and Community Affairs The taxable portion may NOT be the same for Alabama purposes as for Federal purposes because you may have a different cost basis. You can also file a joint return if your spouse died in 2013 before filing a 2013 return. Statement from Alabama Department of Revenue: "For the most up-to-date information concerning the status of your current year refund, call 1-855-894-7391 or check our website, then click on Where's My Refund. Enter the taxable amount of your pension or annuity on line 5b. Subsistence allowance received by law enforcement and corrections officers of the State of Alabama. If your return is corrected by the Department, the amount contributed cannot be used to pay any additional tax due. Note to readers: if you purchase something through one of our affiliate links we may earn a commission. Interest on: bank deposits, bonds, notes, Federal Income Tax Refunds, mortgages on which you receive payments, accounts with savings and loan associations, mutual savings banks, credit unions, etc. This credit is available to recently deployed and now discharged unemployed veterans who start their own business. Privacy Policy and Cookie Statement updated 7/1/2022). Accurate records should be kept of the amounts contributed in order to determine your cost basis when the funds are withdrawn. When you purchase merchandise from a business located outside of Alabama the seller might collect use tax on the purchase. options to request Verification of Non-filing. Estimated tax payments were not credited in the correct manner. From Monday through Friday.The ideal time to contact someone is first thing in the morning.Option 1 should not be selected after you have selected your language (regarding refund info).Instead, select Option 2 for your Personal Income Tax return. This copy should be marked "To Be Filed With Your Alabama Income Tax Return.". The amounts entered on these lines will be paid to the programs you indicate. For more information concerning the prepaid debit card go to page 32. All retirement compensation received by an eligible peace officer or a designated beneficiary from any Alabama police retirement system. Enter the amounts you received as alimony or separate maintenance. and Common Mistakes That Delay Refunds on page 4 of this booklet for further information about your refund. Enter the full amount you received on line 9 and the taxable portion on line 10. If you move after filing your return and expect a refund, you should notify the Department of Revenue and send a change of address notice to: Alabama Department of Revenue, Individual and Corporate Tax Division, P. O. Usually this is 3 years from the date the return was filed. If a citizen of a foreign country comes to Alabama to work (no matter how long he stays), buys a home, secures an Alabama driver's license, does not intend to apply for U.S. refund tax guy filing paper revenue refunds carolina department welcome south fusion cold Gross income usually means money, goods, and property you received on which you must pay tax. Beginning January 1, 1998, all benefits received from Alabama Prepaid Tuition Contracts (PACT). (See page 21. If you have questions about whether a preparer is required to sign a return, please contact an Alabama Taxpayer Service Center. Each year thousands of returns are mailed to the Internal Revenue Service instead of the Alabama Department of Revenue. If you are a victim of IRS Identity Theft and have been selected for verification you must provide a copy of your Tax Return DataBase View (TRDBV) along with a signed and dated statement indicating that you are a victim and that the IRS has been notified. The increase must equal or exceed the number of newly hired employees for which a credit is sought by one employee for each newly hired employee for whom a credit is being sought for the current year, plus one employee for all employees for whom credits were claimed in prior years. Last year over 50 percent of the income tax returns filed were received between April 1 and April 15. Subtract line 21 from line 28, and enter the amount on line 30 - this is the amount you overpaid. Our team is happy to answer questions about this process. attempts exceeded addresources webfiles For example, electronically filed returns are received and processed significantly faster than mailed returns. If you purchased items for use in Alabama from out-of-state sellers who did not charge sales or use tax, you owe consumers use tax on the items. This is true even if the taxpayer leaves no property in Alabama. You MAY Use Form 40A If You Meet ALL The Following Conditions: Part-year residents of Alabama should only report income earned while a resident of Alabama. Because of the COVID-19 pandemic, the Internal Revenue Service (IRS) has extended the deadline for filing tax returns for tax year 2019 from April 15 to July 15, 2020. If you received income from sources taxable for Federal purposes but exempt for Alabama tax purposes, the source(s) and amount(s) should be entered on line 5 unless they are explained elsewhere on the Alabama return. A married nonresident military person with income earned in Alabama may file either a separate return claiming himself or herself only, or a joint return claiming the total allowable personal exemption. The state will ask you to enter the exact amount of your expected refund in whole dollars. If the former employee began receiving payments after De cem ber 31, 1986, the beneficiary must continue to use the Federal Annuity Tables based on the beneficiary's life expectancy in determining the taxable part. This child must be your dependent. The payer should send you a Form 1099-INT, Form 1099-OID, or 1099-DIV, if applicable, showing interest or dividends you must report. Tennessee Valley Authority Pension System benefits. Are you ready to file your income tax return? P. O. 3. This includes regular distributions, early distributions, rollovers, Roth conversions, and any other money or property you received from your IRA account or annuity. Alabama resident taxpayers may deduct from Alabama gross income 100 percent of the amounts that they pay as health insurance premiums as part of an employer provided health insurance plan who are employed by an employer that has less than 25 employees and earns no more than $50,000.00 of wages and reports no more than $75,000.00 of adjusted gross income on their Alabama individual income tax return or $150,000.00 if married filing joint.  Welcome to MyAlabama.gov, your online portal for Alabama services. 5. Any person failing to file a return as required by Alabama law or rendering a willfully false or fraudulent return will be assessed by the Alabama Department of Revenue on the basis of the best information obtainable by the Department with respect to the income of such taxpayer. Did You Have Someone Else Prepare Your Return? Domicile may be by birth, choice, or operation of law. Step 2:Sign in using your username and password, Step 3:Once signed in, click "Report a donation to an SGO" on the right side of the screen. Step 8: An authorization code for your intial login will be emailed to you and may take up to 24 hours. numbers for loan or credit card associated with your name, and mobile phone A resident of Alabama for only a part of 2013 may deduct only those expenses paid or incurred while a resident of Alabama. If you and your spouse file a joint return, your spouse must have a social security number. Your envelope should be addressed in accordance with one of the following examples: If you are not making a payment, mail your return to: Alabama Department of Revenue Property transferred in conjunction with performance of services. applies to purchases of machinery or equipment used in connection with the production of agricultural products, livestock, or poultry on farms and the replacement parts for such machinery or equipment. Generally, you may deduct the ordinary and necessary expenses of doing business - the cost of merchandise, salaries, interest, taxes, rent, repairs, and incidental supplies. ), you should complete a worksheet for each type of account. Accurate records of all expenses claimed as an adjustment to income must be maintained by the taxpayer and be available to the Alabama Department of Revenue upon request. Rehabilitation, Preservation and Development of Historic Structures Credit. Submitting unrecquired documents could slow down the award process. Direct deposit is only available for electronically filed or Alabama Form 40 individual returns. Income earned while serving as a foreign missionary after first serving 24 months as a missionary in a foreign country. Line 6a, 6b, 6c or 7: Select the checkbox on the right hand side for one of these For more information on the above exclusions, please see the instructions for Part II on page 15. Each year the Alabama Depart ment of Revenue receives over 1.8 million income tax re turns. Part-year residents are allowed to deduct the full standard deduction, personal, and dependent exemptions. If your Alabama gross income exceeds the prorated amount, a return must be filed. Individuals who are domiciled in (or residents of) Alabama are subject to tax on their entire income whether earned within or without Alabama. It is very important that the social security numbers be listed in this order so your refund debit card or check will be issued in the correct name. If you owe money or have a delinquent account under any of the following public assistance programs, your refund may be applied to offset that debt: If the Alabama Department of Human Re sources, Alabama Department of Industrial Relations, Alabama Medicaid Agency, or the Administrative Office of Courts notifies the Alabama Department of Revenue that you have a delinquent account in excess of $25, part or all of your refund may be applied to offset that debt. Use these lines to report only the pensions and annuities you first began receiving in 1987 which are not fully taxable and for which you used the Federal Annuity Tables to compute the taxable portion on your federal return.

Welcome to MyAlabama.gov, your online portal for Alabama services. 5. Any person failing to file a return as required by Alabama law or rendering a willfully false or fraudulent return will be assessed by the Alabama Department of Revenue on the basis of the best information obtainable by the Department with respect to the income of such taxpayer. Did You Have Someone Else Prepare Your Return? Domicile may be by birth, choice, or operation of law. Step 2:Sign in using your username and password, Step 3:Once signed in, click "Report a donation to an SGO" on the right side of the screen. Step 8: An authorization code for your intial login will be emailed to you and may take up to 24 hours. numbers for loan or credit card associated with your name, and mobile phone A resident of Alabama for only a part of 2013 may deduct only those expenses paid or incurred while a resident of Alabama. If you and your spouse file a joint return, your spouse must have a social security number. Your envelope should be addressed in accordance with one of the following examples: If you are not making a payment, mail your return to: Alabama Department of Revenue Property transferred in conjunction with performance of services. applies to purchases of machinery or equipment used in connection with the production of agricultural products, livestock, or poultry on farms and the replacement parts for such machinery or equipment. Generally, you may deduct the ordinary and necessary expenses of doing business - the cost of merchandise, salaries, interest, taxes, rent, repairs, and incidental supplies. ), you should complete a worksheet for each type of account. Accurate records of all expenses claimed as an adjustment to income must be maintained by the taxpayer and be available to the Alabama Department of Revenue upon request. Rehabilitation, Preservation and Development of Historic Structures Credit. Submitting unrecquired documents could slow down the award process. Direct deposit is only available for electronically filed or Alabama Form 40 individual returns. Income earned while serving as a foreign missionary after first serving 24 months as a missionary in a foreign country. Line 6a, 6b, 6c or 7: Select the checkbox on the right hand side for one of these For more information on the above exclusions, please see the instructions for Part II on page 15. Each year the Alabama Depart ment of Revenue receives over 1.8 million income tax re turns. Part-year residents are allowed to deduct the full standard deduction, personal, and dependent exemptions. If your Alabama gross income exceeds the prorated amount, a return must be filed. Individuals who are domiciled in (or residents of) Alabama are subject to tax on their entire income whether earned within or without Alabama. It is very important that the social security numbers be listed in this order so your refund debit card or check will be issued in the correct name. If you owe money or have a delinquent account under any of the following public assistance programs, your refund may be applied to offset that debt: If the Alabama Department of Human Re sources, Alabama Department of Industrial Relations, Alabama Medicaid Agency, or the Administrative Office of Courts notifies the Alabama Department of Revenue that you have a delinquent account in excess of $25, part or all of your refund may be applied to offset that debt. Use these lines to report only the pensions and annuities you first began receiving in 1987 which are not fully taxable and for which you used the Federal Annuity Tables to compute the taxable portion on your federal return.