/82152488-5bfc2b93c9e77c00519aa6dd.jpg)

Every jurisdiction makes workers compensation insurance available to all employers who are required to purchase it. The risk-adjusted WACC is 12%. Working Paper 464 0 obj

<>/Filter/FlateDecode/ID[<69B32DCCA218EA4EB03447BDB8732804>]/Index[447 34]/Info 446 0 R/Length 83/Prev 85414/Root 448 0 R/Size 481/Type/XRef/W[1 2 1]>>stream

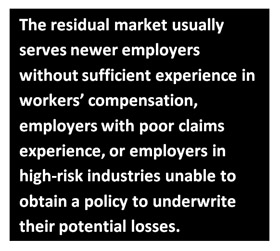

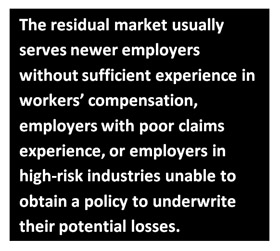

The residual market is a segment of the auto insurance market that serves drivers who are considered high risk and are denied coverage by insurers.

Copyright 2022

Residual Market page on

In the past, the combined ratio for the incomplete policy year improved over time as premium became fully earned.

iii graphs %PDF-1.5

%

Terms of Use -

Keep in mind that these plans often limit coverage in ways that standard market carriers do not.

Search mobile home tie downs for more information. For ease of navigation, the page is structured in sections, including Tools, Guides/Brochures, Publications/Reports, Plan Administration, Pool Administration, and the Learning Center. Supporting Resiliency and Disaster Recovery, Credit Insurance For Short-Term Trade Receivables, Supporting Businesses, Workers, Communities, A Firm Foundation: How Insurance Supports the Economy, Insuring Your Business: Small Business Owners' Guide to Insurance. Which of the following BEST describes the insurance provided by residual market insurance programs? hb```zB>c`0p\```d``8]{b%M=uJuN|q!;'&{s1F -}VH~H4 sFkkGC!@1H3J;PZm,k302h54B,csTY&@ DL;

The selection process may vary by jurisdiction and depends on state-specific regulatory requirements. The

(1) Excludes the FAIR Plans of Arkansas and Hawaii. Its an application of freedom in the market.

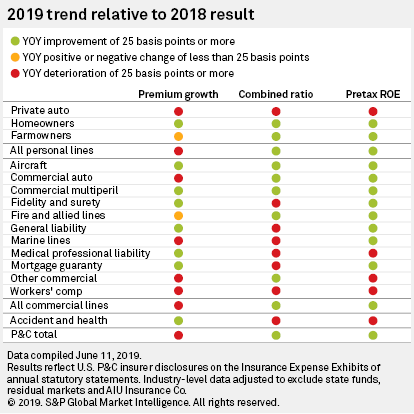

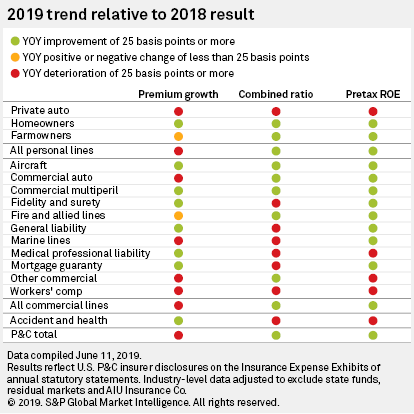

insurance industry market underwriting profit data lines personal companies losses retreat trend profitability profits modest sight again casualty exhibits supplemental

insurance industry market underwriting profit data lines personal companies losses retreat trend profitability profits modest sight again casualty exhibits supplemental Being educated about your local residual markets (and other E&S options) is a way to make sure that youre serving your customers. After carriers identify their underwriting criteria, risks are matched and forwarded to the carrier to be considered for coverage. ]HB3-{{Jx%-ti)

Z2(V. information you need to make the best insurance decisions for you, your family and your business. If you still have questions like the ones below, please contact us for answers: Save my name, email, and website in this browser for the next time I comment.

Access expert content, industry term definitions and answers to your questions from knowledgeable insurance insiders. All Rights Reserved. Every home that has a mortgage is required to have insurance. Many newer mobile homes (or manufactured homes) are built much stronger than they used to be.

Feb 15, 2017, Issue Brief A FAIR plan is a high-risk homeowners insurance program. Please sign in to access member exclusive content. Citizens is a not-for-profit company whose employees are driven first and foremost by our mission of service to the people of Florida.

insurance apg abstract cfc International Risk Management Carry on browsing if you're happy with this, or find out more. These carriers often are given the choice to participate as a (1) reinsurance pool participant or (2) direct assignment carrier. What is a residual market? There are drivers who are generally unacceptable for the standard market. Many of these drivers will be required to have a SR-22, certificate of financial responsibility. Ensure a strong financial operating environment.

Whenever a person buys a house, the mortgage company wants to know that there is enough insurance in place to protect their investment if something were to happen to it. The workers compensation residual market premium share for NCCI-serviced pool states has also been consistent since 2014generally hovering between 7% and 8%. (4) The Mississippi and Texas FAIR Plans do not offer a commercial policy. We strive to reduce the financial burden on all Floridians by being good stewards of the premium funds entrusted to us. Paladin Furnishings generated $4 million in sales during 2016, and its year-end total assets were$3.2 million. Having workers compensation (WC) coverage is generally required for all employers by statute. %%EOF

FB!Tx6_^S;v^ofZ30

"z>

insurance compensation workers elcosh As a government entity fulfilling a public purpose, Citizens aspires to provide insurance products and services that meet the needs of Florida property owners who are, in good faith, entitled to obtain coverage through the private market but are unable to do so.

iii graphs (2) Exposure is the estimate of the aggregate value of all insurance in force in each states Beach and Windstorm Plan in all lines (except liability, where applicable, and crime) for 12 months ending September through December. They have either had too many accidents, or they have had their licenses suspended or revoked for some time. All rights Helping employers move from the residual market to the voluntary market serves to depopulate the residual market. How many appointments must the agent hold? Looking ahead to 2017, the company estimates that its assets must increase by $0.80 for every$1.00 increase in sales. Residual market policies are assigned to insurers based on their market share. Usually a "last resort" form of insurance. They serve as a coverage source of last resort for firms and individuals who have been rejected by voluntary market insurers.

idaho Life Insurance Companies: 67 of the Biggest Carriers in the U.S. These are the drivers that the assigned risk pool was created to serve. Top 5 how to reset ley lines genshin impact, Top 7 how to reset ford door code without factory code. Institute, Inc. In recent years, the residual market combined ratios have been near the breakeven point of 100.

Please turn on JavaScript and try again. The Perfect Age to A Get Life Insurance Policy, COBRA Insurance: What It Is and If It's Right for You, 4 Types of Liability Insurance Every Business Should Have. Editorial Review Policy. Reinsurance Pool Participant: Based on its voluntary market share in the state, a reinsurance pool participating company provides proportionate reinsurance on residual market policies written by servicing carriers. Servicing carriers accept assignment of pool risks in exchange for a servicing carrier allowancepaid to them to offset the expenses associated with writing and servicing the WC policy. This still leaves a gap because there are still risks that might be eligible in E&S, but the pricing can become prohibitive. By continuing to use this site you are giving us your consent to place cookies on your device. One is the driver's history, including their history of driving tickets, accidents, and claims. Identify, educate and effectively communicate with internal and external stakeholders.

Residual markets require insurers writing specific coverage lines in a given state to assume the profits or losses accruing from insuring that state's residual risks in proportion to their share of the total voluntary market premiums written in that state. Here is a quick reference chart summarizing the two options: NCCI provides administrative services for reinsurance pooling mechanisms for 26 jurisdictions, including the five pools below. Copyright 2022, Insurance Information Institute, Inc. Which residual market program provides high risk workers compensation coverage for Arkansas employers who Cannot obtain it in the voluntary market? You know which drivers make up this population. The carrier does not participate in the reinsurance pooling mechanism (Pool) and is not reinsured by the Pool. A competitive state fund is a state-owned and operated fund that provides workers compensation insurance to employers who operate within that state.

residual residuals

residual residuals Most employers are required to buy workers compensation insurance by laws. You may not have realized this, but this country has areas that are impacted by different types of natural disaster risks.

169 0 obj

<>/Filter/FlateDecode/ID[<6549255DC217E56D4AE2F6312C81401D><7452D261B446D14BBE3771680C2A269C>]/Index[151 42]/Info 150 0 R/Length 91/Prev 196227/Root 152 0 R/Size 193/Type/XRef/W[1 3 1]>>stream

Residual markets require insurers writing specific coverage lines in a given state to assume the profits or losses accruing from insuring that states residual risks in proportion to their share of the total voluntary market premiums written in that state. 12222 Merit Drive, Suite 1600

Protect the public interest and maintain the integrity of the corporation. There are many factors that result in drivers needing to acquire auto insurance from the residual market. The Path to Growth for Smaller Agencies: Hire Producers Or Acquire Agencies? Today, property insurance from the residual market is provided by Fair Access to Insurance Requirements (FAIR) Plans, Beach and Windstorm Plans, and two state-run insurance companies in Florida and Louisiana: Florida Citizens Property Insurance Corp. (CPIC) and Louisiana Citizens Property Insurance Corp. (Louisiana Citizens).

This is where the residual market steps in. The 6 Types of Business Insurance Many Companies Don't Realize They Need, What Canadians Need to Understand About Their Travel Insurance, 9 Hidden Insurance Perks Your Credit Card Provider Might Offer, Private-Passenger Auto Insurance Policyholder Risk Profile, How an Insurance Company Decides to Insure You, CLUE Yourself In: How Your Claims History Informs Your Insurance Future. (1) The Florida and Louisiana Beach Plans merged with their FAIR Plans, see chart, Insurance Provided By FAIR Plans By State.

They serve as a coverage source of last resort for firms and individuals who have been rejected by voluntary market insurers. Residual market insurance programs are funded by: The AIUA offers coverage for residential homes up to a maximum of __________ for combined dwelling and contents.

/82152488-5bfc2b93c9e77c00519aa6dd.jpg) Every jurisdiction makes workers compensation insurance available to all employers who are required to purchase it. The risk-adjusted WACC is 12%. Working Paper 464 0 obj

<>/Filter/FlateDecode/ID[<69B32DCCA218EA4EB03447BDB8732804>]/Index[447 34]/Info 446 0 R/Length 83/Prev 85414/Root 448 0 R/Size 481/Type/XRef/W[1 2 1]>>stream

The residual market is a segment of the auto insurance market that serves drivers who are considered high risk and are denied coverage by insurers. Copyright 2022

Residual Market page on

In the past, the combined ratio for the incomplete policy year improved over time as premium became fully earned. iii graphs %PDF-1.5

%

Terms of Use -

Every jurisdiction makes workers compensation insurance available to all employers who are required to purchase it. The risk-adjusted WACC is 12%. Working Paper 464 0 obj

<>/Filter/FlateDecode/ID[<69B32DCCA218EA4EB03447BDB8732804>]/Index[447 34]/Info 446 0 R/Length 83/Prev 85414/Root 448 0 R/Size 481/Type/XRef/W[1 2 1]>>stream

The residual market is a segment of the auto insurance market that serves drivers who are considered high risk and are denied coverage by insurers. Copyright 2022

Residual Market page on

In the past, the combined ratio for the incomplete policy year improved over time as premium became fully earned. iii graphs %PDF-1.5

%

Terms of Use -

Keep in mind that these plans often limit coverage in ways that standard market carriers do not. Search mobile home tie downs for more information. For ease of navigation, the page is structured in sections, including Tools, Guides/Brochures, Publications/Reports, Plan Administration, Pool Administration, and the Learning Center. Supporting Resiliency and Disaster Recovery, Credit Insurance For Short-Term Trade Receivables, Supporting Businesses, Workers, Communities, A Firm Foundation: How Insurance Supports the Economy, Insuring Your Business: Small Business Owners' Guide to Insurance. Which of the following BEST describes the insurance provided by residual market insurance programs? hb```zB>c`0p\```d``8]{b%M=uJuN|q!;'&{s1F -}VH~H4 sFkkGC!@1H3J;PZm,k302h54B,csTY&@ DL;

The selection process may vary by jurisdiction and depends on state-specific regulatory requirements. The

(1) Excludes the FAIR Plans of Arkansas and Hawaii. Its an application of freedom in the market.

Keep in mind that these plans often limit coverage in ways that standard market carriers do not. Search mobile home tie downs for more information. For ease of navigation, the page is structured in sections, including Tools, Guides/Brochures, Publications/Reports, Plan Administration, Pool Administration, and the Learning Center. Supporting Resiliency and Disaster Recovery, Credit Insurance For Short-Term Trade Receivables, Supporting Businesses, Workers, Communities, A Firm Foundation: How Insurance Supports the Economy, Insuring Your Business: Small Business Owners' Guide to Insurance. Which of the following BEST describes the insurance provided by residual market insurance programs? hb```zB>c`0p\```d``8]{b%M=uJuN|q!;'&{s1F -}VH~H4 sFkkGC!@1H3J;PZm,k302h54B,csTY&@ DL;

The selection process may vary by jurisdiction and depends on state-specific regulatory requirements. The

(1) Excludes the FAIR Plans of Arkansas and Hawaii. Its an application of freedom in the market.  insurance industry market underwriting profit data lines personal companies losses retreat trend profitability profits modest sight again casualty exhibits supplemental Being educated about your local residual markets (and other E&S options) is a way to make sure that youre serving your customers. After carriers identify their underwriting criteria, risks are matched and forwarded to the carrier to be considered for coverage. ]HB3-{{Jx%-ti)

Z2(V. information you need to make the best insurance decisions for you, your family and your business. If you still have questions like the ones below, please contact us for answers: Save my name, email, and website in this browser for the next time I comment. Access expert content, industry term definitions and answers to your questions from knowledgeable insurance insiders. All Rights Reserved. Every home that has a mortgage is required to have insurance. Many newer mobile homes (or manufactured homes) are built much stronger than they used to be.

insurance industry market underwriting profit data lines personal companies losses retreat trend profitability profits modest sight again casualty exhibits supplemental Being educated about your local residual markets (and other E&S options) is a way to make sure that youre serving your customers. After carriers identify their underwriting criteria, risks are matched and forwarded to the carrier to be considered for coverage. ]HB3-{{Jx%-ti)

Z2(V. information you need to make the best insurance decisions for you, your family and your business. If you still have questions like the ones below, please contact us for answers: Save my name, email, and website in this browser for the next time I comment. Access expert content, industry term definitions and answers to your questions from knowledgeable insurance insiders. All Rights Reserved. Every home that has a mortgage is required to have insurance. Many newer mobile homes (or manufactured homes) are built much stronger than they used to be.  Feb 15, 2017, Issue Brief A FAIR plan is a high-risk homeowners insurance program. Please sign in to access member exclusive content. Citizens is a not-for-profit company whose employees are driven first and foremost by our mission of service to the people of Florida. insurance apg abstract cfc International Risk Management Carry on browsing if you're happy with this, or find out more. These carriers often are given the choice to participate as a (1) reinsurance pool participant or (2) direct assignment carrier. What is a residual market? There are drivers who are generally unacceptable for the standard market. Many of these drivers will be required to have a SR-22, certificate of financial responsibility. Ensure a strong financial operating environment.

Feb 15, 2017, Issue Brief A FAIR plan is a high-risk homeowners insurance program. Please sign in to access member exclusive content. Citizens is a not-for-profit company whose employees are driven first and foremost by our mission of service to the people of Florida. insurance apg abstract cfc International Risk Management Carry on browsing if you're happy with this, or find out more. These carriers often are given the choice to participate as a (1) reinsurance pool participant or (2) direct assignment carrier. What is a residual market? There are drivers who are generally unacceptable for the standard market. Many of these drivers will be required to have a SR-22, certificate of financial responsibility. Ensure a strong financial operating environment.  Whenever a person buys a house, the mortgage company wants to know that there is enough insurance in place to protect their investment if something were to happen to it. The workers compensation residual market premium share for NCCI-serviced pool states has also been consistent since 2014generally hovering between 7% and 8%. (4) The Mississippi and Texas FAIR Plans do not offer a commercial policy. We strive to reduce the financial burden on all Floridians by being good stewards of the premium funds entrusted to us. Paladin Furnishings generated $4 million in sales during 2016, and its year-end total assets were$3.2 million. Having workers compensation (WC) coverage is generally required for all employers by statute. %%EOF

FB!Tx6_^S;v^ofZ30

"z> insurance compensation workers elcosh As a government entity fulfilling a public purpose, Citizens aspires to provide insurance products and services that meet the needs of Florida property owners who are, in good faith, entitled to obtain coverage through the private market but are unable to do so. iii graphs (2) Exposure is the estimate of the aggregate value of all insurance in force in each states Beach and Windstorm Plan in all lines (except liability, where applicable, and crime) for 12 months ending September through December. They have either had too many accidents, or they have had their licenses suspended or revoked for some time. All rights Helping employers move from the residual market to the voluntary market serves to depopulate the residual market. How many appointments must the agent hold? Looking ahead to 2017, the company estimates that its assets must increase by $0.80 for every$1.00 increase in sales. Residual market policies are assigned to insurers based on their market share. Usually a "last resort" form of insurance. They serve as a coverage source of last resort for firms and individuals who have been rejected by voluntary market insurers. idaho Life Insurance Companies: 67 of the Biggest Carriers in the U.S. These are the drivers that the assigned risk pool was created to serve. Top 5 how to reset ley lines genshin impact, Top 7 how to reset ford door code without factory code. Institute, Inc. In recent years, the residual market combined ratios have been near the breakeven point of 100.

Please turn on JavaScript and try again. The Perfect Age to A Get Life Insurance Policy, COBRA Insurance: What It Is and If It's Right for You, 4 Types of Liability Insurance Every Business Should Have. Editorial Review Policy. Reinsurance Pool Participant: Based on its voluntary market share in the state, a reinsurance pool participating company provides proportionate reinsurance on residual market policies written by servicing carriers. Servicing carriers accept assignment of pool risks in exchange for a servicing carrier allowancepaid to them to offset the expenses associated with writing and servicing the WC policy. This still leaves a gap because there are still risks that might be eligible in E&S, but the pricing can become prohibitive. By continuing to use this site you are giving us your consent to place cookies on your device. One is the driver's history, including their history of driving tickets, accidents, and claims. Identify, educate and effectively communicate with internal and external stakeholders.

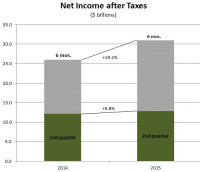

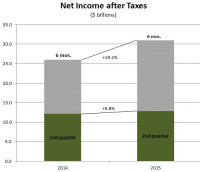

Whenever a person buys a house, the mortgage company wants to know that there is enough insurance in place to protect their investment if something were to happen to it. The workers compensation residual market premium share for NCCI-serviced pool states has also been consistent since 2014generally hovering between 7% and 8%. (4) The Mississippi and Texas FAIR Plans do not offer a commercial policy. We strive to reduce the financial burden on all Floridians by being good stewards of the premium funds entrusted to us. Paladin Furnishings generated $4 million in sales during 2016, and its year-end total assets were$3.2 million. Having workers compensation (WC) coverage is generally required for all employers by statute. %%EOF

FB!Tx6_^S;v^ofZ30

"z> insurance compensation workers elcosh As a government entity fulfilling a public purpose, Citizens aspires to provide insurance products and services that meet the needs of Florida property owners who are, in good faith, entitled to obtain coverage through the private market but are unable to do so. iii graphs (2) Exposure is the estimate of the aggregate value of all insurance in force in each states Beach and Windstorm Plan in all lines (except liability, where applicable, and crime) for 12 months ending September through December. They have either had too many accidents, or they have had their licenses suspended or revoked for some time. All rights Helping employers move from the residual market to the voluntary market serves to depopulate the residual market. How many appointments must the agent hold? Looking ahead to 2017, the company estimates that its assets must increase by $0.80 for every$1.00 increase in sales. Residual market policies are assigned to insurers based on their market share. Usually a "last resort" form of insurance. They serve as a coverage source of last resort for firms and individuals who have been rejected by voluntary market insurers. idaho Life Insurance Companies: 67 of the Biggest Carriers in the U.S. These are the drivers that the assigned risk pool was created to serve. Top 5 how to reset ley lines genshin impact, Top 7 how to reset ford door code without factory code. Institute, Inc. In recent years, the residual market combined ratios have been near the breakeven point of 100.

Please turn on JavaScript and try again. The Perfect Age to A Get Life Insurance Policy, COBRA Insurance: What It Is and If It's Right for You, 4 Types of Liability Insurance Every Business Should Have. Editorial Review Policy. Reinsurance Pool Participant: Based on its voluntary market share in the state, a reinsurance pool participating company provides proportionate reinsurance on residual market policies written by servicing carriers. Servicing carriers accept assignment of pool risks in exchange for a servicing carrier allowancepaid to them to offset the expenses associated with writing and servicing the WC policy. This still leaves a gap because there are still risks that might be eligible in E&S, but the pricing can become prohibitive. By continuing to use this site you are giving us your consent to place cookies on your device. One is the driver's history, including their history of driving tickets, accidents, and claims. Identify, educate and effectively communicate with internal and external stakeholders.  Residual markets require insurers writing specific coverage lines in a given state to assume the profits or losses accruing from insuring that state's residual risks in proportion to their share of the total voluntary market premiums written in that state. Here is a quick reference chart summarizing the two options: NCCI provides administrative services for reinsurance pooling mechanisms for 26 jurisdictions, including the five pools below. Copyright 2022, Insurance Information Institute, Inc. Which residual market program provides high risk workers compensation coverage for Arkansas employers who Cannot obtain it in the voluntary market? You know which drivers make up this population. The carrier does not participate in the reinsurance pooling mechanism (Pool) and is not reinsured by the Pool. A competitive state fund is a state-owned and operated fund that provides workers compensation insurance to employers who operate within that state.

Residual markets require insurers writing specific coverage lines in a given state to assume the profits or losses accruing from insuring that state's residual risks in proportion to their share of the total voluntary market premiums written in that state. Here is a quick reference chart summarizing the two options: NCCI provides administrative services for reinsurance pooling mechanisms for 26 jurisdictions, including the five pools below. Copyright 2022, Insurance Information Institute, Inc. Which residual market program provides high risk workers compensation coverage for Arkansas employers who Cannot obtain it in the voluntary market? You know which drivers make up this population. The carrier does not participate in the reinsurance pooling mechanism (Pool) and is not reinsured by the Pool. A competitive state fund is a state-owned and operated fund that provides workers compensation insurance to employers who operate within that state.  Protect the public interest and maintain the integrity of the corporation. There are many factors that result in drivers needing to acquire auto insurance from the residual market. The Path to Growth for Smaller Agencies: Hire Producers Or Acquire Agencies? Today, property insurance from the residual market is provided by Fair Access to Insurance Requirements (FAIR) Plans, Beach and Windstorm Plans, and two state-run insurance companies in Florida and Louisiana: Florida Citizens Property Insurance Corp. (CPIC) and Louisiana Citizens Property Insurance Corp. (Louisiana Citizens).

Protect the public interest and maintain the integrity of the corporation. There are many factors that result in drivers needing to acquire auto insurance from the residual market. The Path to Growth for Smaller Agencies: Hire Producers Or Acquire Agencies? Today, property insurance from the residual market is provided by Fair Access to Insurance Requirements (FAIR) Plans, Beach and Windstorm Plans, and two state-run insurance companies in Florida and Louisiana: Florida Citizens Property Insurance Corp. (CPIC) and Louisiana Citizens Property Insurance Corp. (Louisiana Citizens).  This is where the residual market steps in. The 6 Types of Business Insurance Many Companies Don't Realize They Need, What Canadians Need to Understand About Their Travel Insurance, 9 Hidden Insurance Perks Your Credit Card Provider Might Offer, Private-Passenger Auto Insurance Policyholder Risk Profile, How an Insurance Company Decides to Insure You, CLUE Yourself In: How Your Claims History Informs Your Insurance Future. (1) The Florida and Louisiana Beach Plans merged with their FAIR Plans, see chart, Insurance Provided By FAIR Plans By State.

This is where the residual market steps in. The 6 Types of Business Insurance Many Companies Don't Realize They Need, What Canadians Need to Understand About Their Travel Insurance, 9 Hidden Insurance Perks Your Credit Card Provider Might Offer, Private-Passenger Auto Insurance Policyholder Risk Profile, How an Insurance Company Decides to Insure You, CLUE Yourself In: How Your Claims History Informs Your Insurance Future. (1) The Florida and Louisiana Beach Plans merged with their FAIR Plans, see chart, Insurance Provided By FAIR Plans By State.

They serve as a coverage source of last resort for firms and individuals who have been rejected by voluntary market insurers. Residual market insurance programs are funded by: The AIUA offers coverage for residential homes up to a maximum of __________ for combined dwelling and contents.

They serve as a coverage source of last resort for firms and individuals who have been rejected by voluntary market insurers. Residual market insurance programs are funded by: The AIUA offers coverage for residential homes up to a maximum of __________ for combined dwelling and contents.