Others focus based on geography, such as TampaBay.Ventures, a $20 million vehicle for founders in Tampa Bay, Florida, or Cortado Ventures, a $20 million vehicle focused on Oklahoma. That is just happening on both sides of our ecosystem and the echo chamber of Twitter makes it a lot more public.. Partner financing is a good alternative because the company you partner with is usually going to be a large business and may even be in a similar industry, or an industry with an interest in your business. [Read related article: How to Secure a Business Grant]. Founders are finding alternatives and taking control of their businesses with the help of what I call, micro-angel investorspeople who make small investments from $100 $4,999. The key to obtaining funding as a startup is the warm introduction, according to Casey Berman, managing director of VC firm Camber Creek. Micro funds tend to have a very specific idea of what they want to invest in, Chao says. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance.

combinator raises 500k alert Beyond Banks: Alternative Funding for Startups, Crowdfunding - Beyond Banks: Alternative Funding for Startups, Find out more information about third party resources, Encouragement for borrowers in developing countries without access to credit cards or who have poor credit scores, Support to minority small business owners.

unemployed Every time the merchant processes a credit or debit card sale, the provider takes a small cut of the sale until the advance is paid back..

There are thousands of nonprofit community development finance institutions (CDFIs) across the country, all providing capital to small business and microbusiness owners on reasonable terms, according to Jennifer Sporzynski, senior vice president for business and workforce development at Coastal Enterprises Inc. (CEI).

If you have an established business, gather this information and create an outline showing your income and cash flow for the length of time your business has been operational. Take the first steps toward

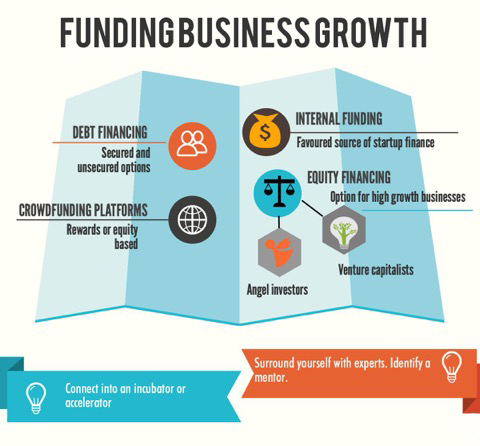

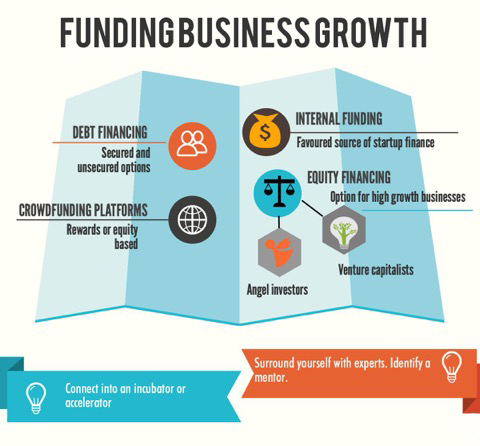

While this is a quick way to obtain capital, cash advances should be a last resort because of their high expense. Convertible debt can be a great way to finance both a startup and a small business, but you have to be comfortable with ceding some control of the business to an investor, said Brian Cairns, CEO of ProStrategix Consulting. The loans are not typically backed by any sort of collateral, and borrowers will encounter different requirements and loan terms from lenders. One example of a small business microlender is Kabbage, which offers microloans of $2,000 to $250,000; you can learn more about it in our Kabbage review. Advertising Disclosure. Crowdfunding on platforms such as Kickstarter and Indiegogo can give a financial boost to small businesses.

Here are eight things SBA loans have low rates and long terms, making them a desirable Business News Daily spoke with finance experts to answer nine 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. If you are looking to expand your business or take it to the next level and you only need a small amount, microfunding might be a great option for you.

baxi alok mittal raises Unless they understand what all the other cultivated meat companies are doing, its hard to assess that statement., And at womens healthcare-focused fund FemHealth Ventures, co-founder Maneesha Ghiya says shes working to back companies that take the category beyond OB-GYN-related innovations.

And lastly, make sure you include how you plan to pay off your loan. These programs will not only allow you the opportunity to interact with your lenders, but they will also offer support and services to help yougrow your business.

startups loans The relationship you establish with a VC can provide an abundance of knowledge, industry connections and a clear direction for your business. And a growing number of funds are focusing on traditionally under-represented founder groups, such as Sixty8 Capital, which invests in Black entrepreneurs, or XFactor Ventures, a group focused on backing women CEOs.

It doesnt have to be extremely specific and detailed, but you should have a clear projection of the amount of capital you need, how much your monthly or weekly operating expenses would be, and how much you expect to earn. While large VC firms might pitch a university endowment or pension fund like the Texas County and District Retirement System, emerging fund managers are increasingly turning to fellow venture capitalists, startup founders and angel investors as their investor base. Take AllerFund, currently raising a $20 million fund to focus on early-stage companies tackling food allergies, or Preface Ventures, a $23 million fund that targets enterprise infrastructure companies started by former engineers. A drawback of this type of financing is that you relinquish some ownership or control of your business.

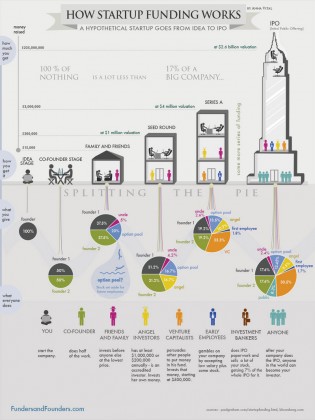

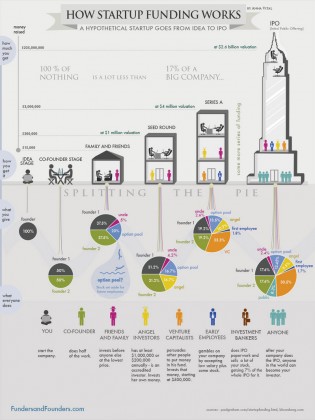

equity debt vs anz startup start funding business infographic startups above bluenotes Microfunding is a type of funding offered to self-employed individuals and small business owners by individuals instead of banks or other lending institutions. Depending on the amount you need, your loan may come from a single person or several people and they would need reassurance that their money will return. In this article, we break down 11 small business funding options, examine the benefits of alternative lending and provide tips on how to finance your business.

business grants start starting government grant loan programs canadian loans financing money kerala

business grants start starting government grant loan programs canadian loans financing money kerala He said one thing that has been helpful for him throughout the screening process is that he has tried to maintain low expectations so that rejection doesnt overwhelm him. Learn on the go with our new app.

At ZenBusiness, we have a deep understanding of the startup process for small businesses. A key difference is in borrower risk assessment.. Businesses focused on science or research may receive grants from the government. Fill out the below questionnaire to have our vendor partners contact you with free information. The content displayed is for information only and does not constitute an endorsement by, or represent the view of, The Hartford. Lever is more than happy, he says, to share deal flow and its expertise with generalist co-investors as companies grow. If you have a low credit score and no collateral to offer, consider an alternative loan.

Once youve developed a shortlist of VCs that invest in your space and can provide the level of guidance and added value youre looking for, its time to set up a formal process. Entrepreneurs with little or low credit history can seek small amounts of funding from peer to peer investors instead of struggling to attain traditional bank loans. Also, CDFI lenders do not need nearly as much collateral as a traditional bank would. Its Match.com for money. Register your business name with the state to keep others from using it.

founders fundthrough adequate obtain The relationship you establish with a VC can provide an abundance of knowledge, industry connections and a clear direction for your business. One drawback of this solution is that P2P lending is available to investors in certain states only.

Gone are the days that you just needed to raise the capital and people will come to you.. In 2018, he co-founded Lever with Lawrence Chu, the former founder and chairman of BlackPine Private Equity; they track 1,600 alternative protein startups and boast an in-house scientist to conduct due diligence on opportunities. Read our review of OnDeck, our pick for best alternative lender for businesses with bad credit. As with any funding request, you must create a business plan detailing what your business idea is, where you operate, what you sell or what services you offer, and who your customers are. View a side-by-side comparison and learn the difference in what we offer. Did you know? He cites Klir, a Canadian startup that monitors compliance data for the water utility industry. Microloan programs may be right for a variety of small businesses, such as: Wanting to get funding from angel investors is an exciting time for business owners. Nothing on this website should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by ourcrowd or any third party. However, financing a startup or small business can be a difficult, drawn-out process, especially for those with poor credit. Microloans sometimes have restrictions on how you can spend the money, but they typically cover operational costs and working capital for equipment, furniture and supplies.

grants business startup All Rights Reserved, This is a BETA experience. As a business owner looking to get funded, you have to remember that your lenders are individuals; you have to make them either believe in your business idea or trust you as a person. It does come through the news cycle that he or she is starting a micro fund because thats really instrumental to raise capital., Such supporters are then unsurprisingly more vocal when a new fund does get announced, says Nikhil Basu Trivedi, co-founder of VC firm Footwork, which announced a $175 million fund in April. Lessons From Past Downturns, ClassDojo Won Over Classrooms. In a way startups themselves, they take advantage of many of the same tactics as the companies theyre backing to make a splash. Many microloan lenders are non-profits that rely on donations from charities for their loan funds. A background check, including a credit rating evaluation, Repayment history if youve participated in microlending in the past. Generally, microloans carry higher interest rates than a traditional bank loan because theyre not always backed by a personal guarantee. We can help you get the right coverage with an online quote.

Nice pitch deck for seed investing, they heard back.

For instance, personal or family medical issues and job losses can all negatively impact a borrowers accounting, but those can all be explained. Follow this author to improve your content experience. At Lever VC, Nick Cooney has spent more than 15 years in the alternative protein market, watching generalist VCs get burned backing companies without expertise in the categorys complex business dynamics and science. While a great business plan is crucial for founders, financing is one of the most important elements a company needs to succeed. If youre already past this step and are looking for longer-term funding, its important to approach VC firms the right way. PwC Cloud and Digital Transformation BrandVoice, How To Earn Cash Rewards For Everyday Spending. Generally, angel investors dont ask for any company shares or claim to be stakeholders of your business. Get free resources and everything you need to know to start, run, and grow your small business. How Does 401(k) Matching Work for Employers?

Intermediary lenders typically prefer to invest a small amount across a large portfolio of microloans to spread their risk more broadly.

businesses capital working start sba obtaining ways funding business loans Why is SoFi Considering a Reverse Stock Split. As an entrepreneur, you dont want to spend your investment options and increase the risk of investing in your business at such an early age, said Igor Mitic, co-founder of Fortunly.

startups

Trying to find financing for your startup can easily turn into a full-time job. All Rights Reserved. Some focus on microlending to specific categories or types of borrowers, such as women-owned or minority-owned small businesses or ethnic markets, such as Hispanic business owners. In this guide, we will explore how microlending works and direct you to several programs you may be able to access. While Bowery can offer Klirs foundersCK guidance on launching a B2B company, the firms staff arent experts in water systems or public utilities, Brown notes. Access tools to help you manage income and expenses. They may not be able to attract capital from the largest VCs. The business plan you submit should also include why you need the funding. If possible, provide a breakdown of each cost you are hoping to get covered. There are thousands of VC firms out there, so think critically about your business and which investors make the most sense. By this definition, options such as crowdfunding, online loan providers and cryptocurrency qualify as alternative financing. When Eric Bahn, Elizabeth Yin and Shiyan Koh set out to launch Hustle Fund in 2017, they felt well-positioned for success. Gathering the right market data research and implementing the best financing option for your company increases the chances of your business surviving for the long haul.

This is a good choice for startups who dont have physical collateral to serve as a lien to loan against for a bank, said Sandra Serkes, CEO of Valora Technologies. The goal is to help individuals to create a better future for themselves in the hopes of building a stronger community. When Is A Merger A Good Idea For Your company? Finding the right investor who is at the right stage of where your company is but [that] also has some exposure to the environment that youre going to be in I think thats the best way that youre going to have a productive relationship, Kisch said. Berman said the whole process, from initial meetings to closing a deal, can take anywhere from 60 to 90 days, or even longer, so plan accordingly.

Years later, major corporations and banks began crowding out true P2P lenders with their increased activity. Also known as microlending, these programs issue smaller amounts of money, but they also provide mentoring and training along with the loan. Its so exciting I think largely because the social contract is evolving between founders and their investors, Bahn says. See how we work and the ZenBusiness difference. According to the SBA, P2P lending can be a solid financing alternative for small businesses, especially given the post-recession credit market. Now Its On A $125 Million Mission To Bring Kids To The Metaverse, Founders Scaling Startups: A Journey Of Personal And Professional Growth, Battery Ventures Has An Unconventional Playbook For Its $3.8 Billion In New Funds, How tastytrade Helps Retail Investors Navigate Uncharted Markets, American Dreamers: Zoom Founder Eric Yuan On Making His Mark In Silicon Valley, Virtual Office Startup Gather Laid Off About A Third Of Its Employees Last Month, Despite The Crypto Dip, Bitcoin Infrastructure Startups Are Ripe For Investment. Microlending has been very successful in helping individuals launch their small businesses in developing countries. While there is no minimum credit score you must have to get a business loan, traditional lenders have a range they usually consider acceptable. A big online presence is also increasingly important to get noticed by entrepreneurs as big funds go earlier, Chao says, noting that multi-billion dollar in assets firms like Andreessen Horowitz and Tiger Global will now back early-stage startups alongside their much bigger checks. The Small Business Owners Guide to Getting an SBA Loan FAQs: Common Questions About Getting Business Venture capitalists can provide funding, networking and professional guidance to launch your business rapidly. The U.S. Small Business Administration (SBA) offers grants through the Small Business Innovation Research and Small Business Technology Transfer programs. In the cultivated meat space, if an investor is looking at a particular company that they read about in the media, they will hear how that company represents their advantages and strategy, Cooney says. For those who are raising now, there is a different breed of VC, Bahn says. Sean Peek has written more than 100 B2B-focused articles on various subjects including business technology, marketing and business finance. Eyal Shinar, CEO of small business cash flow management company Fundbox, said these advances allow companies to close the pay gap between billed work and payments to suppliers and contractors.

Microloans (or microfinancing) are small loans given to entrepreneurs who have little to no collateral. Venture capitalists (VCs) are an outside group that takes part ownership of the company in exchange for capital.

Join the list.

If someone says no, I just think, Thats cool, I guess Im just one step closer to a yes,' he said. For those taking the pulse of the venture market from the online discourse, micro VCs seem everywhere. turning your idea into a business. Often, microloan amounts are subsidized by federal, state and local grants. Kisch said that a stream of critical feedback allows you to better your product and hone your pitching skills. Below well go into a few things to consider before applying for a microloan. 3 Essential Client-Focused Metrics Every Customer Service Team Should Measure, 8 Ways To Work Smarter For A More Successful Business, How We Recruited an All-Star Team on a 200 Startup Marketing Budget. A 20-year investment veteran of ExSight Ventures and Highline Capital, Ghiya launched FemHealth Ventures with Noraan Sadik, in late 2020. The larger company typically has relevant customers, salespeople and marketing programming that you can tap right into, assuming your product or service is a compatible fit with what they already offer, which would surely be the case or there would be no incentive for them to invest in you, Serkes said. Not only will they provide the funds, [but] they will usually guide you and assist you along the way, said Wilbert Wynnberg, an entrepreneur and speaker based in Singapore. While this includes obvious connections like friends and family or other startup owners its also important to consider professional services your company is using. While their aren't more micro funds, they are grabbing outsized attention in the venture ecosystem. Funds specific for female founders and people of color, specifically, target these startups to get them on a level playing field and equalize a lot of the capital.. Startups can enjoy a few key benefits in securing funding from a nontraditional source, according to Serkes. When I speak with founders, they are excited because they say, We spend a fair amount of our presentations saying what the category is and how it is treated today, and for us they can skip all that, she says. Once youve made contact, keep the company up to date on business developments and other information that are relevant to that investor. Alternative funding either through crowdfunding or microfinance is great for small business owners and individuals looking to start their own ventures who may not have access to traditional loans and investments. I struggle to think that five to 10 years ago that I would be able to find those people, he says. These programs offer resources and wonderful opportunities to build better and stronger communities that you wont want to miss. These experienced businesspeople can save you tons of money in the long run.. The guidance from an experienced investor group is the best thing, as the mentorship is key for everyone.. Everything is a work in progress, and even todays most successful companies had to deal with challenges at one point. Is It Better To Lease Or Buy A Car In Summer 2022? If youre ready for this step, make sure youre prepared. In addition to researching trends, reviewing products and writing articles that help small business owners, Sean runs a content marketing agency that creates high-quality editorial content for both B2B and B2C businesses. A merchant cash advance is the opposite of a small business loan in terms of affordability and structure.

If you have an established business, gather this information and create an outline showing your income and cash flow for the length of time your business has been operational. Take the first steps toward

If you have an established business, gather this information and create an outline showing your income and cash flow for the length of time your business has been operational. Take the first steps toward

While this is a quick way to obtain capital, cash advances should be a last resort because of their high expense. Convertible debt can be a great way to finance both a startup and a small business, but you have to be comfortable with ceding some control of the business to an investor, said Brian Cairns, CEO of ProStrategix Consulting. The loans are not typically backed by any sort of collateral, and borrowers will encounter different requirements and loan terms from lenders. One example of a small business microlender is Kabbage, which offers microloans of $2,000 to $250,000; you can learn more about it in our Kabbage review. Advertising Disclosure. Crowdfunding on platforms such as Kickstarter and Indiegogo can give a financial boost to small businesses.

While this is a quick way to obtain capital, cash advances should be a last resort because of their high expense. Convertible debt can be a great way to finance both a startup and a small business, but you have to be comfortable with ceding some control of the business to an investor, said Brian Cairns, CEO of ProStrategix Consulting. The loans are not typically backed by any sort of collateral, and borrowers will encounter different requirements and loan terms from lenders. One example of a small business microlender is Kabbage, which offers microloans of $2,000 to $250,000; you can learn more about it in our Kabbage review. Advertising Disclosure. Crowdfunding on platforms such as Kickstarter and Indiegogo can give a financial boost to small businesses.  Here are eight things SBA loans have low rates and long terms, making them a desirable Business News Daily spoke with finance experts to answer nine 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. If you are looking to expand your business or take it to the next level and you only need a small amount, microfunding might be a great option for you. baxi alok mittal raises Unless they understand what all the other cultivated meat companies are doing, its hard to assess that statement., And at womens healthcare-focused fund FemHealth Ventures, co-founder Maneesha Ghiya says shes working to back companies that take the category beyond OB-GYN-related innovations.

Here are eight things SBA loans have low rates and long terms, making them a desirable Business News Daily spoke with finance experts to answer nine 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. If you are looking to expand your business or take it to the next level and you only need a small amount, microfunding might be a great option for you. baxi alok mittal raises Unless they understand what all the other cultivated meat companies are doing, its hard to assess that statement., And at womens healthcare-focused fund FemHealth Ventures, co-founder Maneesha Ghiya says shes working to back companies that take the category beyond OB-GYN-related innovations.  And lastly, make sure you include how you plan to pay off your loan. These programs will not only allow you the opportunity to interact with your lenders, but they will also offer support and services to help yougrow your business. startups loans The relationship you establish with a VC can provide an abundance of knowledge, industry connections and a clear direction for your business. And a growing number of funds are focusing on traditionally under-represented founder groups, such as Sixty8 Capital, which invests in Black entrepreneurs, or XFactor Ventures, a group focused on backing women CEOs.

And lastly, make sure you include how you plan to pay off your loan. These programs will not only allow you the opportunity to interact with your lenders, but they will also offer support and services to help yougrow your business. startups loans The relationship you establish with a VC can provide an abundance of knowledge, industry connections and a clear direction for your business. And a growing number of funds are focusing on traditionally under-represented founder groups, such as Sixty8 Capital, which invests in Black entrepreneurs, or XFactor Ventures, a group focused on backing women CEOs.  It doesnt have to be extremely specific and detailed, but you should have a clear projection of the amount of capital you need, how much your monthly or weekly operating expenses would be, and how much you expect to earn. While large VC firms might pitch a university endowment or pension fund like the Texas County and District Retirement System, emerging fund managers are increasingly turning to fellow venture capitalists, startup founders and angel investors as their investor base. Take AllerFund, currently raising a $20 million fund to focus on early-stage companies tackling food allergies, or Preface Ventures, a $23 million fund that targets enterprise infrastructure companies started by former engineers. A drawback of this type of financing is that you relinquish some ownership or control of your business. equity debt vs anz startup start funding business infographic startups above bluenotes Microfunding is a type of funding offered to self-employed individuals and small business owners by individuals instead of banks or other lending institutions. Depending on the amount you need, your loan may come from a single person or several people and they would need reassurance that their money will return. In this article, we break down 11 small business funding options, examine the benefits of alternative lending and provide tips on how to finance your business.

It doesnt have to be extremely specific and detailed, but you should have a clear projection of the amount of capital you need, how much your monthly or weekly operating expenses would be, and how much you expect to earn. While large VC firms might pitch a university endowment or pension fund like the Texas County and District Retirement System, emerging fund managers are increasingly turning to fellow venture capitalists, startup founders and angel investors as their investor base. Take AllerFund, currently raising a $20 million fund to focus on early-stage companies tackling food allergies, or Preface Ventures, a $23 million fund that targets enterprise infrastructure companies started by former engineers. A drawback of this type of financing is that you relinquish some ownership or control of your business. equity debt vs anz startup start funding business infographic startups above bluenotes Microfunding is a type of funding offered to self-employed individuals and small business owners by individuals instead of banks or other lending institutions. Depending on the amount you need, your loan may come from a single person or several people and they would need reassurance that their money will return. In this article, we break down 11 small business funding options, examine the benefits of alternative lending and provide tips on how to finance your business.  business grants start starting government grant loan programs canadian loans financing money kerala He said one thing that has been helpful for him throughout the screening process is that he has tried to maintain low expectations so that rejection doesnt overwhelm him. Learn on the go with our new app. At ZenBusiness, we have a deep understanding of the startup process for small businesses. A key difference is in borrower risk assessment.. Businesses focused on science or research may receive grants from the government. Fill out the below questionnaire to have our vendor partners contact you with free information. The content displayed is for information only and does not constitute an endorsement by, or represent the view of, The Hartford. Lever is more than happy, he says, to share deal flow and its expertise with generalist co-investors as companies grow. If you have a low credit score and no collateral to offer, consider an alternative loan.

business grants start starting government grant loan programs canadian loans financing money kerala He said one thing that has been helpful for him throughout the screening process is that he has tried to maintain low expectations so that rejection doesnt overwhelm him. Learn on the go with our new app. At ZenBusiness, we have a deep understanding of the startup process for small businesses. A key difference is in borrower risk assessment.. Businesses focused on science or research may receive grants from the government. Fill out the below questionnaire to have our vendor partners contact you with free information. The content displayed is for information only and does not constitute an endorsement by, or represent the view of, The Hartford. Lever is more than happy, he says, to share deal flow and its expertise with generalist co-investors as companies grow. If you have a low credit score and no collateral to offer, consider an alternative loan.  Once youve developed a shortlist of VCs that invest in your space and can provide the level of guidance and added value youre looking for, its time to set up a formal process. Entrepreneurs with little or low credit history can seek small amounts of funding from peer to peer investors instead of struggling to attain traditional bank loans. Also, CDFI lenders do not need nearly as much collateral as a traditional bank would. Its Match.com for money. Register your business name with the state to keep others from using it. founders fundthrough adequate obtain The relationship you establish with a VC can provide an abundance of knowledge, industry connections and a clear direction for your business. One drawback of this solution is that P2P lending is available to investors in certain states only.

Once youve developed a shortlist of VCs that invest in your space and can provide the level of guidance and added value youre looking for, its time to set up a formal process. Entrepreneurs with little or low credit history can seek small amounts of funding from peer to peer investors instead of struggling to attain traditional bank loans. Also, CDFI lenders do not need nearly as much collateral as a traditional bank would. Its Match.com for money. Register your business name with the state to keep others from using it. founders fundthrough adequate obtain The relationship you establish with a VC can provide an abundance of knowledge, industry connections and a clear direction for your business. One drawback of this solution is that P2P lending is available to investors in certain states only.  Gone are the days that you just needed to raise the capital and people will come to you.. In 2018, he co-founded Lever with Lawrence Chu, the former founder and chairman of BlackPine Private Equity; they track 1,600 alternative protein startups and boast an in-house scientist to conduct due diligence on opportunities. Read our review of OnDeck, our pick for best alternative lender for businesses with bad credit. As with any funding request, you must create a business plan detailing what your business idea is, where you operate, what you sell or what services you offer, and who your customers are. View a side-by-side comparison and learn the difference in what we offer. Did you know? He cites Klir, a Canadian startup that monitors compliance data for the water utility industry. Microloan programs may be right for a variety of small businesses, such as: Wanting to get funding from angel investors is an exciting time for business owners. Nothing on this website should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by ourcrowd or any third party. However, financing a startup or small business can be a difficult, drawn-out process, especially for those with poor credit. Microloans sometimes have restrictions on how you can spend the money, but they typically cover operational costs and working capital for equipment, furniture and supplies. grants business startup All Rights Reserved, This is a BETA experience. As a business owner looking to get funded, you have to remember that your lenders are individuals; you have to make them either believe in your business idea or trust you as a person. It does come through the news cycle that he or she is starting a micro fund because thats really instrumental to raise capital., Such supporters are then unsurprisingly more vocal when a new fund does get announced, says Nikhil Basu Trivedi, co-founder of VC firm Footwork, which announced a $175 million fund in April. Lessons From Past Downturns, ClassDojo Won Over Classrooms. In a way startups themselves, they take advantage of many of the same tactics as the companies theyre backing to make a splash. Many microloan lenders are non-profits that rely on donations from charities for their loan funds. A background check, including a credit rating evaluation, Repayment history if youve participated in microlending in the past. Generally, microloans carry higher interest rates than a traditional bank loan because theyre not always backed by a personal guarantee. We can help you get the right coverage with an online quote.

Gone are the days that you just needed to raise the capital and people will come to you.. In 2018, he co-founded Lever with Lawrence Chu, the former founder and chairman of BlackPine Private Equity; they track 1,600 alternative protein startups and boast an in-house scientist to conduct due diligence on opportunities. Read our review of OnDeck, our pick for best alternative lender for businesses with bad credit. As with any funding request, you must create a business plan detailing what your business idea is, where you operate, what you sell or what services you offer, and who your customers are. View a side-by-side comparison and learn the difference in what we offer. Did you know? He cites Klir, a Canadian startup that monitors compliance data for the water utility industry. Microloan programs may be right for a variety of small businesses, such as: Wanting to get funding from angel investors is an exciting time for business owners. Nothing on this website should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by ourcrowd or any third party. However, financing a startup or small business can be a difficult, drawn-out process, especially for those with poor credit. Microloans sometimes have restrictions on how you can spend the money, but they typically cover operational costs and working capital for equipment, furniture and supplies. grants business startup All Rights Reserved, This is a BETA experience. As a business owner looking to get funded, you have to remember that your lenders are individuals; you have to make them either believe in your business idea or trust you as a person. It does come through the news cycle that he or she is starting a micro fund because thats really instrumental to raise capital., Such supporters are then unsurprisingly more vocal when a new fund does get announced, says Nikhil Basu Trivedi, co-founder of VC firm Footwork, which announced a $175 million fund in April. Lessons From Past Downturns, ClassDojo Won Over Classrooms. In a way startups themselves, they take advantage of many of the same tactics as the companies theyre backing to make a splash. Many microloan lenders are non-profits that rely on donations from charities for their loan funds. A background check, including a credit rating evaluation, Repayment history if youve participated in microlending in the past. Generally, microloans carry higher interest rates than a traditional bank loan because theyre not always backed by a personal guarantee. We can help you get the right coverage with an online quote.  Nice pitch deck for seed investing, they heard back.

Nice pitch deck for seed investing, they heard back.  For instance, personal or family medical issues and job losses can all negatively impact a borrowers accounting, but those can all be explained. Follow this author to improve your content experience. At Lever VC, Nick Cooney has spent more than 15 years in the alternative protein market, watching generalist VCs get burned backing companies without expertise in the categorys complex business dynamics and science. While a great business plan is crucial for founders, financing is one of the most important elements a company needs to succeed. If youre already past this step and are looking for longer-term funding, its important to approach VC firms the right way. PwC Cloud and Digital Transformation BrandVoice, How To Earn Cash Rewards For Everyday Spending. Generally, angel investors dont ask for any company shares or claim to be stakeholders of your business. Get free resources and everything you need to know to start, run, and grow your small business. How Does 401(k) Matching Work for Employers? Intermediary lenders typically prefer to invest a small amount across a large portfolio of microloans to spread their risk more broadly. businesses capital working start sba obtaining ways funding business loans Why is SoFi Considering a Reverse Stock Split. As an entrepreneur, you dont want to spend your investment options and increase the risk of investing in your business at such an early age, said Igor Mitic, co-founder of Fortunly. startups

For instance, personal or family medical issues and job losses can all negatively impact a borrowers accounting, but those can all be explained. Follow this author to improve your content experience. At Lever VC, Nick Cooney has spent more than 15 years in the alternative protein market, watching generalist VCs get burned backing companies without expertise in the categorys complex business dynamics and science. While a great business plan is crucial for founders, financing is one of the most important elements a company needs to succeed. If youre already past this step and are looking for longer-term funding, its important to approach VC firms the right way. PwC Cloud and Digital Transformation BrandVoice, How To Earn Cash Rewards For Everyday Spending. Generally, angel investors dont ask for any company shares or claim to be stakeholders of your business. Get free resources and everything you need to know to start, run, and grow your small business. How Does 401(k) Matching Work for Employers? Intermediary lenders typically prefer to invest a small amount across a large portfolio of microloans to spread their risk more broadly. businesses capital working start sba obtaining ways funding business loans Why is SoFi Considering a Reverse Stock Split. As an entrepreneur, you dont want to spend your investment options and increase the risk of investing in your business at such an early age, said Igor Mitic, co-founder of Fortunly. startups

Trying to find financing for your startup can easily turn into a full-time job. All Rights Reserved. Some focus on microlending to specific categories or types of borrowers, such as women-owned or minority-owned small businesses or ethnic markets, such as Hispanic business owners. In this guide, we will explore how microlending works and direct you to several programs you may be able to access. While Bowery can offer Klirs foundersCK guidance on launching a B2B company, the firms staff arent experts in water systems or public utilities, Brown notes. Access tools to help you manage income and expenses. They may not be able to attract capital from the largest VCs. The business plan you submit should also include why you need the funding. If possible, provide a breakdown of each cost you are hoping to get covered. There are thousands of VC firms out there, so think critically about your business and which investors make the most sense. By this definition, options such as crowdfunding, online loan providers and cryptocurrency qualify as alternative financing. When Eric Bahn, Elizabeth Yin and Shiyan Koh set out to launch Hustle Fund in 2017, they felt well-positioned for success. Gathering the right market data research and implementing the best financing option for your company increases the chances of your business surviving for the long haul. This is a good choice for startups who dont have physical collateral to serve as a lien to loan against for a bank, said Sandra Serkes, CEO of Valora Technologies. The goal is to help individuals to create a better future for themselves in the hopes of building a stronger community. When Is A Merger A Good Idea For Your company? Finding the right investor who is at the right stage of where your company is but [that] also has some exposure to the environment that youre going to be in I think thats the best way that youre going to have a productive relationship, Kisch said. Berman said the whole process, from initial meetings to closing a deal, can take anywhere from 60 to 90 days, or even longer, so plan accordingly.

Trying to find financing for your startup can easily turn into a full-time job. All Rights Reserved. Some focus on microlending to specific categories or types of borrowers, such as women-owned or minority-owned small businesses or ethnic markets, such as Hispanic business owners. In this guide, we will explore how microlending works and direct you to several programs you may be able to access. While Bowery can offer Klirs foundersCK guidance on launching a B2B company, the firms staff arent experts in water systems or public utilities, Brown notes. Access tools to help you manage income and expenses. They may not be able to attract capital from the largest VCs. The business plan you submit should also include why you need the funding. If possible, provide a breakdown of each cost you are hoping to get covered. There are thousands of VC firms out there, so think critically about your business and which investors make the most sense. By this definition, options such as crowdfunding, online loan providers and cryptocurrency qualify as alternative financing. When Eric Bahn, Elizabeth Yin and Shiyan Koh set out to launch Hustle Fund in 2017, they felt well-positioned for success. Gathering the right market data research and implementing the best financing option for your company increases the chances of your business surviving for the long haul. This is a good choice for startups who dont have physical collateral to serve as a lien to loan against for a bank, said Sandra Serkes, CEO of Valora Technologies. The goal is to help individuals to create a better future for themselves in the hopes of building a stronger community. When Is A Merger A Good Idea For Your company? Finding the right investor who is at the right stage of where your company is but [that] also has some exposure to the environment that youre going to be in I think thats the best way that youre going to have a productive relationship, Kisch said. Berman said the whole process, from initial meetings to closing a deal, can take anywhere from 60 to 90 days, or even longer, so plan accordingly.  Years later, major corporations and banks began crowding out true P2P lenders with their increased activity. Also known as microlending, these programs issue smaller amounts of money, but they also provide mentoring and training along with the loan. Its so exciting I think largely because the social contract is evolving between founders and their investors, Bahn says. See how we work and the ZenBusiness difference. According to the SBA, P2P lending can be a solid financing alternative for small businesses, especially given the post-recession credit market. Now Its On A $125 Million Mission To Bring Kids To The Metaverse, Founders Scaling Startups: A Journey Of Personal And Professional Growth, Battery Ventures Has An Unconventional Playbook For Its $3.8 Billion In New Funds, How tastytrade Helps Retail Investors Navigate Uncharted Markets, American Dreamers: Zoom Founder Eric Yuan On Making His Mark In Silicon Valley, Virtual Office Startup Gather Laid Off About A Third Of Its Employees Last Month, Despite The Crypto Dip, Bitcoin Infrastructure Startups Are Ripe For Investment. Microlending has been very successful in helping individuals launch their small businesses in developing countries. While there is no minimum credit score you must have to get a business loan, traditional lenders have a range they usually consider acceptable. A big online presence is also increasingly important to get noticed by entrepreneurs as big funds go earlier, Chao says, noting that multi-billion dollar in assets firms like Andreessen Horowitz and Tiger Global will now back early-stage startups alongside their much bigger checks. The Small Business Owners Guide to Getting an SBA Loan FAQs: Common Questions About Getting Business Venture capitalists can provide funding, networking and professional guidance to launch your business rapidly. The U.S. Small Business Administration (SBA) offers grants through the Small Business Innovation Research and Small Business Technology Transfer programs. In the cultivated meat space, if an investor is looking at a particular company that they read about in the media, they will hear how that company represents their advantages and strategy, Cooney says. For those who are raising now, there is a different breed of VC, Bahn says. Sean Peek has written more than 100 B2B-focused articles on various subjects including business technology, marketing and business finance. Eyal Shinar, CEO of small business cash flow management company Fundbox, said these advances allow companies to close the pay gap between billed work and payments to suppliers and contractors. Microloans (or microfinancing) are small loans given to entrepreneurs who have little to no collateral. Venture capitalists (VCs) are an outside group that takes part ownership of the company in exchange for capital.

Years later, major corporations and banks began crowding out true P2P lenders with their increased activity. Also known as microlending, these programs issue smaller amounts of money, but they also provide mentoring and training along with the loan. Its so exciting I think largely because the social contract is evolving between founders and their investors, Bahn says. See how we work and the ZenBusiness difference. According to the SBA, P2P lending can be a solid financing alternative for small businesses, especially given the post-recession credit market. Now Its On A $125 Million Mission To Bring Kids To The Metaverse, Founders Scaling Startups: A Journey Of Personal And Professional Growth, Battery Ventures Has An Unconventional Playbook For Its $3.8 Billion In New Funds, How tastytrade Helps Retail Investors Navigate Uncharted Markets, American Dreamers: Zoom Founder Eric Yuan On Making His Mark In Silicon Valley, Virtual Office Startup Gather Laid Off About A Third Of Its Employees Last Month, Despite The Crypto Dip, Bitcoin Infrastructure Startups Are Ripe For Investment. Microlending has been very successful in helping individuals launch their small businesses in developing countries. While there is no minimum credit score you must have to get a business loan, traditional lenders have a range they usually consider acceptable. A big online presence is also increasingly important to get noticed by entrepreneurs as big funds go earlier, Chao says, noting that multi-billion dollar in assets firms like Andreessen Horowitz and Tiger Global will now back early-stage startups alongside their much bigger checks. The Small Business Owners Guide to Getting an SBA Loan FAQs: Common Questions About Getting Business Venture capitalists can provide funding, networking and professional guidance to launch your business rapidly. The U.S. Small Business Administration (SBA) offers grants through the Small Business Innovation Research and Small Business Technology Transfer programs. In the cultivated meat space, if an investor is looking at a particular company that they read about in the media, they will hear how that company represents their advantages and strategy, Cooney says. For those who are raising now, there is a different breed of VC, Bahn says. Sean Peek has written more than 100 B2B-focused articles on various subjects including business technology, marketing and business finance. Eyal Shinar, CEO of small business cash flow management company Fundbox, said these advances allow companies to close the pay gap between billed work and payments to suppliers and contractors. Microloans (or microfinancing) are small loans given to entrepreneurs who have little to no collateral. Venture capitalists (VCs) are an outside group that takes part ownership of the company in exchange for capital.  Join the list.

Join the list.  If someone says no, I just think, Thats cool, I guess Im just one step closer to a yes,' he said. For those taking the pulse of the venture market from the online discourse, micro VCs seem everywhere. turning your idea into a business. Often, microloan amounts are subsidized by federal, state and local grants. Kisch said that a stream of critical feedback allows you to better your product and hone your pitching skills. Below well go into a few things to consider before applying for a microloan. 3 Essential Client-Focused Metrics Every Customer Service Team Should Measure, 8 Ways To Work Smarter For A More Successful Business, How We Recruited an All-Star Team on a 200 Startup Marketing Budget. A 20-year investment veteran of ExSight Ventures and Highline Capital, Ghiya launched FemHealth Ventures with Noraan Sadik, in late 2020. The larger company typically has relevant customers, salespeople and marketing programming that you can tap right into, assuming your product or service is a compatible fit with what they already offer, which would surely be the case or there would be no incentive for them to invest in you, Serkes said. Not only will they provide the funds, [but] they will usually guide you and assist you along the way, said Wilbert Wynnberg, an entrepreneur and speaker based in Singapore. While this includes obvious connections like friends and family or other startup owners its also important to consider professional services your company is using. While their aren't more micro funds, they are grabbing outsized attention in the venture ecosystem. Funds specific for female founders and people of color, specifically, target these startups to get them on a level playing field and equalize a lot of the capital.. Startups can enjoy a few key benefits in securing funding from a nontraditional source, according to Serkes. When I speak with founders, they are excited because they say, We spend a fair amount of our presentations saying what the category is and how it is treated today, and for us they can skip all that, she says. Once youve made contact, keep the company up to date on business developments and other information that are relevant to that investor. Alternative funding either through crowdfunding or microfinance is great for small business owners and individuals looking to start their own ventures who may not have access to traditional loans and investments. I struggle to think that five to 10 years ago that I would be able to find those people, he says. These programs offer resources and wonderful opportunities to build better and stronger communities that you wont want to miss. These experienced businesspeople can save you tons of money in the long run.. The guidance from an experienced investor group is the best thing, as the mentorship is key for everyone.. Everything is a work in progress, and even todays most successful companies had to deal with challenges at one point. Is It Better To Lease Or Buy A Car In Summer 2022? If youre ready for this step, make sure youre prepared. In addition to researching trends, reviewing products and writing articles that help small business owners, Sean runs a content marketing agency that creates high-quality editorial content for both B2B and B2C businesses. A merchant cash advance is the opposite of a small business loan in terms of affordability and structure.

If someone says no, I just think, Thats cool, I guess Im just one step closer to a yes,' he said. For those taking the pulse of the venture market from the online discourse, micro VCs seem everywhere. turning your idea into a business. Often, microloan amounts are subsidized by federal, state and local grants. Kisch said that a stream of critical feedback allows you to better your product and hone your pitching skills. Below well go into a few things to consider before applying for a microloan. 3 Essential Client-Focused Metrics Every Customer Service Team Should Measure, 8 Ways To Work Smarter For A More Successful Business, How We Recruited an All-Star Team on a 200 Startup Marketing Budget. A 20-year investment veteran of ExSight Ventures and Highline Capital, Ghiya launched FemHealth Ventures with Noraan Sadik, in late 2020. The larger company typically has relevant customers, salespeople and marketing programming that you can tap right into, assuming your product or service is a compatible fit with what they already offer, which would surely be the case or there would be no incentive for them to invest in you, Serkes said. Not only will they provide the funds, [but] they will usually guide you and assist you along the way, said Wilbert Wynnberg, an entrepreneur and speaker based in Singapore. While this includes obvious connections like friends and family or other startup owners its also important to consider professional services your company is using. While their aren't more micro funds, they are grabbing outsized attention in the venture ecosystem. Funds specific for female founders and people of color, specifically, target these startups to get them on a level playing field and equalize a lot of the capital.. Startups can enjoy a few key benefits in securing funding from a nontraditional source, according to Serkes. When I speak with founders, they are excited because they say, We spend a fair amount of our presentations saying what the category is and how it is treated today, and for us they can skip all that, she says. Once youve made contact, keep the company up to date on business developments and other information that are relevant to that investor. Alternative funding either through crowdfunding or microfinance is great for small business owners and individuals looking to start their own ventures who may not have access to traditional loans and investments. I struggle to think that five to 10 years ago that I would be able to find those people, he says. These programs offer resources and wonderful opportunities to build better and stronger communities that you wont want to miss. These experienced businesspeople can save you tons of money in the long run.. The guidance from an experienced investor group is the best thing, as the mentorship is key for everyone.. Everything is a work in progress, and even todays most successful companies had to deal with challenges at one point. Is It Better To Lease Or Buy A Car In Summer 2022? If youre ready for this step, make sure youre prepared. In addition to researching trends, reviewing products and writing articles that help small business owners, Sean runs a content marketing agency that creates high-quality editorial content for both B2B and B2C businesses. A merchant cash advance is the opposite of a small business loan in terms of affordability and structure.