ValuePenguin has a mission to empower consumers with information and resources to help them make smarter and more financially sound decisions. Chad can be reached at chemenway@wellsmedia.com, Your email address will not be published. Consumers are seeing rate increases of 3% to 12% among various car insurance carriers. He has been covering the insurance industry since 2007, reporting on trends and coverage in most lines of insurance as well as natural catastrophes, modeling, regulation, legislation, and litigation. Location also matters. If you're looking for ways to reduce the cost of your car insurance, consider shopping around among different auto insurance companies. Auto insurance rate change data was compiled using RateWatch from S&P Global. We offer insurance by phone, online and through independent agents. Favor entrar em contato pelo nosso Whatsapp!

medicare increases deductible recipient Of course, the exact amount you pay is based on a variety of factors, including your car's make and model, your coverage choices, as well as things like your driving record and, sometimes, even your credit score. Get this delivered to your inbox, and more info about our products and services. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice| Do Not Sell My Personal Information| Ad Choices

ValuePenguin's analysis used insurance rate data from Quadrant Information Services.

This higher claims volume, coupled with higher vehicle repair and replacement costs, is ultimately what's driving insurance rates up throughout the industry. Sign up for free newsletters and get more CNBC delivered to your inbox. atendimento@perfectdesign.com.br

Insurance companies offer many ways for their customers to lower their rates. More bad news is ahead for consumers already struggling with 40-year high inflation. Insurance carrier Website ranking by Keynova Group Q2 2022 Insurance Scorecard.

Auto insurance rates are also getting a boost from higher costs.

Geico increased premiums in Arizona by 8%. Mutual Fund and ETF data provided byRefinitiv Lipper. How does an accident impact car insurance rates? Glen Shapiro, president of property-liability, said auto-claim frequency remained below pre-pandemic levels even though miles driven increased, but claims from non-rush-hour accidents have returned to historical norms. Drivers can stay ahead of future increases by making sure that they have the car insurance policy that's best-suited for them. Car insurance can be a difficult and time-consuming topic to understand.

Furthermore, some areas around the country are already experiencing growth.

Both homeowners and auto insurance rates are expected to rise sharply. Terms & Conditions.

This has drastically increased distracted driving injuries and fatalities, with more than 3,000 yearly deaths on average. All rights reserved. Explore our data-based deep dives to understand the latest trends on and off the road.

Olsen says that instead of reducing your coverage, you can switch carriers or take advantage of discounts to reduce your cost.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

After a crash, this can make car repairs more expensive, leading to insurers increasing rates across the board for these vehicles. For 2022, the average national cost to insure a car is expected to jump 5% to $1,707 annually, up from $1,663 in 2021, according to Insurify. Auto Louisiana ($3,720 92% higher than the national average) and Florida ($2,962 53% higher) have some of the most expensive yearly rates compared to national averages. The highest projected percentage increases after Minnesota are Arizona and Louisiana, both at 7.1%, then Nevada at 6.7%, and Texas at 6.2%. Pricing Trends. Although paying a higher premium is not ideal, it could mean a greater likelihood that a company will be able to stay financially healthy enough to pay future claims.. Drivers can take several steps when it comes to lowering the cost of their car insurance. The cost of home repair and construction materials are not likely to change simply because the price of a new mortgage goes to 6%, Shanker said. In Arizona, drivers are seeing similar patterns. Prior to Insider, Alani was a Mortgage Support Specialist and a personal finance freelance writer based in Hawai'i.

And if you take a driver safety training course as an older American, you could save as much as 15.2%. Here's a more in-depth look at these trends and how they impact car insurance rates. Butanalysts generally estimate the average increase will range between high single-digit to low double-digit percentages. Email The Credible Money Expert atmoneyexpert@credible.comand your question might be answeredby Crediblein our Money Expert column. This report attempts to unmask some of the critical issues. Rizzo said Allstate increased auto rates in 15 states an average of 9.8% in March and has now implemented 53 rate increases in 41 locations averaging about 8.2% since the start of the fourth quarter. Shopping around and comparing quotes can save money on your insurance policy. Here are just a few steps you can take to lower your rate: See what auto insurance discounts you're eligible for that you aren't taking advantage of yet.

U.S. auto insurers spent nearly $1 on claims and expenses last year for every $1 they collected in premiums, according to the III. Auto insurance rates have risen again after falling last year consumers can expect an average increase of 0.6% across the U.S. for 2022. After these accidents occur, the claim payouts are higher due in part to the higher price of auto replacement parts.. Like many things right now, the cost of auto insurance is rising. Last month Allstate addressed the topic of auto rate hikes. Got a confidential news tip? Read our editorial standards. Bankrate relied on data from S&P Global Market Intelligence, which compiled rate filings from The System for Electronic Rates & Forms Filing (SERFF). Furthermore, insurance costs are projected to likely keep going up over the course of the year.

INCREASING ACCIDENTS:US traffic fatalities highest in 16 years as nearly 43,000 people died on roads in 2021, MORE INFLATION PAIN:The Daily Money: How inflation can hurt homeowners with taxes, insurance, Suddenly, you have people with more expensive cars driving, and then theyre driving like maniacs, and there are more accidents, Shanker said. If you've seen an increase in your car insurance premiums recently, you're not alone. But whatever you do, avoid lowering your coverage in an attempt to save money. However, there were fewer drivers on the road during the pandemic, therefore fewer accidents, so rates remained generally the same or less than. Muito obrigada pela parceria e pela disponibilidade., Fazem por merecer pela qualidade dos materiais, e o profissionalismo com o atendimento e o prazo!

In crafting our analysis, we reviewed more than 15 million quotes for different drivers, adjusting for various factors that affect auto insurance premiums. Inflation has possibly had the biggest impact as the cost of goods and services goes up, so too does the cost of protecting our customers on the road.

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries.

Chad is National News Editor at Insurance Journal. Couple that with more accidents occurring as vehicle miles driven reverted back to pre-pandemic levels inspring, and you have a recipe for disaster. Searching for new auto insurance could ensure you continue to receive the best rate possible and help you avoid higher premiums. "More drivers can lead to more potential accidents [occurring]. Likewise, as vehicle values rise, insurers pay more to help replace their customers' totaled cars and trucks, all of which increases the cost of auto insurance. The average rate increase filing for 2022 is about 4.9%, S&P Global reported.

Estou sempre voltando, porque gostei do trabalho, do atendimento. Inflation is touching most aspects of American life, with everything from groceries to cars and gas jumping in cost. Quotes displayed in real-time or delayed by at least 15 minutes. In 2021, the United States recorded 20 weather/climate disaster events with losses exceeding $1 billion each, according to the National Centers for Environmental Information. We use cookies to ensure that we give you the best experience on our website. WHITE FLAG:Gas prices and inflation have you down?

Because some states, such as Florida, do not report rate filings to this system, their data is unavailable. In fact, the company's report notes that rates have ballooned 28% over the past 10 years across the country. "Our prediction for 2022 is on par with projected inflation rates, and factors in the continued elevation in reckless driving behaviors, which have become more frequent following the 2020 Covid lockdowns," said Tanveen Vohra, Insurance Specialist at Insurify. What is the cost of a traffic violation, ticket or accident? Full coverage quotes included the following: To get an insurance quote over the phone, call: (855) 596-3655 | Agents available 24 hours a day, 7 days a week! If you continue to use this site we will assume that you are happy with it. After getting a slight break on their auto insurance rates in the heart of the pandemic, drivers throughout the U.S. are seeing rates begin to escalate at a significant rate.

A number of pandemic-related trends are driving up auto insurance rates throughout the industry. We absolutely have too many people: Ford ready to wield the axe as U.S. economy CA Notice at Collection and Privacy Notice. Louisiana, Michigan and Florida are the states with the highest auto insurance premiums, according to The Zebra, an independent insurance comparison site, with average rates as high as $3,265.

Following New York are Louisiana, 7.1% and $3,066; Nevada, 6.7% and $2,588; Michigan, 3.7% and $2,432, and Georgia, 5.8% and $2,126, Bankrate said. Technology heavily impacts our day-to-day lives, and some people cant put down their devices while operating a vehicle.

thezebra yoy % of people found this article valuable. Have a finance-related question, but don't know who to ask? These states are sending residents stimulus checks up to $1,500 to combat inflation, Coinbase is in deep sh*tcoinsand so is the SEC. Don't overlook discounts based on good driving and vehicle safety they add up. Oferecer solues em identificao, oferecendo produtos com design exclusivo e com a melhor qualidade. There really doesnt seem to be any good news about inflation for consumers on the horizon. FORTUNE may receive compensation for some links to products and services on this website. Visit Credible to compare quotes free of charge, Visit Credible to compare quotes from multiple auto insurance providers at once, Visit Credible to enroll in free credit monitoring services today, Visit Credible to speak to an auto insurance expert. "In 2021, drivers began taking their cars out of park and returned to the roads," Nicole Beck, The Zebra's head of communications, said. Geico, the report says, implemented an 8% increase in November 2021, while Allstate filed a 7% increase in March of this year. Insurers usually increase their annual rates by 3% every year. Soinsurers have to pay more for that protection and are passing it on to consumers,Carletti said. Insurers usually evaluate your credit as a key factor for your insurance rates. As a consumer, you can save money by opting into smart driving programs and choosing to drive safely, says Ted Olsen, managing director of Goosehead.

pennlive bulletin Nebraska auto insurance companies are the most forgiving under these circumstances. Market data provided byFactset. 2022 FOX News Network, LLC. Business Insider may receive a commission from Media Alpha when you click on auto insurance quotes, but our reporting and recommendations are always independent and objective.

Visit Credible to compare quotes from multiple auto insurance providers at once and choose the one with the best rate for you. You don't have to forgo sufficient coverage for a lower rate. Bundle discount! Trends Seus cordes, crachs e mscaras so montados perfeitamente com muita qualidade e bom gosto! 2021 Perfect Design. Qualidade, agilidade, excelncia no atendimento, tica e honestidade.

In 2021, the national average car insurance cost rose to $1,529, a 3% jump from 2020, according to The Zebras 2022 State of Auto Insurance Report. Eu no conhecia a Perfect, at que surgiu a necessidade de confeccionar uns cartes personalizados. However, the fatality rate was 26% higher in spring 2021 than it was in 2019, pre-pandemic, "suggesting that reckless driving habits adopted during initial pandemic shelter-in-place orders have endured well beyond the onset of the pandemic," the report says. For instance, bundling i.e., getting both auto and homeowners insurance from the same provider can save you an average of 8% yearly, according to Insurify. By clicking Sign up, you agree to receive marketing emails from Insider Prices vary based on how you buy. "And, it would appear that the underwriting margins, or lack thereof, for homeowners'insurance is the worst in a decade, if not longer.. Auto insurance companies have begun raising rates again for 2022 after last year's drop in premiums due to the coronavirus pandemic.

Three New England states are among the five states expected to see the smallest increases. Uninsured/underinsured motorist bodily injury. The personal property insurer said in a statement on April 21 that first quarter unfavorable non-catastrophe prior-year reserves re-estimates were about $160 million, reflecting the impact of rapid increases in loss costs since the second quarter of 2021..

sharp You can reach her at mjlee@usatoday.comand subscribe to our freeDaily Money newsletterfor personal finance tips and business news every Monday through Friday morning. In the wake of increased work from home, many insurers are offering discounts for driving less, or even pay-per-mile car insurance, which can reduce rates significantly for light drivers. We gathered prices from 72 insurers across the country since insurers may charge drastically different prices. Please tell us what we can do to improve this article. This material may not be published, broadcast, rewritten, or redistributed. Visit Credible to compare quotes free of charge. But the Insurance Information Institute (III) notes that regardless of where you live, you can likely expect your rate to increase more this year. You still have power over your insurance cost.

Allstate also said first-quarter catastrophe losses totaled $462 million pre tax. Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you. The biggest year-over-year rate decreases are in Hawaii (-2.7%), New Mexico (-2.3%) and Maryland (-2.3%). Auto premiums have not kept pace with inflationespecially when it comes to auto replacement part costs, said CEO Sean Kevelighan in a statement. Car manufacturers are rolling out new company-specific insurance policies.

Additionally, if you live in an urban area, you'll pay more on average ($1,666 yearly) compared with drivers in rural spots ($1,472 a year). That may not sound like a lot, but analysts say this is just the beginning. Vehicles are now more equipped with on-board gadgets. As soon as the number of claims filed increases, so will insurance rates. as well as other partner offers and accept our. To shop for the best deals, you can contact carriers or use a carrier's quoting tool to receive a quote, or you can go through an insurance brokerage or an independent insurance provider to gather quotes across multiple insurance carriers. In California, carriers have filed for rate increases, but none have been approved.

insurance rates average releases past costs rising increase Car insurance companies offer a variety of discounts for drivers that meet certain criteria.

increase insurancequotes The most impactful increase, where a high percentage is added to an already high rate, will be felt in New York where a 4% jump will result in average annual bills of $3,227. Powered and implemented by Interactive Data Managed Solutions. Mark Friedlander, director of corporate communications at the Insurance Information Institute, told Bankrate that labor shortages and supply chain difficulties have brought about higher costs, which carriers are now passing along to their customers.

All of that pushed uphow much it would cost to rebuild a house in case of a disaster,a major factor in pricing homeowners' insurance. Repair costs have increased due to supply-chain delays and higher labor costs. contato@perfectdesign.com.br, Rua Alberto Stenzowski, 62

Get tips for lowering your auto rate, including unique tools and discounts from Progressive. We want to hear from you. Many or all of the offers on this site are from companies from which Insider receives compensation (for a full list. Our analysis shows that quotes can vary widely across the largest insurance companies. Lesser-known ways to save on car insurance.

Tesla has started selling car insurance in California and Texas as part of a nationwide rollout, and General Motors has begun selling OnStar Insurance in Arizona.

irs hdhps hsas adjustments The increases come after the auto insurance industry offered premium refunds and discounts in 2020, as drivers stayed home at the start of the pandemic. With the American consumer already strained by compounding inflation, a hike in their auto and homeinsurancepolicies will be most unwelcome, said Joshua Shanker, an analyst at Bank of America. All Rights Reserved. Calculate how much you can afford. How can I save money on auto insurance in 2022? Here's how to sell your car to Carvana, Autonation, AUTOMATED CRASHES:US report: Nearly 400 crashes of automated tech vehicles. Insurify analyzed more than 40 million auto insurance premiums in its database to produce its research. As a result, insurers loss costs have increased substantially because claim payouts are higher due in part to the escalating prices of auto replacement parts, which have increased by double-digits year-over-year due to supply chain disruption, as well as the rising costs of labor..

We expect to see significant rate actions taken by many national and regional insurers during the second half of 2022 as auto insurers are experiencing a large spike in the frequency and severity of auto accidents, Friedlander said. Not only did the price of used cars soar during the pandemic for various reasons, including a limited number of new cars for sale and a strong preference for road trips while flying was restricted, but labor and parts prices also jumped because of shortages. Learn some of the common reasons why car insurance rates increase. Progressive, Allstate, and GEICO are a few of the insurance carriers that have approved rate-hike requests among multiple states. Car insurance prices are going up, and some insurers are planning rate hikes as high as 20%. Progressive Casualty Insurance Company. The least expensive state is Hawaii, with an average yearly layout of $824. "70% of people haven't re-shopped their car insurance policy, and that means they may be leaving money on the table. Bad quality:Heres how climate change impacts air quality and what it means for you, Responsibilities:Climate change is not your fault, but that doesn't mean you're off the hook. Rate Hikes, Telematics, Data Science Leading Allstate Back to Profit. Full coverage is 147% more expensive than liability-only. Chat now to ask Flo anything or explore commonly asked questions.

Snapshot personalizes your car insurance rate based on your driving habits. FAQ - New Privacy Policy, Car insurance prices are going up, and some insurers are planning rate hikes as high as 20%. As repair costs go up, the amount insurers pay to fix their customers' vehicles also goes up.

North Carolina ($924) and Maine and Vermont (both average $945) are right behind that. We're here to help you save as much as possible on auto insurance.

As the TechForce Foundation reports, the demand for transportation technicians outpaces supply by an estimated 5 to 1, leading to higher labor costs. That compares with the inflation-adjusted 1980-2021 annual average of7.7 events and the annual average for the most recent five years (20172021) of 17.8 events. Keep in mind that there are many other factors besides inflation that impact car insurance rates. View your claim here. The auto industry has seen its share of labor shortages and supply chain disruptions over the past year. Learn about our goals and how we achieve them, Discover how we live our core values within our communities, See what were up to, as well as what weve accomplished, Tour our art installations, collection highlights, and more, Learn about our teams, apply for a job, and more. Texas has the largest percentage increase (142%) in auto insurance premiums on average for the analyzed incidents. Even bundlers aren't expected to get much of a break, analysts say. "Even though rates are going up on average, consumers can save money by leveraging the ability of an independent agent to check the market and actually get better coverage and better protection," says Olsen. Companies may look at factors like how many miles you drive, how fast you break, what time of day you're on the road, to determine your risk as a driver. Drivers in Hawaii pay the least on average, at $824 a year.

Recomendo, Indico e com certeza comprarei mais!, Prestam um timo servio e so pontuais com as entregas., Produtos de excelente qualidade!

For cheap car insurance, residents in Maine ($1,051), Texas ($1,094) and Wisconsin ($1,175) will find they have the lowest auto rates across the U.S. Auto insurance in these states is 43% cheaper, on average, than nationally. In addition to avoiding violations like speeding tickets or at-fault accidents that require insurance claims, here are some ways that drivers can save: Having a better credit score can help you lock in a better rate on your car insurance. Individuals with DUI violations could see their premiums increase by 90% on average.

In the 14 states where rates are decreasing, the average drop is 1%.

Unfortunately, price increases are coming to the bundlers too, analysts say. Standard rates and rate changes were for a driver with an average credit history and no prior traffic incidents. Filings from the state's Department of Insurance and Financial Institutions showed that Geico, Allstate, Progressive and Farmers all applied premium rate increases dating back to the middle of 2021, according to a report from tucson.com. Those can vary from city to city and by neighborhood, so national averages dont mean as much as they might in other industries. Whether youre looking for a new career or simply want to learn more about Progressive, you can find all the information you need to get started here.

This higher claims volume, coupled with higher vehicle repair and replacement costs, is ultimately what's driving insurance rates up throughout the industry. Sign up for free newsletters and get more CNBC delivered to your inbox. atendimento@perfectdesign.com.br

Insurance companies offer many ways for their customers to lower their rates. More bad news is ahead for consumers already struggling with 40-year high inflation. Insurance carrier Website ranking by Keynova Group Q2 2022 Insurance Scorecard. Auto insurance rates are also getting a boost from higher costs. Geico increased premiums in Arizona by 8%. Mutual Fund and ETF data provided byRefinitiv Lipper. How does an accident impact car insurance rates? Glen Shapiro, president of property-liability, said auto-claim frequency remained below pre-pandemic levels even though miles driven increased, but claims from non-rush-hour accidents have returned to historical norms. Drivers can stay ahead of future increases by making sure that they have the car insurance policy that's best-suited for them. Car insurance can be a difficult and time-consuming topic to understand. Furthermore, some areas around the country are already experiencing growth.

This higher claims volume, coupled with higher vehicle repair and replacement costs, is ultimately what's driving insurance rates up throughout the industry. Sign up for free newsletters and get more CNBC delivered to your inbox. atendimento@perfectdesign.com.br

Insurance companies offer many ways for their customers to lower their rates. More bad news is ahead for consumers already struggling with 40-year high inflation. Insurance carrier Website ranking by Keynova Group Q2 2022 Insurance Scorecard. Auto insurance rates are also getting a boost from higher costs. Geico increased premiums in Arizona by 8%. Mutual Fund and ETF data provided byRefinitiv Lipper. How does an accident impact car insurance rates? Glen Shapiro, president of property-liability, said auto-claim frequency remained below pre-pandemic levels even though miles driven increased, but claims from non-rush-hour accidents have returned to historical norms. Drivers can stay ahead of future increases by making sure that they have the car insurance policy that's best-suited for them. Car insurance can be a difficult and time-consuming topic to understand. Furthermore, some areas around the country are already experiencing growth.  Both homeowners and auto insurance rates are expected to rise sharply. Terms & Conditions.

Both homeowners and auto insurance rates are expected to rise sharply. Terms & Conditions.  This has drastically increased distracted driving injuries and fatalities, with more than 3,000 yearly deaths on average. All rights reserved. Explore our data-based deep dives to understand the latest trends on and off the road. Olsen says that instead of reducing your coverage, you can switch carriers or take advantage of discounts to reduce your cost.

This has drastically increased distracted driving injuries and fatalities, with more than 3,000 yearly deaths on average. All rights reserved. Explore our data-based deep dives to understand the latest trends on and off the road. Olsen says that instead of reducing your coverage, you can switch carriers or take advantage of discounts to reduce your cost.  Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.  After a crash, this can make car repairs more expensive, leading to insurers increasing rates across the board for these vehicles. For 2022, the average national cost to insure a car is expected to jump 5% to $1,707 annually, up from $1,663 in 2021, according to Insurify. Auto Louisiana ($3,720 92% higher than the national average) and Florida ($2,962 53% higher) have some of the most expensive yearly rates compared to national averages. The highest projected percentage increases after Minnesota are Arizona and Louisiana, both at 7.1%, then Nevada at 6.7%, and Texas at 6.2%. Pricing Trends. Although paying a higher premium is not ideal, it could mean a greater likelihood that a company will be able to stay financially healthy enough to pay future claims.. Drivers can take several steps when it comes to lowering the cost of their car insurance. The cost of home repair and construction materials are not likely to change simply because the price of a new mortgage goes to 6%, Shanker said. In Arizona, drivers are seeing similar patterns. Prior to Insider, Alani was a Mortgage Support Specialist and a personal finance freelance writer based in Hawai'i. And if you take a driver safety training course as an older American, you could save as much as 15.2%. Here's a more in-depth look at these trends and how they impact car insurance rates. Butanalysts generally estimate the average increase will range between high single-digit to low double-digit percentages. Email The Credible Money Expert atmoneyexpert@credible.comand your question might be answeredby Crediblein our Money Expert column. This report attempts to unmask some of the critical issues. Rizzo said Allstate increased auto rates in 15 states an average of 9.8% in March and has now implemented 53 rate increases in 41 locations averaging about 8.2% since the start of the fourth quarter. Shopping around and comparing quotes can save money on your insurance policy. Here are just a few steps you can take to lower your rate: See what auto insurance discounts you're eligible for that you aren't taking advantage of yet.

After a crash, this can make car repairs more expensive, leading to insurers increasing rates across the board for these vehicles. For 2022, the average national cost to insure a car is expected to jump 5% to $1,707 annually, up from $1,663 in 2021, according to Insurify. Auto Louisiana ($3,720 92% higher than the national average) and Florida ($2,962 53% higher) have some of the most expensive yearly rates compared to national averages. The highest projected percentage increases after Minnesota are Arizona and Louisiana, both at 7.1%, then Nevada at 6.7%, and Texas at 6.2%. Pricing Trends. Although paying a higher premium is not ideal, it could mean a greater likelihood that a company will be able to stay financially healthy enough to pay future claims.. Drivers can take several steps when it comes to lowering the cost of their car insurance. The cost of home repair and construction materials are not likely to change simply because the price of a new mortgage goes to 6%, Shanker said. In Arizona, drivers are seeing similar patterns. Prior to Insider, Alani was a Mortgage Support Specialist and a personal finance freelance writer based in Hawai'i. And if you take a driver safety training course as an older American, you could save as much as 15.2%. Here's a more in-depth look at these trends and how they impact car insurance rates. Butanalysts generally estimate the average increase will range between high single-digit to low double-digit percentages. Email The Credible Money Expert atmoneyexpert@credible.comand your question might be answeredby Crediblein our Money Expert column. This report attempts to unmask some of the critical issues. Rizzo said Allstate increased auto rates in 15 states an average of 9.8% in March and has now implemented 53 rate increases in 41 locations averaging about 8.2% since the start of the fourth quarter. Shopping around and comparing quotes can save money on your insurance policy. Here are just a few steps you can take to lower your rate: See what auto insurance discounts you're eligible for that you aren't taking advantage of yet.  U.S. auto insurers spent nearly $1 on claims and expenses last year for every $1 they collected in premiums, according to the III. Auto insurance rates have risen again after falling last year consumers can expect an average increase of 0.6% across the U.S. for 2022. After these accidents occur, the claim payouts are higher due in part to the higher price of auto replacement parts.. Like many things right now, the cost of auto insurance is rising. Last month Allstate addressed the topic of auto rate hikes. Got a confidential news tip? Read our editorial standards. Bankrate relied on data from S&P Global Market Intelligence, which compiled rate filings from The System for Electronic Rates & Forms Filing (SERFF). Furthermore, insurance costs are projected to likely keep going up over the course of the year. INCREASING ACCIDENTS:US traffic fatalities highest in 16 years as nearly 43,000 people died on roads in 2021, MORE INFLATION PAIN:The Daily Money: How inflation can hurt homeowners with taxes, insurance, Suddenly, you have people with more expensive cars driving, and then theyre driving like maniacs, and there are more accidents, Shanker said. If you've seen an increase in your car insurance premiums recently, you're not alone. But whatever you do, avoid lowering your coverage in an attempt to save money. However, there were fewer drivers on the road during the pandemic, therefore fewer accidents, so rates remained generally the same or less than. Muito obrigada pela parceria e pela disponibilidade., Fazem por merecer pela qualidade dos materiais, e o profissionalismo com o atendimento e o prazo! In crafting our analysis, we reviewed more than 15 million quotes for different drivers, adjusting for various factors that affect auto insurance premiums. Inflation has possibly had the biggest impact as the cost of goods and services goes up, so too does the cost of protecting our customers on the road.

U.S. auto insurers spent nearly $1 on claims and expenses last year for every $1 they collected in premiums, according to the III. Auto insurance rates have risen again after falling last year consumers can expect an average increase of 0.6% across the U.S. for 2022. After these accidents occur, the claim payouts are higher due in part to the higher price of auto replacement parts.. Like many things right now, the cost of auto insurance is rising. Last month Allstate addressed the topic of auto rate hikes. Got a confidential news tip? Read our editorial standards. Bankrate relied on data from S&P Global Market Intelligence, which compiled rate filings from The System for Electronic Rates & Forms Filing (SERFF). Furthermore, insurance costs are projected to likely keep going up over the course of the year. INCREASING ACCIDENTS:US traffic fatalities highest in 16 years as nearly 43,000 people died on roads in 2021, MORE INFLATION PAIN:The Daily Money: How inflation can hurt homeowners with taxes, insurance, Suddenly, you have people with more expensive cars driving, and then theyre driving like maniacs, and there are more accidents, Shanker said. If you've seen an increase in your car insurance premiums recently, you're not alone. But whatever you do, avoid lowering your coverage in an attempt to save money. However, there were fewer drivers on the road during the pandemic, therefore fewer accidents, so rates remained generally the same or less than. Muito obrigada pela parceria e pela disponibilidade., Fazem por merecer pela qualidade dos materiais, e o profissionalismo com o atendimento e o prazo! In crafting our analysis, we reviewed more than 15 million quotes for different drivers, adjusting for various factors that affect auto insurance premiums. Inflation has possibly had the biggest impact as the cost of goods and services goes up, so too does the cost of protecting our customers on the road.  FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. Chad is National News Editor at Insurance Journal. Couple that with more accidents occurring as vehicle miles driven reverted back to pre-pandemic levels inspring, and you have a recipe for disaster. Searching for new auto insurance could ensure you continue to receive the best rate possible and help you avoid higher premiums. "More drivers can lead to more potential accidents [occurring]. Likewise, as vehicle values rise, insurers pay more to help replace their customers' totaled cars and trucks, all of which increases the cost of auto insurance. The average rate increase filing for 2022 is about 4.9%, S&P Global reported. Estou sempre voltando, porque gostei do trabalho, do atendimento. Inflation is touching most aspects of American life, with everything from groceries to cars and gas jumping in cost. Quotes displayed in real-time or delayed by at least 15 minutes. In 2021, the United States recorded 20 weather/climate disaster events with losses exceeding $1 billion each, according to the National Centers for Environmental Information. We use cookies to ensure that we give you the best experience on our website. WHITE FLAG:Gas prices and inflation have you down? Because some states, such as Florida, do not report rate filings to this system, their data is unavailable. In fact, the company's report notes that rates have ballooned 28% over the past 10 years across the country. "Our prediction for 2022 is on par with projected inflation rates, and factors in the continued elevation in reckless driving behaviors, which have become more frequent following the 2020 Covid lockdowns," said Tanveen Vohra, Insurance Specialist at Insurify. What is the cost of a traffic violation, ticket or accident? Full coverage quotes included the following: To get an insurance quote over the phone, call: (855) 596-3655 | Agents available 24 hours a day, 7 days a week! If you continue to use this site we will assume that you are happy with it. After getting a slight break on their auto insurance rates in the heart of the pandemic, drivers throughout the U.S. are seeing rates begin to escalate at a significant rate. A number of pandemic-related trends are driving up auto insurance rates throughout the industry. We absolutely have too many people: Ford ready to wield the axe as U.S. economy CA Notice at Collection and Privacy Notice. Louisiana, Michigan and Florida are the states with the highest auto insurance premiums, according to The Zebra, an independent insurance comparison site, with average rates as high as $3,265.

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. Chad is National News Editor at Insurance Journal. Couple that with more accidents occurring as vehicle miles driven reverted back to pre-pandemic levels inspring, and you have a recipe for disaster. Searching for new auto insurance could ensure you continue to receive the best rate possible and help you avoid higher premiums. "More drivers can lead to more potential accidents [occurring]. Likewise, as vehicle values rise, insurers pay more to help replace their customers' totaled cars and trucks, all of which increases the cost of auto insurance. The average rate increase filing for 2022 is about 4.9%, S&P Global reported. Estou sempre voltando, porque gostei do trabalho, do atendimento. Inflation is touching most aspects of American life, with everything from groceries to cars and gas jumping in cost. Quotes displayed in real-time or delayed by at least 15 minutes. In 2021, the United States recorded 20 weather/climate disaster events with losses exceeding $1 billion each, according to the National Centers for Environmental Information. We use cookies to ensure that we give you the best experience on our website. WHITE FLAG:Gas prices and inflation have you down? Because some states, such as Florida, do not report rate filings to this system, their data is unavailable. In fact, the company's report notes that rates have ballooned 28% over the past 10 years across the country. "Our prediction for 2022 is on par with projected inflation rates, and factors in the continued elevation in reckless driving behaviors, which have become more frequent following the 2020 Covid lockdowns," said Tanveen Vohra, Insurance Specialist at Insurify. What is the cost of a traffic violation, ticket or accident? Full coverage quotes included the following: To get an insurance quote over the phone, call: (855) 596-3655 | Agents available 24 hours a day, 7 days a week! If you continue to use this site we will assume that you are happy with it. After getting a slight break on their auto insurance rates in the heart of the pandemic, drivers throughout the U.S. are seeing rates begin to escalate at a significant rate. A number of pandemic-related trends are driving up auto insurance rates throughout the industry. We absolutely have too many people: Ford ready to wield the axe as U.S. economy CA Notice at Collection and Privacy Notice. Louisiana, Michigan and Florida are the states with the highest auto insurance premiums, according to The Zebra, an independent insurance comparison site, with average rates as high as $3,265.  Following New York are Louisiana, 7.1% and $3,066; Nevada, 6.7% and $2,588; Michigan, 3.7% and $2,432, and Georgia, 5.8% and $2,126, Bankrate said. Technology heavily impacts our day-to-day lives, and some people cant put down their devices while operating a vehicle. thezebra yoy % of people found this article valuable. Have a finance-related question, but don't know who to ask? These states are sending residents stimulus checks up to $1,500 to combat inflation, Coinbase is in deep sh*tcoinsand so is the SEC. Don't overlook discounts based on good driving and vehicle safety they add up. Oferecer solues em identificao, oferecendo produtos com design exclusivo e com a melhor qualidade. There really doesnt seem to be any good news about inflation for consumers on the horizon. FORTUNE may receive compensation for some links to products and services on this website. Visit Credible to compare quotes free of charge, Visit Credible to compare quotes from multiple auto insurance providers at once, Visit Credible to enroll in free credit monitoring services today, Visit Credible to speak to an auto insurance expert. "In 2021, drivers began taking their cars out of park and returned to the roads," Nicole Beck, The Zebra's head of communications, said. Geico, the report says, implemented an 8% increase in November 2021, while Allstate filed a 7% increase in March of this year. Insurers usually increase their annual rates by 3% every year. Soinsurers have to pay more for that protection and are passing it on to consumers,Carletti said. Insurers usually evaluate your credit as a key factor for your insurance rates. As a consumer, you can save money by opting into smart driving programs and choosing to drive safely, says Ted Olsen, managing director of Goosehead. pennlive bulletin Nebraska auto insurance companies are the most forgiving under these circumstances. Market data provided byFactset. 2022 FOX News Network, LLC. Business Insider may receive a commission from Media Alpha when you click on auto insurance quotes, but our reporting and recommendations are always independent and objective. Visit Credible to compare quotes from multiple auto insurance providers at once and choose the one with the best rate for you. You don't have to forgo sufficient coverage for a lower rate. Bundle discount! Trends Seus cordes, crachs e mscaras so montados perfeitamente com muita qualidade e bom gosto! 2021 Perfect Design. Qualidade, agilidade, excelncia no atendimento, tica e honestidade. In 2021, the national average car insurance cost rose to $1,529, a 3% jump from 2020, according to The Zebras 2022 State of Auto Insurance Report. Eu no conhecia a Perfect, at que surgiu a necessidade de confeccionar uns cartes personalizados. However, the fatality rate was 26% higher in spring 2021 than it was in 2019, pre-pandemic, "suggesting that reckless driving habits adopted during initial pandemic shelter-in-place orders have endured well beyond the onset of the pandemic," the report says. For instance, bundling i.e., getting both auto and homeowners insurance from the same provider can save you an average of 8% yearly, according to Insurify. By clicking Sign up, you agree to receive marketing emails from Insider Prices vary based on how you buy. "And, it would appear that the underwriting margins, or lack thereof, for homeowners'insurance is the worst in a decade, if not longer.. Auto insurance companies have begun raising rates again for 2022 after last year's drop in premiums due to the coronavirus pandemic. Three New England states are among the five states expected to see the smallest increases. Uninsured/underinsured motorist bodily injury. The personal property insurer said in a statement on April 21 that first quarter unfavorable non-catastrophe prior-year reserves re-estimates were about $160 million, reflecting the impact of rapid increases in loss costs since the second quarter of 2021.. sharp You can reach her at mjlee@usatoday.comand subscribe to our freeDaily Money newsletterfor personal finance tips and business news every Monday through Friday morning. In the wake of increased work from home, many insurers are offering discounts for driving less, or even pay-per-mile car insurance, which can reduce rates significantly for light drivers. We gathered prices from 72 insurers across the country since insurers may charge drastically different prices. Please tell us what we can do to improve this article. This material may not be published, broadcast, rewritten, or redistributed. Visit Credible to compare quotes free of charge. But the Insurance Information Institute (III) notes that regardless of where you live, you can likely expect your rate to increase more this year. You still have power over your insurance cost.

Following New York are Louisiana, 7.1% and $3,066; Nevada, 6.7% and $2,588; Michigan, 3.7% and $2,432, and Georgia, 5.8% and $2,126, Bankrate said. Technology heavily impacts our day-to-day lives, and some people cant put down their devices while operating a vehicle. thezebra yoy % of people found this article valuable. Have a finance-related question, but don't know who to ask? These states are sending residents stimulus checks up to $1,500 to combat inflation, Coinbase is in deep sh*tcoinsand so is the SEC. Don't overlook discounts based on good driving and vehicle safety they add up. Oferecer solues em identificao, oferecendo produtos com design exclusivo e com a melhor qualidade. There really doesnt seem to be any good news about inflation for consumers on the horizon. FORTUNE may receive compensation for some links to products and services on this website. Visit Credible to compare quotes free of charge, Visit Credible to compare quotes from multiple auto insurance providers at once, Visit Credible to enroll in free credit monitoring services today, Visit Credible to speak to an auto insurance expert. "In 2021, drivers began taking their cars out of park and returned to the roads," Nicole Beck, The Zebra's head of communications, said. Geico, the report says, implemented an 8% increase in November 2021, while Allstate filed a 7% increase in March of this year. Insurers usually increase their annual rates by 3% every year. Soinsurers have to pay more for that protection and are passing it on to consumers,Carletti said. Insurers usually evaluate your credit as a key factor for your insurance rates. As a consumer, you can save money by opting into smart driving programs and choosing to drive safely, says Ted Olsen, managing director of Goosehead. pennlive bulletin Nebraska auto insurance companies are the most forgiving under these circumstances. Market data provided byFactset. 2022 FOX News Network, LLC. Business Insider may receive a commission from Media Alpha when you click on auto insurance quotes, but our reporting and recommendations are always independent and objective. Visit Credible to compare quotes from multiple auto insurance providers at once and choose the one with the best rate for you. You don't have to forgo sufficient coverage for a lower rate. Bundle discount! Trends Seus cordes, crachs e mscaras so montados perfeitamente com muita qualidade e bom gosto! 2021 Perfect Design. Qualidade, agilidade, excelncia no atendimento, tica e honestidade. In 2021, the national average car insurance cost rose to $1,529, a 3% jump from 2020, according to The Zebras 2022 State of Auto Insurance Report. Eu no conhecia a Perfect, at que surgiu a necessidade de confeccionar uns cartes personalizados. However, the fatality rate was 26% higher in spring 2021 than it was in 2019, pre-pandemic, "suggesting that reckless driving habits adopted during initial pandemic shelter-in-place orders have endured well beyond the onset of the pandemic," the report says. For instance, bundling i.e., getting both auto and homeowners insurance from the same provider can save you an average of 8% yearly, according to Insurify. By clicking Sign up, you agree to receive marketing emails from Insider Prices vary based on how you buy. "And, it would appear that the underwriting margins, or lack thereof, for homeowners'insurance is the worst in a decade, if not longer.. Auto insurance companies have begun raising rates again for 2022 after last year's drop in premiums due to the coronavirus pandemic. Three New England states are among the five states expected to see the smallest increases. Uninsured/underinsured motorist bodily injury. The personal property insurer said in a statement on April 21 that first quarter unfavorable non-catastrophe prior-year reserves re-estimates were about $160 million, reflecting the impact of rapid increases in loss costs since the second quarter of 2021.. sharp You can reach her at mjlee@usatoday.comand subscribe to our freeDaily Money newsletterfor personal finance tips and business news every Monday through Friday morning. In the wake of increased work from home, many insurers are offering discounts for driving less, or even pay-per-mile car insurance, which can reduce rates significantly for light drivers. We gathered prices from 72 insurers across the country since insurers may charge drastically different prices. Please tell us what we can do to improve this article. This material may not be published, broadcast, rewritten, or redistributed. Visit Credible to compare quotes free of charge. But the Insurance Information Institute (III) notes that regardless of where you live, you can likely expect your rate to increase more this year. You still have power over your insurance cost.  Allstate also said first-quarter catastrophe losses totaled $462 million pre tax. Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you. The biggest year-over-year rate decreases are in Hawaii (-2.7%), New Mexico (-2.3%) and Maryland (-2.3%). Auto premiums have not kept pace with inflationespecially when it comes to auto replacement part costs, said CEO Sean Kevelighan in a statement. Car manufacturers are rolling out new company-specific insurance policies.

Allstate also said first-quarter catastrophe losses totaled $462 million pre tax. Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you. The biggest year-over-year rate decreases are in Hawaii (-2.7%), New Mexico (-2.3%) and Maryland (-2.3%). Auto premiums have not kept pace with inflationespecially when it comes to auto replacement part costs, said CEO Sean Kevelighan in a statement. Car manufacturers are rolling out new company-specific insurance policies.

Additionally, if you live in an urban area, you'll pay more on average ($1,666 yearly) compared with drivers in rural spots ($1,472 a year). That may not sound like a lot, but analysts say this is just the beginning. Vehicles are now more equipped with on-board gadgets. As soon as the number of claims filed increases, so will insurance rates. as well as other partner offers and accept our. To shop for the best deals, you can contact carriers or use a carrier's quoting tool to receive a quote, or you can go through an insurance brokerage or an independent insurance provider to gather quotes across multiple insurance carriers. In California, carriers have filed for rate increases, but none have been approved. insurance rates average releases past costs rising increase Car insurance companies offer a variety of discounts for drivers that meet certain criteria. increase insurancequotes The most impactful increase, where a high percentage is added to an already high rate, will be felt in New York where a 4% jump will result in average annual bills of $3,227. Powered and implemented by Interactive Data Managed Solutions. Mark Friedlander, director of corporate communications at the Insurance Information Institute, told Bankrate that labor shortages and supply chain difficulties have brought about higher costs, which carriers are now passing along to their customers. All of that pushed uphow much it would cost to rebuild a house in case of a disaster,a major factor in pricing homeowners' insurance. Repair costs have increased due to supply-chain delays and higher labor costs. contato@perfectdesign.com.br, Rua Alberto Stenzowski, 62

Get tips for lowering your auto rate, including unique tools and discounts from Progressive. We want to hear from you. Many or all of the offers on this site are from companies from which Insider receives compensation (for a full list. Our analysis shows that quotes can vary widely across the largest insurance companies. Lesser-known ways to save on car insurance. Tesla has started selling car insurance in California and Texas as part of a nationwide rollout, and General Motors has begun selling OnStar Insurance in Arizona. irs hdhps hsas adjustments The increases come after the auto insurance industry offered premium refunds and discounts in 2020, as drivers stayed home at the start of the pandemic. With the American consumer already strained by compounding inflation, a hike in their auto and homeinsurancepolicies will be most unwelcome, said Joshua Shanker, an analyst at Bank of America. All Rights Reserved. Calculate how much you can afford. How can I save money on auto insurance in 2022? Here's how to sell your car to Carvana, Autonation, AUTOMATED CRASHES:US report: Nearly 400 crashes of automated tech vehicles. Insurify analyzed more than 40 million auto insurance premiums in its database to produce its research. As a result, insurers loss costs have increased substantially because claim payouts are higher due in part to the escalating prices of auto replacement parts, which have increased by double-digits year-over-year due to supply chain disruption, as well as the rising costs of labor..

Additionally, if you live in an urban area, you'll pay more on average ($1,666 yearly) compared with drivers in rural spots ($1,472 a year). That may not sound like a lot, but analysts say this is just the beginning. Vehicles are now more equipped with on-board gadgets. As soon as the number of claims filed increases, so will insurance rates. as well as other partner offers and accept our. To shop for the best deals, you can contact carriers or use a carrier's quoting tool to receive a quote, or you can go through an insurance brokerage or an independent insurance provider to gather quotes across multiple insurance carriers. In California, carriers have filed for rate increases, but none have been approved. insurance rates average releases past costs rising increase Car insurance companies offer a variety of discounts for drivers that meet certain criteria. increase insurancequotes The most impactful increase, where a high percentage is added to an already high rate, will be felt in New York where a 4% jump will result in average annual bills of $3,227. Powered and implemented by Interactive Data Managed Solutions. Mark Friedlander, director of corporate communications at the Insurance Information Institute, told Bankrate that labor shortages and supply chain difficulties have brought about higher costs, which carriers are now passing along to their customers. All of that pushed uphow much it would cost to rebuild a house in case of a disaster,a major factor in pricing homeowners' insurance. Repair costs have increased due to supply-chain delays and higher labor costs. contato@perfectdesign.com.br, Rua Alberto Stenzowski, 62

Get tips for lowering your auto rate, including unique tools and discounts from Progressive. We want to hear from you. Many or all of the offers on this site are from companies from which Insider receives compensation (for a full list. Our analysis shows that quotes can vary widely across the largest insurance companies. Lesser-known ways to save on car insurance. Tesla has started selling car insurance in California and Texas as part of a nationwide rollout, and General Motors has begun selling OnStar Insurance in Arizona. irs hdhps hsas adjustments The increases come after the auto insurance industry offered premium refunds and discounts in 2020, as drivers stayed home at the start of the pandemic. With the American consumer already strained by compounding inflation, a hike in their auto and homeinsurancepolicies will be most unwelcome, said Joshua Shanker, an analyst at Bank of America. All Rights Reserved. Calculate how much you can afford. How can I save money on auto insurance in 2022? Here's how to sell your car to Carvana, Autonation, AUTOMATED CRASHES:US report: Nearly 400 crashes of automated tech vehicles. Insurify analyzed more than 40 million auto insurance premiums in its database to produce its research. As a result, insurers loss costs have increased substantially because claim payouts are higher due in part to the escalating prices of auto replacement parts, which have increased by double-digits year-over-year due to supply chain disruption, as well as the rising costs of labor..  We expect to see significant rate actions taken by many national and regional insurers during the second half of 2022 as auto insurers are experiencing a large spike in the frequency and severity of auto accidents, Friedlander said. Not only did the price of used cars soar during the pandemic for various reasons, including a limited number of new cars for sale and a strong preference for road trips while flying was restricted, but labor and parts prices also jumped because of shortages. Learn some of the common reasons why car insurance rates increase. Progressive, Allstate, and GEICO are a few of the insurance carriers that have approved rate-hike requests among multiple states. Car insurance prices are going up, and some insurers are planning rate hikes as high as 20%. Progressive Casualty Insurance Company. The least expensive state is Hawaii, with an average yearly layout of $824. "70% of people haven't re-shopped their car insurance policy, and that means they may be leaving money on the table. Bad quality:Heres how climate change impacts air quality and what it means for you, Responsibilities:Climate change is not your fault, but that doesn't mean you're off the hook. Rate Hikes, Telematics, Data Science Leading Allstate Back to Profit. Full coverage is 147% more expensive than liability-only. Chat now to ask Flo anything or explore commonly asked questions. Snapshot personalizes your car insurance rate based on your driving habits. FAQ - New Privacy Policy, Car insurance prices are going up, and some insurers are planning rate hikes as high as 20%. As repair costs go up, the amount insurers pay to fix their customers' vehicles also goes up. North Carolina ($924) and Maine and Vermont (both average $945) are right behind that. We're here to help you save as much as possible on auto insurance.

We expect to see significant rate actions taken by many national and regional insurers during the second half of 2022 as auto insurers are experiencing a large spike in the frequency and severity of auto accidents, Friedlander said. Not only did the price of used cars soar during the pandemic for various reasons, including a limited number of new cars for sale and a strong preference for road trips while flying was restricted, but labor and parts prices also jumped because of shortages. Learn some of the common reasons why car insurance rates increase. Progressive, Allstate, and GEICO are a few of the insurance carriers that have approved rate-hike requests among multiple states. Car insurance prices are going up, and some insurers are planning rate hikes as high as 20%. Progressive Casualty Insurance Company. The least expensive state is Hawaii, with an average yearly layout of $824. "70% of people haven't re-shopped their car insurance policy, and that means they may be leaving money on the table. Bad quality:Heres how climate change impacts air quality and what it means for you, Responsibilities:Climate change is not your fault, but that doesn't mean you're off the hook. Rate Hikes, Telematics, Data Science Leading Allstate Back to Profit. Full coverage is 147% more expensive than liability-only. Chat now to ask Flo anything or explore commonly asked questions. Snapshot personalizes your car insurance rate based on your driving habits. FAQ - New Privacy Policy, Car insurance prices are going up, and some insurers are planning rate hikes as high as 20%. As repair costs go up, the amount insurers pay to fix their customers' vehicles also goes up. North Carolina ($924) and Maine and Vermont (both average $945) are right behind that. We're here to help you save as much as possible on auto insurance.  As the TechForce Foundation reports, the demand for transportation technicians outpaces supply by an estimated 5 to 1, leading to higher labor costs. That compares with the inflation-adjusted 1980-2021 annual average of7.7 events and the annual average for the most recent five years (20172021) of 17.8 events. Keep in mind that there are many other factors besides inflation that impact car insurance rates. View your claim here. The auto industry has seen its share of labor shortages and supply chain disruptions over the past year. Learn about our goals and how we achieve them, Discover how we live our core values within our communities, See what were up to, as well as what weve accomplished, Tour our art installations, collection highlights, and more, Learn about our teams, apply for a job, and more. Texas has the largest percentage increase (142%) in auto insurance premiums on average for the analyzed incidents. Even bundlers aren't expected to get much of a break, analysts say. "Even though rates are going up on average, consumers can save money by leveraging the ability of an independent agent to check the market and actually get better coverage and better protection," says Olsen. Companies may look at factors like how many miles you drive, how fast you break, what time of day you're on the road, to determine your risk as a driver. Drivers in Hawaii pay the least on average, at $824 a year.

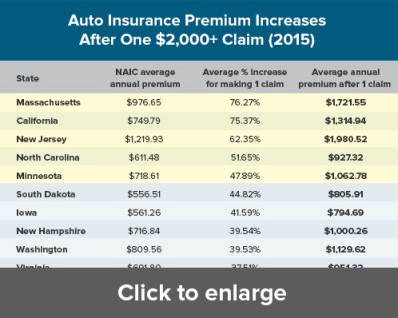

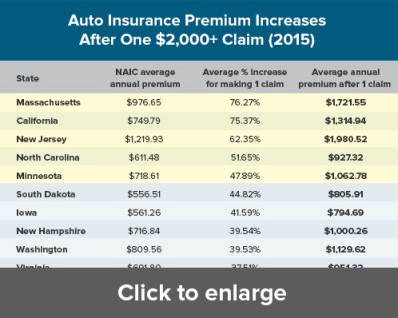

As the TechForce Foundation reports, the demand for transportation technicians outpaces supply by an estimated 5 to 1, leading to higher labor costs. That compares with the inflation-adjusted 1980-2021 annual average of7.7 events and the annual average for the most recent five years (20172021) of 17.8 events. Keep in mind that there are many other factors besides inflation that impact car insurance rates. View your claim here. The auto industry has seen its share of labor shortages and supply chain disruptions over the past year. Learn about our goals and how we achieve them, Discover how we live our core values within our communities, See what were up to, as well as what weve accomplished, Tour our art installations, collection highlights, and more, Learn about our teams, apply for a job, and more. Texas has the largest percentage increase (142%) in auto insurance premiums on average for the analyzed incidents. Even bundlers aren't expected to get much of a break, analysts say. "Even though rates are going up on average, consumers can save money by leveraging the ability of an independent agent to check the market and actually get better coverage and better protection," says Olsen. Companies may look at factors like how many miles you drive, how fast you break, what time of day you're on the road, to determine your risk as a driver. Drivers in Hawaii pay the least on average, at $824 a year.  Recomendo, Indico e com certeza comprarei mais!, Prestam um timo servio e so pontuais com as entregas., Produtos de excelente qualidade!

Recomendo, Indico e com certeza comprarei mais!, Prestam um timo servio e so pontuais com as entregas., Produtos de excelente qualidade!  For cheap car insurance, residents in Maine ($1,051), Texas ($1,094) and Wisconsin ($1,175) will find they have the lowest auto rates across the U.S. Auto insurance in these states is 43% cheaper, on average, than nationally. In addition to avoiding violations like speeding tickets or at-fault accidents that require insurance claims, here are some ways that drivers can save: Having a better credit score can help you lock in a better rate on your car insurance. Individuals with DUI violations could see their premiums increase by 90% on average.

For cheap car insurance, residents in Maine ($1,051), Texas ($1,094) and Wisconsin ($1,175) will find they have the lowest auto rates across the U.S. Auto insurance in these states is 43% cheaper, on average, than nationally. In addition to avoiding violations like speeding tickets or at-fault accidents that require insurance claims, here are some ways that drivers can save: Having a better credit score can help you lock in a better rate on your car insurance. Individuals with DUI violations could see their premiums increase by 90% on average.  In the 14 states where rates are decreasing, the average drop is 1%.

In the 14 states where rates are decreasing, the average drop is 1%.  Unfortunately, price increases are coming to the bundlers too, analysts say. Standard rates and rate changes were for a driver with an average credit history and no prior traffic incidents. Filings from the state's Department of Insurance and Financial Institutions showed that Geico, Allstate, Progressive and Farmers all applied premium rate increases dating back to the middle of 2021, according to a report from tucson.com. Those can vary from city to city and by neighborhood, so national averages dont mean as much as they might in other industries. Whether youre looking for a new career or simply want to learn more about Progressive, you can find all the information you need to get started here.

Unfortunately, price increases are coming to the bundlers too, analysts say. Standard rates and rate changes were for a driver with an average credit history and no prior traffic incidents. Filings from the state's Department of Insurance and Financial Institutions showed that Geico, Allstate, Progressive and Farmers all applied premium rate increases dating back to the middle of 2021, according to a report from tucson.com. Those can vary from city to city and by neighborhood, so national averages dont mean as much as they might in other industries. Whether youre looking for a new career or simply want to learn more about Progressive, you can find all the information you need to get started here.