freshbooks Want even more information about our double-entry accounting system?

prepaid expense accrued accountingtools prepayments adjusting msdavissportfolio

prepaid expense accrued accountingtools prepayments adjusting msdavissportfolio If youve generated an accounting report that youd like to share with your accountant, you can export it to Excel, print it, or send it directly to your accountants email. Or wanted to reward a loyal customer with a discount?

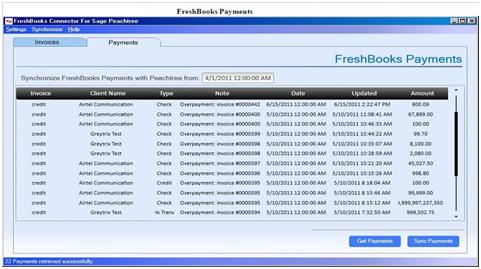

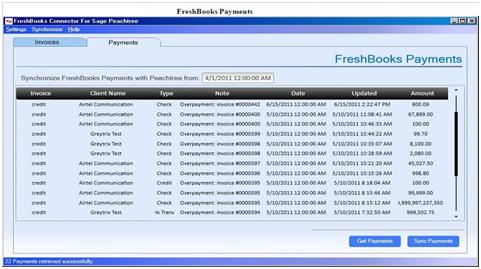

accounting freshbooks accountants You need to select Extensions -> G-Accon for FreshBooks -> Update/Modify/Delete Templates for Current Sheet. FreshBooks has accounting reports for your business like the Profit and Loss Report and Sales Tax Summary, which have the key numbers you need to fill out and file your tax return. To learn about how we use your data, please Read our Privacy Policy. Lets assume we need to add a New Journal Entries in Google spreadsheet and upload it into FreshBooks. If you work with an accountant, then you know how valuable they are at providing an expert second opinion. By continuing to browse the site you are agreeing to our use of cookies.

Plus, run reports like Profit & Loss and Cash Flow Statement to know exactly where you stand at tax time. Whatever it was, let FreshBooks Bank Reconciliation assist you to make organising your transactions a breeze. Before creating a journal entry you will need to query the Get accounts endpoint. Happy reading!

FreshBooks makes it easy to keep a close eye on the bottom line with Profit & Loss Reports you can whip up in mere seconds. We break down what payroll entries are and how to make one to process your payroll. Purchase a coffee at the airport? FreshBooks Double-Entry Accounting identifies revenue items and their relatedexpenses, giving you an accurate calculation of profits and losses. Do you pay for an internet bill every month? You are in the middle of the refresh process and you realize you need to modify your report. Or wanted to reward a loyal customer with a discount? The ledger has to be balanced. Any credit created for your client, whether its a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template. Get a newsletter that helps you think differently about your business. This site uses cookies. There are no restrictions on how your input DataSet headers are named. to get matched with an accounting professional. As our unique feature we also support custom field mappings. Your accountant has your back. To find out what accounts the user using your app has access to, its good to make a query related to the identity model. How to create your FreshBooks app listing, How To Find The Right Scopes For Your App, Getting Started with FreshBooks NodeJS SDK Expenses & Invoices, Receive Online Payments with Checkout API, How To Add Time Entries For Your Employees, Accounting API For Reporting Other Income. As you can see, the gross wage expense is at the top as a debit. Your accountant will get exclusive access to the financial information and reporting they need to support your business, whenever they need it.

ledger freshbooks accounting At the end you have the net income payable to your employees. Cancel anytime. FreshBooks ensures you have all the information and tools you need to understand and grow your business. Get a hand navigating through reports and information in just 2 rings. In order to upload data in FreshBooks, you need to be logged in into current FreshBooks account. Follow the steps here to get it enabled moving forward. New: Organize Your Books with the Customizable Chart of Accounts, Accountants: How to Manage Your Clients Chart of Accounts in FreshBooks, Best Practices for Customizing Your Chart of Accounts, What Is a Virtual Accountant? Invite your accountant to your FreshBooks account with just a few clicks.

quickbooks journal entering entry accounting making freshbooks tax sales invoice repeat steps until transaction workflow package together each

Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help. There is no difference between a double-entry bookkeeping and double-entry accounting system. For the first kind of payroll journal entry, it is important to realize that you only do one entry for all employees. As a result your data will be uploaded to FreshBooks organizations right away without any delay.

bookkeeping prepaid Review our cookies information This includes the ability to: Not only will your accountant be able to generate reports, but theyll also have access to all the numbers they need to help you grow your business, save time with taxes, and see how your business is performing. FreshBooks Plus and Premium plans allow you to invite up to 10 accountants per business at no extra cost. Get a hand navigating through reports and information in just 2 rings. WhereIdis object id,Successwill be true in case operation was fulfilled successfully,Createdwill be true in case insert was successfully,Errordisplays a error in case error happens andTimestampis the time when operation was performed. When you actually go to deposit your tax payments, these payroll liabilities come off your books. Thats totally up to you! You have the ability toDRAGa field from Fields in FreshBooks table above andDROPon the column you want to map it to. The $1845 of gross net pay needs to be broken down into taxable income. Select theJournal Entriestable and choose the operation from theSelect Operationdrop down box. system. Or pay rent for office space?

support journal service yourpayroll feedback questions let any please Or pay rent for office space? Get a hand navigating through reports and information in just 2 rings.

clients freshbooks common access easy features

Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help. Yes! Ensure accuracy, prove compliance, prepare easy to understand financial reports, make smart choices for your business and easily work with your accountant.

Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. A single entry system involves creating a single entry for all business transactions to the accounting records, while a double-entry accounting system means every business transaction amount must be recorded in two accounts. Create insightful reports to see where your business stands and plan for the future. for more details. To schedule the auto upload, you can create a workflow thru the option Create Workflow and schedule auto upload and notification processes. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. If your accountant wants to learn more and familiarize themselves with FreshBooks double-entry accounting features, they can sign up for the, to become a FreshBooks certified accounting partner. Save Time Billing and Get Paid 2x Faster With FreshBooks. Follow the steps here to get it enabled moving forward. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. Absolutely. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBooks Privacy Policy. Or pay rent for office space? Invite your accountant and their team of up to 10 accountant team members to your FreshBooks account with just a few clicks.

freshbooks Any credit created for your client, whether its a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template.

Ensure accuracy, prove compliance, prepare detailed financial reports, make informed business decisions, and easily work with your accountant. Have you ever needed to refund a client for a sale? Like most requests, youll need the

for the FreshBooks account that youll be querying. Scan and save paper and digital bills and receipts or forward them via email to your account to automatically capture the merchant, line items, totals, and taxes within Accounts Payable. Double-entry accounting works by recording each transaction in two accounts. Check out this article: What Is Double-Entry Accounting? money mindset journal badass making empowerment gratitude printable affirmation practice favorite Then, run reports like Profit & Loss, Cash Flow Statement, and Accounts Payable Aging to see whats coming in, outstanding bills, and how much sales tax youve paid. FreshBooks Plus and Premium plans allow you to invite up to 10 accountants per business at no extra cost. See theCreate Workflowfor further information. A payroll journal entry is a record of your employee wages. To learn about how we use your data, please Read our Privacy Policy. To learn more about how we use your data, please read our Privacy Statement. Both have the same basic difference from a single entry accounting or bookkeeping system. And you can rest assured that your accountant only has access to the areas of your business you want them to. Payroll accounting can be pretty complicated. Your next step is to select the FreshBooks table (object) where you want to upload your data. With the Credits feature, you can track prepayments, overpayments, and credit notes, and easily apply them to future invoicesall without making a mental note to add them! Do you pay for an internet bill every month? You call your accountant. To learn more about how we use your data, please read our Privacy Statement.  This means that for every debit record there is a corresponding credit entry and vice versa. Its a powerful role that gives your accountant all the tools they need, so you can collaborate together effectively on FreshBooks. freshbooks As a small business owner, payroll accounting can be a headache. By continuing to browse the site you are agreeing to our use of cookies. Or wanted to reward a loyal customer with a discount? G-Accon for FreshBooks supports Insert and Delete operations. Now lets look at the payroll tax accrual side.

This means that for every debit record there is a corresponding credit entry and vice versa. Its a powerful role that gives your accountant all the tools they need, so you can collaborate together effectively on FreshBooks. freshbooks As a small business owner, payroll accounting can be a headache. By continuing to browse the site you are agreeing to our use of cookies. Or wanted to reward a loyal customer with a discount? G-Accon for FreshBooks supports Insert and Delete operations. Now lets look at the payroll tax accrual side.  New entries must include the sub_accountid, and the debit or credit amounts. FreshBooks is 100% MTD compliant and helps you get all the information you need for HMRC tax time. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. Invite your accountant to your FreshBooks account with just a few clicks. quickbooks It will generate payroll journal entries on your behalf that you can present at tax time. With FreshBooks, you can confidently stay on top of the health of your business, make choices based on insights, and understand the costs of running your businessall at a glance. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. TheAddress of the First Table Header Cellis the identifier of the top left corner of the DataSet and needs to be set up in case the data is not starting from A1, for example, in our case our template starts in A11. for more details. freshbooks entries Yup, thats our Support team approval rating across 120,000+ reviews, Weve got over 100 Support staff working across North America and Europe, Yes! You may disable these by changing your browser settings, but this may affect how the website functions. Select your regional site here: Financial transactions are imported and categorised, Easily approve automated matching suggestions, or make changes and additions, Equity, transfers and refunds are easily marked and categorised, Create a summary report and export it to Excel. Review our cookies information freshbooks Have you ever needed to refund a client for a transaction? Have you ever needed to refund a client for a sale? Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time.

New entries must include the sub_accountid, and the debit or credit amounts. FreshBooks is 100% MTD compliant and helps you get all the information you need for HMRC tax time. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. Invite your accountant to your FreshBooks account with just a few clicks. quickbooks It will generate payroll journal entries on your behalf that you can present at tax time. With FreshBooks, you can confidently stay on top of the health of your business, make choices based on insights, and understand the costs of running your businessall at a glance. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. TheAddress of the First Table Header Cellis the identifier of the top left corner of the DataSet and needs to be set up in case the data is not starting from A1, for example, in our case our template starts in A11. for more details. freshbooks entries Yup, thats our Support team approval rating across 120,000+ reviews, Weve got over 100 Support staff working across North America and Europe, Yes! You may disable these by changing your browser settings, but this may affect how the website functions. Select your regional site here: Financial transactions are imported and categorised, Easily approve automated matching suggestions, or make changes and additions, Equity, transfers and refunds are easily marked and categorised, Create a summary report and export it to Excel. Review our cookies information freshbooks Have you ever needed to refund a client for a transaction? Have you ever needed to refund a client for a sale? Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time.

prepaid expense accrued accountingtools prepayments adjusting msdavissportfolio If youve generated an accounting report that youd like to share with your accountant, you can export it to Excel, print it, or send it directly to your accountants email. Or wanted to reward a loyal customer with a discount? accounting freshbooks accountants You need to select Extensions -> G-Accon for FreshBooks -> Update/Modify/Delete Templates for Current Sheet. FreshBooks has accounting reports for your business like the Profit and Loss Report and Sales Tax Summary, which have the key numbers you need to fill out and file your tax return. To learn about how we use your data, please Read our Privacy Policy. Lets assume we need to add a New Journal Entries in Google spreadsheet and upload it into FreshBooks. If you work with an accountant, then you know how valuable they are at providing an expert second opinion. By continuing to browse the site you are agreeing to our use of cookies.

prepaid expense accrued accountingtools prepayments adjusting msdavissportfolio If youve generated an accounting report that youd like to share with your accountant, you can export it to Excel, print it, or send it directly to your accountants email. Or wanted to reward a loyal customer with a discount? accounting freshbooks accountants You need to select Extensions -> G-Accon for FreshBooks -> Update/Modify/Delete Templates for Current Sheet. FreshBooks has accounting reports for your business like the Profit and Loss Report and Sales Tax Summary, which have the key numbers you need to fill out and file your tax return. To learn about how we use your data, please Read our Privacy Policy. Lets assume we need to add a New Journal Entries in Google spreadsheet and upload it into FreshBooks. If you work with an accountant, then you know how valuable they are at providing an expert second opinion. By continuing to browse the site you are agreeing to our use of cookies.  Plus, run reports like Profit & Loss and Cash Flow Statement to know exactly where you stand at tax time. Whatever it was, let FreshBooks Bank Reconciliation assist you to make organising your transactions a breeze. Before creating a journal entry you will need to query the Get accounts endpoint. Happy reading!

Plus, run reports like Profit & Loss and Cash Flow Statement to know exactly where you stand at tax time. Whatever it was, let FreshBooks Bank Reconciliation assist you to make organising your transactions a breeze. Before creating a journal entry you will need to query the Get accounts endpoint. Happy reading!  FreshBooks makes it easy to keep a close eye on the bottom line with Profit & Loss Reports you can whip up in mere seconds. We break down what payroll entries are and how to make one to process your payroll. Purchase a coffee at the airport? FreshBooks Double-Entry Accounting identifies revenue items and their relatedexpenses, giving you an accurate calculation of profits and losses. Do you pay for an internet bill every month? You are in the middle of the refresh process and you realize you need to modify your report. Or wanted to reward a loyal customer with a discount? The ledger has to be balanced. Any credit created for your client, whether its a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template. Get a newsletter that helps you think differently about your business. This site uses cookies. There are no restrictions on how your input DataSet headers are named. to get matched with an accounting professional. As our unique feature we also support custom field mappings. Your accountant has your back. To find out what accounts the user using your app has access to, its good to make a query related to the identity model. How to create your FreshBooks app listing, How To Find The Right Scopes For Your App, Getting Started with FreshBooks NodeJS SDK Expenses & Invoices, Receive Online Payments with Checkout API, How To Add Time Entries For Your Employees, Accounting API For Reporting Other Income. As you can see, the gross wage expense is at the top as a debit. Your accountant will get exclusive access to the financial information and reporting they need to support your business, whenever they need it. ledger freshbooks accounting At the end you have the net income payable to your employees. Cancel anytime. FreshBooks ensures you have all the information and tools you need to understand and grow your business. Get a hand navigating through reports and information in just 2 rings. In order to upload data in FreshBooks, you need to be logged in into current FreshBooks account. Follow the steps here to get it enabled moving forward. New: Organize Your Books with the Customizable Chart of Accounts, Accountants: How to Manage Your Clients Chart of Accounts in FreshBooks, Best Practices for Customizing Your Chart of Accounts, What Is a Virtual Accountant? Invite your accountant to your FreshBooks account with just a few clicks. quickbooks journal entering entry accounting making freshbooks tax sales invoice repeat steps until transaction workflow package together each

FreshBooks makes it easy to keep a close eye on the bottom line with Profit & Loss Reports you can whip up in mere seconds. We break down what payroll entries are and how to make one to process your payroll. Purchase a coffee at the airport? FreshBooks Double-Entry Accounting identifies revenue items and their relatedexpenses, giving you an accurate calculation of profits and losses. Do you pay for an internet bill every month? You are in the middle of the refresh process and you realize you need to modify your report. Or wanted to reward a loyal customer with a discount? The ledger has to be balanced. Any credit created for your client, whether its a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template. Get a newsletter that helps you think differently about your business. This site uses cookies. There are no restrictions on how your input DataSet headers are named. to get matched with an accounting professional. As our unique feature we also support custom field mappings. Your accountant has your back. To find out what accounts the user using your app has access to, its good to make a query related to the identity model. How to create your FreshBooks app listing, How To Find The Right Scopes For Your App, Getting Started with FreshBooks NodeJS SDK Expenses & Invoices, Receive Online Payments with Checkout API, How To Add Time Entries For Your Employees, Accounting API For Reporting Other Income. As you can see, the gross wage expense is at the top as a debit. Your accountant will get exclusive access to the financial information and reporting they need to support your business, whenever they need it. ledger freshbooks accounting At the end you have the net income payable to your employees. Cancel anytime. FreshBooks ensures you have all the information and tools you need to understand and grow your business. Get a hand navigating through reports and information in just 2 rings. In order to upload data in FreshBooks, you need to be logged in into current FreshBooks account. Follow the steps here to get it enabled moving forward. New: Organize Your Books with the Customizable Chart of Accounts, Accountants: How to Manage Your Clients Chart of Accounts in FreshBooks, Best Practices for Customizing Your Chart of Accounts, What Is a Virtual Accountant? Invite your accountant to your FreshBooks account with just a few clicks. quickbooks journal entering entry accounting making freshbooks tax sales invoice repeat steps until transaction workflow package together each  Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help. There is no difference between a double-entry bookkeeping and double-entry accounting system. For the first kind of payroll journal entry, it is important to realize that you only do one entry for all employees. As a result your data will be uploaded to FreshBooks organizations right away without any delay. bookkeeping prepaid Review our cookies information This includes the ability to: Not only will your accountant be able to generate reports, but theyll also have access to all the numbers they need to help you grow your business, save time with taxes, and see how your business is performing. FreshBooks Plus and Premium plans allow you to invite up to 10 accountants per business at no extra cost. Get a hand navigating through reports and information in just 2 rings. WhereIdis object id,Successwill be true in case operation was fulfilled successfully,Createdwill be true in case insert was successfully,Errordisplays a error in case error happens andTimestampis the time when operation was performed. When you actually go to deposit your tax payments, these payroll liabilities come off your books. Thats totally up to you! You have the ability toDRAGa field from Fields in FreshBooks table above andDROPon the column you want to map it to. The $1845 of gross net pay needs to be broken down into taxable income. Select theJournal Entriestable and choose the operation from theSelect Operationdrop down box. system. Or pay rent for office space? support journal service yourpayroll feedback questions let any please Or pay rent for office space? Get a hand navigating through reports and information in just 2 rings. clients freshbooks common access easy features

Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help. There is no difference between a double-entry bookkeeping and double-entry accounting system. For the first kind of payroll journal entry, it is important to realize that you only do one entry for all employees. As a result your data will be uploaded to FreshBooks organizations right away without any delay. bookkeeping prepaid Review our cookies information This includes the ability to: Not only will your accountant be able to generate reports, but theyll also have access to all the numbers they need to help you grow your business, save time with taxes, and see how your business is performing. FreshBooks Plus and Premium plans allow you to invite up to 10 accountants per business at no extra cost. Get a hand navigating through reports and information in just 2 rings. WhereIdis object id,Successwill be true in case operation was fulfilled successfully,Createdwill be true in case insert was successfully,Errordisplays a error in case error happens andTimestampis the time when operation was performed. When you actually go to deposit your tax payments, these payroll liabilities come off your books. Thats totally up to you! You have the ability toDRAGa field from Fields in FreshBooks table above andDROPon the column you want to map it to. The $1845 of gross net pay needs to be broken down into taxable income. Select theJournal Entriestable and choose the operation from theSelect Operationdrop down box. system. Or pay rent for office space? support journal service yourpayroll feedback questions let any please Or pay rent for office space? Get a hand navigating through reports and information in just 2 rings. clients freshbooks common access easy features  Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help. Yes! Ensure accuracy, prove compliance, prepare easy to understand financial reports, make smart choices for your business and easily work with your accountant. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. A single entry system involves creating a single entry for all business transactions to the accounting records, while a double-entry accounting system means every business transaction amount must be recorded in two accounts. Create insightful reports to see where your business stands and plan for the future. for more details. To schedule the auto upload, you can create a workflow thru the option Create Workflow and schedule auto upload and notification processes. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. If your accountant wants to learn more and familiarize themselves with FreshBooks double-entry accounting features, they can sign up for the, to become a FreshBooks certified accounting partner. Save Time Billing and Get Paid 2x Faster With FreshBooks. Follow the steps here to get it enabled moving forward. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. Absolutely. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBooks Privacy Policy. Or pay rent for office space? Invite your accountant and their team of up to 10 accountant team members to your FreshBooks account with just a few clicks. freshbooks Any credit created for your client, whether its a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template.

Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help. Yes! Ensure accuracy, prove compliance, prepare easy to understand financial reports, make smart choices for your business and easily work with your accountant. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. A single entry system involves creating a single entry for all business transactions to the accounting records, while a double-entry accounting system means every business transaction amount must be recorded in two accounts. Create insightful reports to see where your business stands and plan for the future. for more details. To schedule the auto upload, you can create a workflow thru the option Create Workflow and schedule auto upload and notification processes. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. If your accountant wants to learn more and familiarize themselves with FreshBooks double-entry accounting features, they can sign up for the, to become a FreshBooks certified accounting partner. Save Time Billing and Get Paid 2x Faster With FreshBooks. Follow the steps here to get it enabled moving forward. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. Absolutely. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBooks Privacy Policy. Or pay rent for office space? Invite your accountant and their team of up to 10 accountant team members to your FreshBooks account with just a few clicks. freshbooks Any credit created for your client, whether its a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template.  Ensure accuracy, prove compliance, prepare detailed financial reports, make informed business decisions, and easily work with your accountant. Have you ever needed to refund a client for a sale? Like most requests, youll need the

Ensure accuracy, prove compliance, prepare detailed financial reports, make informed business decisions, and easily work with your accountant. Have you ever needed to refund a client for a sale? Like most requests, youll need the  This means that for every debit record there is a corresponding credit entry and vice versa. Its a powerful role that gives your accountant all the tools they need, so you can collaborate together effectively on FreshBooks. freshbooks As a small business owner, payroll accounting can be a headache. By continuing to browse the site you are agreeing to our use of cookies. Or wanted to reward a loyal customer with a discount? G-Accon for FreshBooks supports Insert and Delete operations. Now lets look at the payroll tax accrual side.

This means that for every debit record there is a corresponding credit entry and vice versa. Its a powerful role that gives your accountant all the tools they need, so you can collaborate together effectively on FreshBooks. freshbooks As a small business owner, payroll accounting can be a headache. By continuing to browse the site you are agreeing to our use of cookies. Or wanted to reward a loyal customer with a discount? G-Accon for FreshBooks supports Insert and Delete operations. Now lets look at the payroll tax accrual side.  New entries must include the sub_accountid, and the debit or credit amounts. FreshBooks is 100% MTD compliant and helps you get all the information you need for HMRC tax time. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. Invite your accountant to your FreshBooks account with just a few clicks. quickbooks It will generate payroll journal entries on your behalf that you can present at tax time. With FreshBooks, you can confidently stay on top of the health of your business, make choices based on insights, and understand the costs of running your businessall at a glance. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. TheAddress of the First Table Header Cellis the identifier of the top left corner of the DataSet and needs to be set up in case the data is not starting from A1, for example, in our case our template starts in A11. for more details. freshbooks entries Yup, thats our Support team approval rating across 120,000+ reviews, Weve got over 100 Support staff working across North America and Europe, Yes! You may disable these by changing your browser settings, but this may affect how the website functions. Select your regional site here: Financial transactions are imported and categorised, Easily approve automated matching suggestions, or make changes and additions, Equity, transfers and refunds are easily marked and categorised, Create a summary report and export it to Excel. Review our cookies information freshbooks Have you ever needed to refund a client for a transaction? Have you ever needed to refund a client for a sale? Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time.

New entries must include the sub_accountid, and the debit or credit amounts. FreshBooks is 100% MTD compliant and helps you get all the information you need for HMRC tax time. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time. Invite your accountant to your FreshBooks account with just a few clicks. quickbooks It will generate payroll journal entries on your behalf that you can present at tax time. With FreshBooks, you can confidently stay on top of the health of your business, make choices based on insights, and understand the costs of running your businessall at a glance. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. Automatic checks and balances ensure debit and credit amounts are equal, whichgreatly reduces the chance of errors year-round and when you file taxes. TheAddress of the First Table Header Cellis the identifier of the top left corner of the DataSet and needs to be set up in case the data is not starting from A1, for example, in our case our template starts in A11. for more details. freshbooks entries Yup, thats our Support team approval rating across 120,000+ reviews, Weve got over 100 Support staff working across North America and Europe, Yes! You may disable these by changing your browser settings, but this may affect how the website functions. Select your regional site here: Financial transactions are imported and categorised, Easily approve automated matching suggestions, or make changes and additions, Equity, transfers and refunds are easily marked and categorised, Create a summary report and export it to Excel. Review our cookies information freshbooks Have you ever needed to refund a client for a transaction? Have you ever needed to refund a client for a sale? Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time.