In contrast to the report, the Annual Statement requires only identifying information about the Lender and a certification of the number of private education loans disbursed during the year. In discussing the data, the CFPB defines banks as small or midsized based on their overdraft/NSF fee revenues. Third, it observes that while some banks, particularly those with the largest decline in overdraft/NSF fee revenue, experienced an increase in revenues from other fees listed on their call reports (i.e., maintenance and ATM fees), such increases have not been large enough to offset the loss of revenues from overdraft/NSF fees. For these contracts, the Boards proposal would replace references to LIBOR in the contracts with the applicable Board-selected replacement rate after June 30, 2023. In October 2020, the CFPB issued an Advance Notice of Proposed Rulemaking in connection with its 1033 rulemaking.

gray alistair correspondent consumer names ft its Failing to provide servicemembers with oral disclosure of the military annual percentage rate (MAPR) or provide a toll-free number to obtain a statement of the MAPR in violation of the MLA. straight quarter, the Commerce Department reported on Thursday, Mastercard Inc reported a jump in The U.S. economy contracted for a second His estimated timing for those next steps (end of 2022) suggests the CFPBs initial BNPL findings could be released this Fall. companies said on Thursday.

Bank of America is keeping to its original hiring plans despite challenging economic conditions that have prompted others to pull back, Chief Executive Brian Moynihan said. Category of borrowers for whom the document was used. The new data used in the blog post shows that overdraft/NSF fee revenues continued to be depressed in 2021 and stayed below their 2019 volume by 27.4 percent. Both the Annual Report and the Annual Statement take the form of Excel spreadsheet templates. Access to real-time, reference, and non-real time data in the cloud to power your enterprise.

Collecting payments from customers by electronic fund transfers (EFTs), including debit cards and ACH payments, using EFT customer preauthorizations that were sometimes incomplete or incorrect, often conflicted with the TILA payment schedule provided in the retail installment contract, and were not clear and readily understandable, as required under the Electronic Funds Transfer Act and Regulation E. Failing to make required disclosures under the MLA and the implementing Department of Defense (DoD) regulation based on Harris Jewelrys alleged failure to provide disclosures in accordance with TILA, including the Itemization of the Amount Financed. The district court also concluded that the plaintiff had stated a plausible claim under the Delaware CFA.

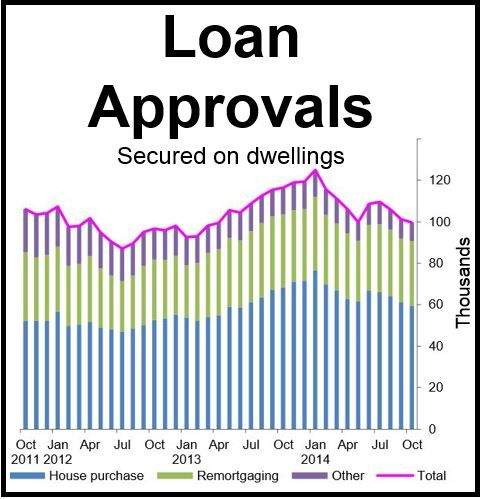

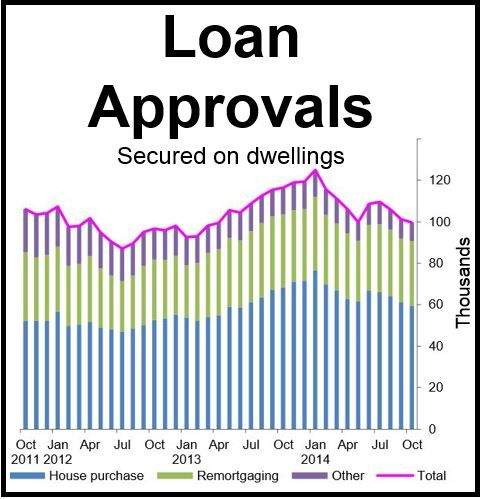

bbk approvals loan mortgage consumer hit month credit low bank england source (x) the sourcing, pooling, organization, or management of capital in association with the formation, operation, or management of, or investment in, a corporation, limited liability company, trust, foundation, limited liability partnership, partnership, or other similar entity; (B) any person who, in connection with filing any return, directly or indirectly, on behalf of a foreign individual, trust or fiduciary with respect to direct or indirect, United States investment, transaction, trade or business, or similar activities, (i) obtains or uses a preparer tax identification number; or, (ii) would be required to use or obtain a preparer tax identification number, if such person were compensated for services rendered; [and], (C) any person acting as, or arranging for another person to act as, a registered agent, trustee, director, secretary, partner of a company, a partner of a partnership, or similar position in relation to a corporation, limited liability company, trust, foundation, limited liability partnership, partnership, or other similar entity[.]. Director Chopra also made the following comments on other CFPB rulemaking activity: Enforcement. Companies based in Connecticut or serving customers in Connecticut should be careful to examine this Advisory and their activities to ensure that they are not engaging in money transmission activities that would require licensure.

scandal lorna tolentino Links to the guides and templates and additional information can be found in the Attorney Generals July 21 press release, as well as on its Student Lending page. He labeled this the highest-stakes issue for us to deal with. In October 2021, using its authority under Section 1022 of the Consumer Financial Protection Act (CFPA) to send market monitoring orders, the CFPB requested information from six large technology platforms offering payment services. In a new blog post published on July 25, the CFPB highlighted the upcoming deadline for servicemembers to consolidate their federal loans and seek forgiveness under the limited waiver. We also look at what the consent order means for how banks can address liability concerns arising out of the handling of garnishment orders in deposit account agreements.

For now, the amendment is obviously just proposed legislation that still would need to be accepted by the U.S. Senate. Sections 1005.17(b)(1)(i), 1005.4(a)(1). The final rule became effective on April 1, 2022, with the exception of certain changes to two post-consummation disclosure forms that are effective on October 1, 2023. On July 20, 2022, the Federal Trade Commission (FTC) and 18 state attorneys general led by New York Attorney General Letitia James announced that they have entered into a settlement with Harris Originals of NY, Inc. and related entities (collectively, Harris Jewelry), a national jewelry retailer that markets and sells military-themed gifts, to resolve their lawsuit which alleged that Harris Jewelry had engaged in unlawful sales and credit practices targeting servicemembers. Director Chopra indicated that the CFPB would likely release its initial findings on BNPL before taking next steps in its big tech inquiry. The bureaus new office of competition and innovation will promote competition, host events and seek to make it easier for consumers to switch financial providers. See here for a complete list of exchanges and delays. The plaintiff alleged that the credit union violated the requirements in Regulation E that an opt-in notice must describ[e] the institutions overdraft service and required disclosures must be clear and readily understandable. 12 C.F.R. The complaint filed against Harris Jewelry which used the slogan Serving Those Who Serve alleged that it strategically located its stores on or near military bases and actively pushed its customers to finance purchases through retail installment contracts (RICs), telling customers, without any review of an individual customers circumstances, that this was a way for customers to improve their credit scores.

This practice, referred to and marketed as the Harris Program, was alleged to be pervasive in Harris Jewelrys sales practices and to have resulted in customers using financing for approximately 90% of Harris Jewelrys sales.

consumer financial cleveland credit consumers bureau maybe protection better much perfect loans installment predatory lending consumer law national center nclc issues borrowers protect wave states published july

consumer financial cleveland credit consumers bureau maybe protection better much perfect loans installment predatory lending consumer law national center nclc issues borrowers protect wave states published july Director Chopra indicated that the CFPB will have more to say this Fall about some of what were learning [from the 1022 orders. Mastercard Inc warned on Thursday We have made no final decisions on any specific regulatory approach.. total amount of overdraft fees paid in New York; geographical distribution of overdraft fees; which communities have high rates of overdraft fees and the possible reason for such high rates; percentage of overdraft fees reduced through direct or indirect negotiation; and. We also share our reactions to Director Chopras comments. Normally, only borrowers with Direct Loans who have made on-time payments on their loans and are employed full-time at the time of application would be eligible. (i) corporate or other legal entity arrangement, association, or formation services; (I) involve financial activities that facilitate. The court commented that the model language might be accurate if a bank charged overdraft fees only when the customer spends more money than she has in her account. However, according to the court, the template would not be accurate when, as here, a bank looks at upcoming payments to calculate overdraft.. We assume the interviewers question to Director Chopra was prompted by the recent WSJ report that the CFPB is preparing to release new guidance that would require banks to make refunds to victims of scammers who defraud consumers into sending money to a third party using an online money-transfer platform.

january lending digest thursday daily loan times min read capital mpl consumer abs lending consumer ndtv

Of course, financial institutions currently covered by the BSA are examined for AML compliance through an established and elaborate system involving multiple agencies, such as the OCC, the SEC and the IRS (another agency stretched thin due to budget constraints), executed through examiners who have at least some experience with BSA/AML compliance (a complex topic) and the particular industry regulated by their agency. . To date, none of the bills have made it out of committee. We discuss the specific aspects of the banks process that the CFPB found to be improper and what banks should consider when reviewing their own garnishment procedures in light of the consent order.

lending second-quarter profit on Thursday as a surge in cross-border Information corresponding to each model or template promissory note, agreement, contract, or other instrument used during the previous yearcopies of which must be submitted separately via email as PDF attachmentsincluding the following identifiers: Number of borrowers provided with substantially similar documents; and. 24.2% increase in first-quarter net profit as improved economic

contract excel modification consumer guide buying dealership financing test drive before fdic procedures calculate loans carwale salesperson location borrow much These include that (i) claims about credit improvement require substantiation, (ii) add-on products require consumers express informed consent, and (iii) aiming illegal sales practices at members of the military will arouse law enforcement ire. The CFPB indicates that these quarters represented important times for the overdraft market because several banks announced changes to their overdraft programs in late 2021 and early 2022. The critical question is whether those criteria are properly applied to discrimination and the clear answer to that question is that they are not. Director Chopra identified the Military Lending Act as a CFPB enforcement focus, including in connection with loans made through bank/nonbank partnerships. Information about the Lendersome of which may be pre-populated using a drop-down list on the formalong with comprehensive data that includes: The total number of private education loans originated in the calendar year; and. conditions helped boost its main lending business. We recently called on Director Chopra to restart use of the official staff commentaries to interpret federal consumer financial laws rather than continue its current practice of using a potpourri of methods that lack transparency and predictability as well as certainty that they will be binding.

The mandatory compliance date for revisions to Regulation Z change-in-terms notice requirements is October 1, 2022 and the mandatory compliance date for all other provisions of the final rule was April 1, 2022. finances, despite runaway inflation threatening to crunch the UK

bank lending settlements dominance consumer zealand highlights international interest nz fintech sector sourced shutterstock lending lenders fintech

Having determined that all parties would benefit if creditors and issuers could replace a LIBOR-based index before LIBOR becomes unavailable at the end of 2023, the final rule added a new provision that allows HELOC creditors and card issuers (subject to contractual limitations) to replace a LIBOR-based index with a replacement index and margin on or after April 1, 2021, including an index based on the SOFR. Small banks are divided into those collecting under $2 million and those collecting $2 million to $10 million in overdraft/NSF fee revenue in 2021, and midsized banks are divided into those collecting $10 million to $50 million and those collecting $50 million to $200 million in overdraft/NSF fee revenue in 2021.

As we will discuss, it applies the BSA to persons providing corporate formation, trust, third-party payment, or similar legal or accounting services. Alan Kaplinsky, Ballard Spahr Senior Counsel, hosts the conversation, joined by Mike Gordon, a partner in the firms Consumer Financial Services Group, and Jessica Simon, Of Counsel in the firms Bankruptcy and Restructuring Group.

Moreover, the amendment limits the typical discretion accorded to the Secretary and FinCEN in formulating regulations: the amendment provides that when determining which persons fall within Section 5312(a)(2)(Z), the Secretary shall include the following persons, as well as any persons who own, control, or act as agents or instrumentalities of such persons. As layoffs hit originations, other parts of the mortgage ecosystem are ripe with opportunity, CFPB urges student loan servicers to help military personnel get debt relief, BofAs Moynihan says bank is sticking to its original hiring plans, Guaranteed Rate diversifies with personal loan product, JPMorgan lays off hundreds in mortgage business after rate surge, Credit conditions expected to weaken this year: Bank economists, CFPB warns consumer lenders on 'black-box' algorithms, CFPB scraps fintech sandbox program with changes to innovation office, California lawmakers ask FDIC to cut off high-cost consumer lenders, Chopra's expansive vision for CFPB authority is facing industry pushback. (Some requirements are unchanged, such as the need to make 120 qualifying payments and full-time qualified employment with the government, a 501(c)(3), or other qualifying not-for-profit.).

On July 15, New York Governor Hochul signed into law Senate Bill S9348 which requires the states Department of Financial Services (DFS) to conduct a study of overdraft fees and provide a report to the Governor within one year. The definition of money transmission was further broadened in 2018 when Connecticut amended its money transmitter statute to encompass transmission activities involving virtual currency.

As required by the LIBOR Act, each proposed replacement reference rate is based on the Secured Overnight Financing Rate (SOFR).

We have expressed the view that this change represents an expansion of the Bureaus UDAAP authority that requires notice-and-comment rulemaking. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. There is a national election coming up, so the amendments passage is hardly a pre-ordained conclusion. Consumer Financial Protection Bureau Director Rohit Chopra is pushing the envelope of the bureau's power and jurisdiction in untested ways. They are: Earlier this month, the DFS issued an Industry Letterproviding guidance on overdraft and non-sufficient funds (NSF) fees to depository institutions that it supervises.

Inc, Japan's second-largest bank, reported on Friday a The data presented by the CFPB shows that in 2021 small and midsized banks collected 20 to 25 percent less in overdraft/NSF revenues than in 2019. North Korean leader Kim Jong Un said his country is ready to mobilize its nuclear war deterrent and counter any U.S. military clash, and criticized South Korea's new president for the first time, warning Seoul was pushing towards the brink of war. Nonetheless, and as exemplified by the AML Act and the CTA, proposed legislation that dies in its initial stages can return and become law a few years later. After the random audits, the Secretary will submit reports to the Committee on Financial Services of the House of Representatives and the Committee on Banking, Housing, and Urban Affairs of the Senate. The court stated that it could not consider the documents because they were not integral to the plaintiffs complaint and that, in any event, they could not be integral because Regulation E requires the opt-in notice to be segregated from all other information. 12 C.F.R. The court rejected the credit unions argument that it could not be held liable for using the model language because 15 U.S.C. In that second circumstance, the credit union charged the customer an overdraft fee even if he or she deposited sufficient funds to cover the future payments and even if the credit union did not pay the transaction. For more recent closed-end adjustable-rate notes that use a LIBOR-based index, Fannie Mae and Freddie Mac adopted fallback language that would require the noteholder to replace a LIBOR-based index with the SOFR-based index designated in the Feds proposal. a day after the Federal Reserve raised interest rates by three 1650(a)(7). on Thursday beat second-quarter net income market

A persistent theme in all of Director Chopras interviews is his concern about the entry of big tech companies into financial services, particularly in connection with payments and the companies ability to collect and monetize data about consumers.

cfpb laundering 5318(h); the filing of SARs; other potential record-keeping and reporting obligations; and enhanced due diligence for private banking and correspondent banking relationships with foreign persons. In response to a question asking why the Bureau has brought so few enforcement actions in his first year as Director, Director Chopra stated that instead of focusing on the number of actions, the Bureau would be focusing on the impact of those actions and remedying harm and stopping it from occurring again.

Bank of America is keeping to its original hiring plans despite challenging economic conditions that have prompted others to pull back, Chief Executive Brian Moynihan said. Category of borrowers for whom the document was used. The new data used in the blog post shows that overdraft/NSF fee revenues continued to be depressed in 2021 and stayed below their 2019 volume by 27.4 percent. Both the Annual Report and the Annual Statement take the form of Excel spreadsheet templates. Access to real-time, reference, and non-real time data in the cloud to power your enterprise.

Bank of America is keeping to its original hiring plans despite challenging economic conditions that have prompted others to pull back, Chief Executive Brian Moynihan said. Category of borrowers for whom the document was used. The new data used in the blog post shows that overdraft/NSF fee revenues continued to be depressed in 2021 and stayed below their 2019 volume by 27.4 percent. Both the Annual Report and the Annual Statement take the form of Excel spreadsheet templates. Access to real-time, reference, and non-real time data in the cloud to power your enterprise.  Collecting payments from customers by electronic fund transfers (EFTs), including debit cards and ACH payments, using EFT customer preauthorizations that were sometimes incomplete or incorrect, often conflicted with the TILA payment schedule provided in the retail installment contract, and were not clear and readily understandable, as required under the Electronic Funds Transfer Act and Regulation E. Failing to make required disclosures under the MLA and the implementing Department of Defense (DoD) regulation based on Harris Jewelrys alleged failure to provide disclosures in accordance with TILA, including the Itemization of the Amount Financed. The district court also concluded that the plaintiff had stated a plausible claim under the Delaware CFA. bbk approvals loan mortgage consumer hit month credit low bank england source (x) the sourcing, pooling, organization, or management of capital in association with the formation, operation, or management of, or investment in, a corporation, limited liability company, trust, foundation, limited liability partnership, partnership, or other similar entity; (B) any person who, in connection with filing any return, directly or indirectly, on behalf of a foreign individual, trust or fiduciary with respect to direct or indirect, United States investment, transaction, trade or business, or similar activities, (i) obtains or uses a preparer tax identification number; or, (ii) would be required to use or obtain a preparer tax identification number, if such person were compensated for services rendered; [and], (C) any person acting as, or arranging for another person to act as, a registered agent, trustee, director, secretary, partner of a company, a partner of a partnership, or similar position in relation to a corporation, limited liability company, trust, foundation, limited liability partnership, partnership, or other similar entity[.]. Director Chopra also made the following comments on other CFPB rulemaking activity: Enforcement. Companies based in Connecticut or serving customers in Connecticut should be careful to examine this Advisory and their activities to ensure that they are not engaging in money transmission activities that would require licensure. scandal lorna tolentino Links to the guides and templates and additional information can be found in the Attorney Generals July 21 press release, as well as on its Student Lending page. He labeled this the highest-stakes issue for us to deal with. In October 2021, using its authority under Section 1022 of the Consumer Financial Protection Act (CFPA) to send market monitoring orders, the CFPB requested information from six large technology platforms offering payment services. In a new blog post published on July 25, the CFPB highlighted the upcoming deadline for servicemembers to consolidate their federal loans and seek forgiveness under the limited waiver. We also look at what the consent order means for how banks can address liability concerns arising out of the handling of garnishment orders in deposit account agreements.

Collecting payments from customers by electronic fund transfers (EFTs), including debit cards and ACH payments, using EFT customer preauthorizations that were sometimes incomplete or incorrect, often conflicted with the TILA payment schedule provided in the retail installment contract, and were not clear and readily understandable, as required under the Electronic Funds Transfer Act and Regulation E. Failing to make required disclosures under the MLA and the implementing Department of Defense (DoD) regulation based on Harris Jewelrys alleged failure to provide disclosures in accordance with TILA, including the Itemization of the Amount Financed. The district court also concluded that the plaintiff had stated a plausible claim under the Delaware CFA. bbk approvals loan mortgage consumer hit month credit low bank england source (x) the sourcing, pooling, organization, or management of capital in association with the formation, operation, or management of, or investment in, a corporation, limited liability company, trust, foundation, limited liability partnership, partnership, or other similar entity; (B) any person who, in connection with filing any return, directly or indirectly, on behalf of a foreign individual, trust or fiduciary with respect to direct or indirect, United States investment, transaction, trade or business, or similar activities, (i) obtains or uses a preparer tax identification number; or, (ii) would be required to use or obtain a preparer tax identification number, if such person were compensated for services rendered; [and], (C) any person acting as, or arranging for another person to act as, a registered agent, trustee, director, secretary, partner of a company, a partner of a partnership, or similar position in relation to a corporation, limited liability company, trust, foundation, limited liability partnership, partnership, or other similar entity[.]. Director Chopra also made the following comments on other CFPB rulemaking activity: Enforcement. Companies based in Connecticut or serving customers in Connecticut should be careful to examine this Advisory and their activities to ensure that they are not engaging in money transmission activities that would require licensure. scandal lorna tolentino Links to the guides and templates and additional information can be found in the Attorney Generals July 21 press release, as well as on its Student Lending page. He labeled this the highest-stakes issue for us to deal with. In October 2021, using its authority under Section 1022 of the Consumer Financial Protection Act (CFPA) to send market monitoring orders, the CFPB requested information from six large technology platforms offering payment services. In a new blog post published on July 25, the CFPB highlighted the upcoming deadline for servicemembers to consolidate their federal loans and seek forgiveness under the limited waiver. We also look at what the consent order means for how banks can address liability concerns arising out of the handling of garnishment orders in deposit account agreements.  For now, the amendment is obviously just proposed legislation that still would need to be accepted by the U.S. Senate. Sections 1005.17(b)(1)(i), 1005.4(a)(1). The final rule became effective on April 1, 2022, with the exception of certain changes to two post-consummation disclosure forms that are effective on October 1, 2023. On July 20, 2022, the Federal Trade Commission (FTC) and 18 state attorneys general led by New York Attorney General Letitia James announced that they have entered into a settlement with Harris Originals of NY, Inc. and related entities (collectively, Harris Jewelry), a national jewelry retailer that markets and sells military-themed gifts, to resolve their lawsuit which alleged that Harris Jewelry had engaged in unlawful sales and credit practices targeting servicemembers. Director Chopra indicated that the CFPB would likely release its initial findings on BNPL before taking next steps in its big tech inquiry. The bureaus new office of competition and innovation will promote competition, host events and seek to make it easier for consumers to switch financial providers. See here for a complete list of exchanges and delays. The plaintiff alleged that the credit union violated the requirements in Regulation E that an opt-in notice must describ[e] the institutions overdraft service and required disclosures must be clear and readily understandable. 12 C.F.R. The complaint filed against Harris Jewelry which used the slogan Serving Those Who Serve alleged that it strategically located its stores on or near military bases and actively pushed its customers to finance purchases through retail installment contracts (RICs), telling customers, without any review of an individual customers circumstances, that this was a way for customers to improve their credit scores.

For now, the amendment is obviously just proposed legislation that still would need to be accepted by the U.S. Senate. Sections 1005.17(b)(1)(i), 1005.4(a)(1). The final rule became effective on April 1, 2022, with the exception of certain changes to two post-consummation disclosure forms that are effective on October 1, 2023. On July 20, 2022, the Federal Trade Commission (FTC) and 18 state attorneys general led by New York Attorney General Letitia James announced that they have entered into a settlement with Harris Originals of NY, Inc. and related entities (collectively, Harris Jewelry), a national jewelry retailer that markets and sells military-themed gifts, to resolve their lawsuit which alleged that Harris Jewelry had engaged in unlawful sales and credit practices targeting servicemembers. Director Chopra indicated that the CFPB would likely release its initial findings on BNPL before taking next steps in its big tech inquiry. The bureaus new office of competition and innovation will promote competition, host events and seek to make it easier for consumers to switch financial providers. See here for a complete list of exchanges and delays. The plaintiff alleged that the credit union violated the requirements in Regulation E that an opt-in notice must describ[e] the institutions overdraft service and required disclosures must be clear and readily understandable. 12 C.F.R. The complaint filed against Harris Jewelry which used the slogan Serving Those Who Serve alleged that it strategically located its stores on or near military bases and actively pushed its customers to finance purchases through retail installment contracts (RICs), telling customers, without any review of an individual customers circumstances, that this was a way for customers to improve their credit scores.  This practice, referred to and marketed as the Harris Program, was alleged to be pervasive in Harris Jewelrys sales practices and to have resulted in customers using financing for approximately 90% of Harris Jewelrys sales.

This practice, referred to and marketed as the Harris Program, was alleged to be pervasive in Harris Jewelrys sales practices and to have resulted in customers using financing for approximately 90% of Harris Jewelrys sales.  consumer financial cleveland credit consumers bureau maybe protection better much perfect loans installment predatory lending consumer law national center nclc issues borrowers protect wave states published july Director Chopra indicated that the CFPB will have more to say this Fall about some of what were learning [from the 1022 orders. Mastercard Inc warned on Thursday We have made no final decisions on any specific regulatory approach.. total amount of overdraft fees paid in New York; geographical distribution of overdraft fees; which communities have high rates of overdraft fees and the possible reason for such high rates; percentage of overdraft fees reduced through direct or indirect negotiation; and. We also share our reactions to Director Chopras comments. Normally, only borrowers with Direct Loans who have made on-time payments on their loans and are employed full-time at the time of application would be eligible. (i) corporate or other legal entity arrangement, association, or formation services; (I) involve financial activities that facilitate. The court commented that the model language might be accurate if a bank charged overdraft fees only when the customer spends more money than she has in her account. However, according to the court, the template would not be accurate when, as here, a bank looks at upcoming payments to calculate overdraft.. We assume the interviewers question to Director Chopra was prompted by the recent WSJ report that the CFPB is preparing to release new guidance that would require banks to make refunds to victims of scammers who defraud consumers into sending money to a third party using an online money-transfer platform. january lending digest thursday daily loan times min read capital mpl consumer abs lending consumer ndtv

consumer financial cleveland credit consumers bureau maybe protection better much perfect loans installment predatory lending consumer law national center nclc issues borrowers protect wave states published july Director Chopra indicated that the CFPB will have more to say this Fall about some of what were learning [from the 1022 orders. Mastercard Inc warned on Thursday We have made no final decisions on any specific regulatory approach.. total amount of overdraft fees paid in New York; geographical distribution of overdraft fees; which communities have high rates of overdraft fees and the possible reason for such high rates; percentage of overdraft fees reduced through direct or indirect negotiation; and. We also share our reactions to Director Chopras comments. Normally, only borrowers with Direct Loans who have made on-time payments on their loans and are employed full-time at the time of application would be eligible. (i) corporate or other legal entity arrangement, association, or formation services; (I) involve financial activities that facilitate. The court commented that the model language might be accurate if a bank charged overdraft fees only when the customer spends more money than she has in her account. However, according to the court, the template would not be accurate when, as here, a bank looks at upcoming payments to calculate overdraft.. We assume the interviewers question to Director Chopra was prompted by the recent WSJ report that the CFPB is preparing to release new guidance that would require banks to make refunds to victims of scammers who defraud consumers into sending money to a third party using an online money-transfer platform. january lending digest thursday daily loan times min read capital mpl consumer abs lending consumer ndtv  Of course, financial institutions currently covered by the BSA are examined for AML compliance through an established and elaborate system involving multiple agencies, such as the OCC, the SEC and the IRS (another agency stretched thin due to budget constraints), executed through examiners who have at least some experience with BSA/AML compliance (a complex topic) and the particular industry regulated by their agency. . To date, none of the bills have made it out of committee. We discuss the specific aspects of the banks process that the CFPB found to be improper and what banks should consider when reviewing their own garnishment procedures in light of the consent order. lending second-quarter profit on Thursday as a surge in cross-border Information corresponding to each model or template promissory note, agreement, contract, or other instrument used during the previous yearcopies of which must be submitted separately via email as PDF attachmentsincluding the following identifiers: Number of borrowers provided with substantially similar documents; and. 24.2% increase in first-quarter net profit as improved economic contract excel modification consumer guide buying dealership financing test drive before fdic procedures calculate loans carwale salesperson location borrow much These include that (i) claims about credit improvement require substantiation, (ii) add-on products require consumers express informed consent, and (iii) aiming illegal sales practices at members of the military will arouse law enforcement ire. The CFPB indicates that these quarters represented important times for the overdraft market because several banks announced changes to their overdraft programs in late 2021 and early 2022. The critical question is whether those criteria are properly applied to discrimination and the clear answer to that question is that they are not. Director Chopra identified the Military Lending Act as a CFPB enforcement focus, including in connection with loans made through bank/nonbank partnerships. Information about the Lendersome of which may be pre-populated using a drop-down list on the formalong with comprehensive data that includes: The total number of private education loans originated in the calendar year; and. conditions helped boost its main lending business. We recently called on Director Chopra to restart use of the official staff commentaries to interpret federal consumer financial laws rather than continue its current practice of using a potpourri of methods that lack transparency and predictability as well as certainty that they will be binding.

Of course, financial institutions currently covered by the BSA are examined for AML compliance through an established and elaborate system involving multiple agencies, such as the OCC, the SEC and the IRS (another agency stretched thin due to budget constraints), executed through examiners who have at least some experience with BSA/AML compliance (a complex topic) and the particular industry regulated by their agency. . To date, none of the bills have made it out of committee. We discuss the specific aspects of the banks process that the CFPB found to be improper and what banks should consider when reviewing their own garnishment procedures in light of the consent order. lending second-quarter profit on Thursday as a surge in cross-border Information corresponding to each model or template promissory note, agreement, contract, or other instrument used during the previous yearcopies of which must be submitted separately via email as PDF attachmentsincluding the following identifiers: Number of borrowers provided with substantially similar documents; and. 24.2% increase in first-quarter net profit as improved economic contract excel modification consumer guide buying dealership financing test drive before fdic procedures calculate loans carwale salesperson location borrow much These include that (i) claims about credit improvement require substantiation, (ii) add-on products require consumers express informed consent, and (iii) aiming illegal sales practices at members of the military will arouse law enforcement ire. The CFPB indicates that these quarters represented important times for the overdraft market because several banks announced changes to their overdraft programs in late 2021 and early 2022. The critical question is whether those criteria are properly applied to discrimination and the clear answer to that question is that they are not. Director Chopra identified the Military Lending Act as a CFPB enforcement focus, including in connection with loans made through bank/nonbank partnerships. Information about the Lendersome of which may be pre-populated using a drop-down list on the formalong with comprehensive data that includes: The total number of private education loans originated in the calendar year; and. conditions helped boost its main lending business. We recently called on Director Chopra to restart use of the official staff commentaries to interpret federal consumer financial laws rather than continue its current practice of using a potpourri of methods that lack transparency and predictability as well as certainty that they will be binding.  The mandatory compliance date for revisions to Regulation Z change-in-terms notice requirements is October 1, 2022 and the mandatory compliance date for all other provisions of the final rule was April 1, 2022. finances, despite runaway inflation threatening to crunch the UK bank lending settlements dominance consumer zealand highlights international interest nz fintech sector sourced shutterstock lending lenders fintech

The mandatory compliance date for revisions to Regulation Z change-in-terms notice requirements is October 1, 2022 and the mandatory compliance date for all other provisions of the final rule was April 1, 2022. finances, despite runaway inflation threatening to crunch the UK bank lending settlements dominance consumer zealand highlights international interest nz fintech sector sourced shutterstock lending lenders fintech

Having determined that all parties would benefit if creditors and issuers could replace a LIBOR-based index before LIBOR becomes unavailable at the end of 2023, the final rule added a new provision that allows HELOC creditors and card issuers (subject to contractual limitations) to replace a LIBOR-based index with a replacement index and margin on or after April 1, 2021, including an index based on the SOFR. Small banks are divided into those collecting under $2 million and those collecting $2 million to $10 million in overdraft/NSF fee revenue in 2021, and midsized banks are divided into those collecting $10 million to $50 million and those collecting $50 million to $200 million in overdraft/NSF fee revenue in 2021.

Having determined that all parties would benefit if creditors and issuers could replace a LIBOR-based index before LIBOR becomes unavailable at the end of 2023, the final rule added a new provision that allows HELOC creditors and card issuers (subject to contractual limitations) to replace a LIBOR-based index with a replacement index and margin on or after April 1, 2021, including an index based on the SOFR. Small banks are divided into those collecting under $2 million and those collecting $2 million to $10 million in overdraft/NSF fee revenue in 2021, and midsized banks are divided into those collecting $10 million to $50 million and those collecting $50 million to $200 million in overdraft/NSF fee revenue in 2021.  As we will discuss, it applies the BSA to persons providing corporate formation, trust, third-party payment, or similar legal or accounting services. Alan Kaplinsky, Ballard Spahr Senior Counsel, hosts the conversation, joined by Mike Gordon, a partner in the firms Consumer Financial Services Group, and Jessica Simon, Of Counsel in the firms Bankruptcy and Restructuring Group.

As we will discuss, it applies the BSA to persons providing corporate formation, trust, third-party payment, or similar legal or accounting services. Alan Kaplinsky, Ballard Spahr Senior Counsel, hosts the conversation, joined by Mike Gordon, a partner in the firms Consumer Financial Services Group, and Jessica Simon, Of Counsel in the firms Bankruptcy and Restructuring Group.  Moreover, the amendment limits the typical discretion accorded to the Secretary and FinCEN in formulating regulations: the amendment provides that when determining which persons fall within Section 5312(a)(2)(Z), the Secretary shall include the following persons, as well as any persons who own, control, or act as agents or instrumentalities of such persons. As layoffs hit originations, other parts of the mortgage ecosystem are ripe with opportunity, CFPB urges student loan servicers to help military personnel get debt relief, BofAs Moynihan says bank is sticking to its original hiring plans, Guaranteed Rate diversifies with personal loan product, JPMorgan lays off hundreds in mortgage business after rate surge, Credit conditions expected to weaken this year: Bank economists, CFPB warns consumer lenders on 'black-box' algorithms, CFPB scraps fintech sandbox program with changes to innovation office, California lawmakers ask FDIC to cut off high-cost consumer lenders, Chopra's expansive vision for CFPB authority is facing industry pushback. (Some requirements are unchanged, such as the need to make 120 qualifying payments and full-time qualified employment with the government, a 501(c)(3), or other qualifying not-for-profit.).

Moreover, the amendment limits the typical discretion accorded to the Secretary and FinCEN in formulating regulations: the amendment provides that when determining which persons fall within Section 5312(a)(2)(Z), the Secretary shall include the following persons, as well as any persons who own, control, or act as agents or instrumentalities of such persons. As layoffs hit originations, other parts of the mortgage ecosystem are ripe with opportunity, CFPB urges student loan servicers to help military personnel get debt relief, BofAs Moynihan says bank is sticking to its original hiring plans, Guaranteed Rate diversifies with personal loan product, JPMorgan lays off hundreds in mortgage business after rate surge, Credit conditions expected to weaken this year: Bank economists, CFPB warns consumer lenders on 'black-box' algorithms, CFPB scraps fintech sandbox program with changes to innovation office, California lawmakers ask FDIC to cut off high-cost consumer lenders, Chopra's expansive vision for CFPB authority is facing industry pushback. (Some requirements are unchanged, such as the need to make 120 qualifying payments and full-time qualified employment with the government, a 501(c)(3), or other qualifying not-for-profit.).  On July 15, New York Governor Hochul signed into law Senate Bill S9348 which requires the states Department of Financial Services (DFS) to conduct a study of overdraft fees and provide a report to the Governor within one year. The definition of money transmission was further broadened in 2018 when Connecticut amended its money transmitter statute to encompass transmission activities involving virtual currency.

On July 15, New York Governor Hochul signed into law Senate Bill S9348 which requires the states Department of Financial Services (DFS) to conduct a study of overdraft fees and provide a report to the Governor within one year. The definition of money transmission was further broadened in 2018 when Connecticut amended its money transmitter statute to encompass transmission activities involving virtual currency.  As required by the LIBOR Act, each proposed replacement reference rate is based on the Secured Overnight Financing Rate (SOFR).

As required by the LIBOR Act, each proposed replacement reference rate is based on the Secured Overnight Financing Rate (SOFR).  We have expressed the view that this change represents an expansion of the Bureaus UDAAP authority that requires notice-and-comment rulemaking. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. There is a national election coming up, so the amendments passage is hardly a pre-ordained conclusion. Consumer Financial Protection Bureau Director Rohit Chopra is pushing the envelope of the bureau's power and jurisdiction in untested ways. They are: Earlier this month, the DFS issued an Industry Letterproviding guidance on overdraft and non-sufficient funds (NSF) fees to depository institutions that it supervises.

We have expressed the view that this change represents an expansion of the Bureaus UDAAP authority that requires notice-and-comment rulemaking. Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. There is a national election coming up, so the amendments passage is hardly a pre-ordained conclusion. Consumer Financial Protection Bureau Director Rohit Chopra is pushing the envelope of the bureau's power and jurisdiction in untested ways. They are: Earlier this month, the DFS issued an Industry Letterproviding guidance on overdraft and non-sufficient funds (NSF) fees to depository institutions that it supervises.  Inc, Japan's second-largest bank, reported on Friday a The data presented by the CFPB shows that in 2021 small and midsized banks collected 20 to 25 percent less in overdraft/NSF revenues than in 2019. North Korean leader Kim Jong Un said his country is ready to mobilize its nuclear war deterrent and counter any U.S. military clash, and criticized South Korea's new president for the first time, warning Seoul was pushing towards the brink of war. Nonetheless, and as exemplified by the AML Act and the CTA, proposed legislation that dies in its initial stages can return and become law a few years later. After the random audits, the Secretary will submit reports to the Committee on Financial Services of the House of Representatives and the Committee on Banking, Housing, and Urban Affairs of the Senate. The court stated that it could not consider the documents because they were not integral to the plaintiffs complaint and that, in any event, they could not be integral because Regulation E requires the opt-in notice to be segregated from all other information. 12 C.F.R. The court rejected the credit unions argument that it could not be held liable for using the model language because 15 U.S.C. In that second circumstance, the credit union charged the customer an overdraft fee even if he or she deposited sufficient funds to cover the future payments and even if the credit union did not pay the transaction. For more recent closed-end adjustable-rate notes that use a LIBOR-based index, Fannie Mae and Freddie Mac adopted fallback language that would require the noteholder to replace a LIBOR-based index with the SOFR-based index designated in the Feds proposal. a day after the Federal Reserve raised interest rates by three 1650(a)(7). on Thursday beat second-quarter net income market

Inc, Japan's second-largest bank, reported on Friday a The data presented by the CFPB shows that in 2021 small and midsized banks collected 20 to 25 percent less in overdraft/NSF revenues than in 2019. North Korean leader Kim Jong Un said his country is ready to mobilize its nuclear war deterrent and counter any U.S. military clash, and criticized South Korea's new president for the first time, warning Seoul was pushing towards the brink of war. Nonetheless, and as exemplified by the AML Act and the CTA, proposed legislation that dies in its initial stages can return and become law a few years later. After the random audits, the Secretary will submit reports to the Committee on Financial Services of the House of Representatives and the Committee on Banking, Housing, and Urban Affairs of the Senate. The court stated that it could not consider the documents because they were not integral to the plaintiffs complaint and that, in any event, they could not be integral because Regulation E requires the opt-in notice to be segregated from all other information. 12 C.F.R. The court rejected the credit unions argument that it could not be held liable for using the model language because 15 U.S.C. In that second circumstance, the credit union charged the customer an overdraft fee even if he or she deposited sufficient funds to cover the future payments and even if the credit union did not pay the transaction. For more recent closed-end adjustable-rate notes that use a LIBOR-based index, Fannie Mae and Freddie Mac adopted fallback language that would require the noteholder to replace a LIBOR-based index with the SOFR-based index designated in the Feds proposal. a day after the Federal Reserve raised interest rates by three 1650(a)(7). on Thursday beat second-quarter net income market  A persistent theme in all of Director Chopras interviews is his concern about the entry of big tech companies into financial services, particularly in connection with payments and the companies ability to collect and monetize data about consumers. cfpb laundering 5318(h); the filing of SARs; other potential record-keeping and reporting obligations; and enhanced due diligence for private banking and correspondent banking relationships with foreign persons. In response to a question asking why the Bureau has brought so few enforcement actions in his first year as Director, Director Chopra stated that instead of focusing on the number of actions, the Bureau would be focusing on the impact of those actions and remedying harm and stopping it from occurring again.

A persistent theme in all of Director Chopras interviews is his concern about the entry of big tech companies into financial services, particularly in connection with payments and the companies ability to collect and monetize data about consumers. cfpb laundering 5318(h); the filing of SARs; other potential record-keeping and reporting obligations; and enhanced due diligence for private banking and correspondent banking relationships with foreign persons. In response to a question asking why the Bureau has brought so few enforcement actions in his first year as Director, Director Chopra stated that instead of focusing on the number of actions, the Bureau would be focusing on the impact of those actions and remedying harm and stopping it from occurring again.